Answered step by step

Verified Expert Solution

Question

1 Approved Answer

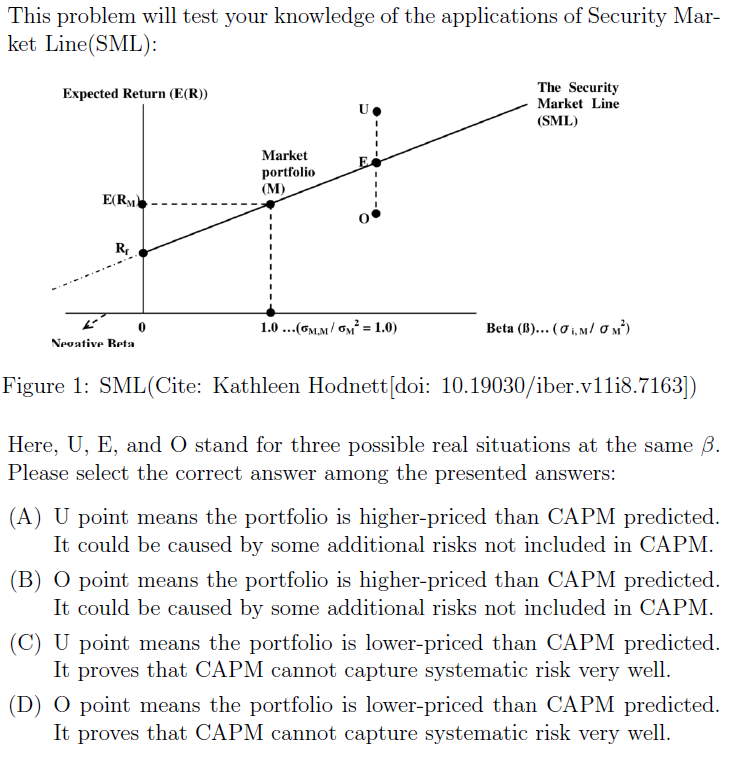

This problem will test your knowledge of the applications of Security Mar- ket Line(SML): Expected Return (E(R)) The Security Market Line (SML) Market portfolio

This problem will test your knowledge of the applications of Security Mar- ket Line(SML): Expected Return (E(R)) The Security Market Line (SML) Market portfolio (M) E(RM) R Negative Reta 0 1.0...(GM.M/GM = 1.0) Beta (B)... (M M) Figure 1: SML(Cite: Kathleen Hodnett[doi: 10.19030/iber.v11i8.7163]) Here, U, E, and O stand for three possible real situations at the same . Please select the correct answer among the presented answers: (A) U point means the portfolio is higher-priced than CAPM predicted. It could be caused by some additional risks not included in CAPM. (B) O point means the portfolio is higher-priced than CAPM predicted. It could be caused by some additional risks not included in CAPM. (C) U point means the portfolio is lower-priced than CAPM predicted. It proves that CAPM cannot capture systematic risk very well. (D) O point means the portfolio is lower-priced than CAPM predicted. It proves that CAPM cannot capture systematic risk very well.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Based on the infor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started