This project is due Sunday night, any help is greatly appreciated thanks!! Which parts are unclear? I can explain

This project is due Sunday night, any help is greatly appreciated thanks!! Which parts are unclear? I can explain

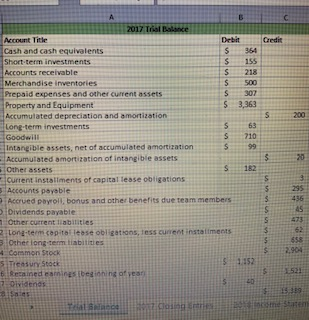

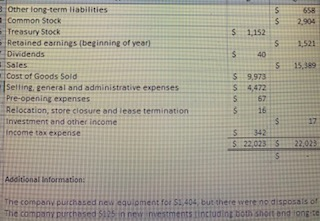

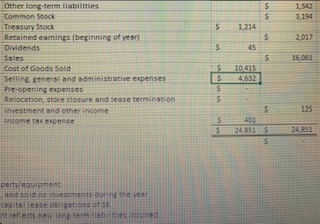

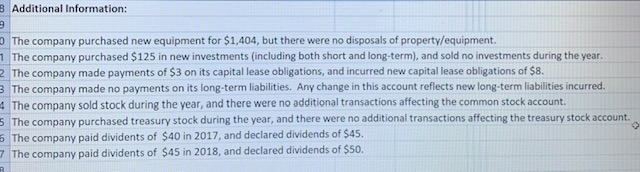

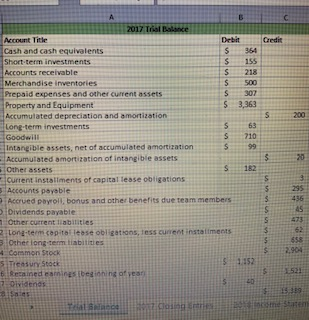

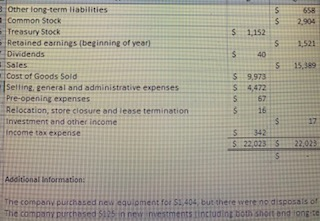

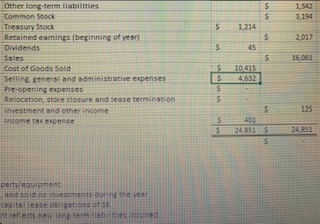

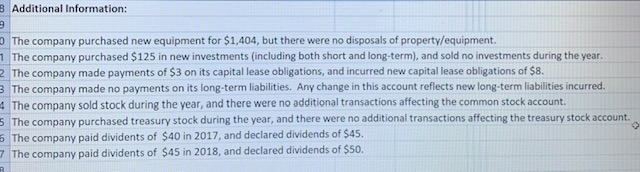

2017 Tial Balance Account Tithe Cash and cash equivelents Shot term investments DebitCredit S 364 s 155 S 218 Accounts receivable 500 S 307 S 3,363 Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation and amortization Long-term investments Goodwili Intangible ossets, net of accumulated amortization Accumutated amortization of intangible assets Other assets Curtent installments of capital lease obligations Accounts payeble Accrued pbyroll, bonus and other benefits due team members Dividends payable Other current liabilitles S200 563 S 710 S99 152 295 436 45 2 Long-termcepital lease obligations, jess cuneet instattments 62 58 s Osher iong term tiabitities 4 Cormmon tock siTisasuny Stock S1.152 521 Other long-term liabilities Common Stock Treasury Stock Retained carnings (beginning of year 658 S2.904 s 1,521 15,389 S 1,152 Dividends Sales Cost of Goods Sold Selting, general and administrative expenses Pre-opening expenses Relocation, store closure and lease termination Investment and other income ncome tax expense 40 S9,973 S: :4,472 567 16 17 5342 5 22,02322.023 Additional Inforsation ere wereoo dispozals of 2018 Trial Balance Account Title Debit Gedit 718 200 Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumutated depreciation and amortization Long term investments Goodwitt ntangible assets, net of accumutated amortization Accumutated smortization of intangible assets Orher assets Current instaliments of capital lease obligations Accounts payable Accrued payroll, bonus and other benetits due team members Dividends payable Other current diabilities Long-term capital lease obiigstions, less current Instalilments Osher tong-tem tiabilties Common Stock 792 170 5 4,762 375 $ 1413 5 710 5 30 5 182 473 50 65 1342 3, N 5.224 2017 Rera ned earnings ibag Dividends 45 Other long-term tiabilities Common Stock Treasury Stock Retained earnings tbeginning of yean Dividends Sates Cost of Goods Sold Selling. senersi and administrative expenses Pre-opening expenses Retocation, store closure and lease termination Investment and otherincome income tax expense 1,342 s3,19 2017 16,061 1214 45 S4,632 125 S24852 $ 24ES B Additional Information: 0 The company purchased new equipment for $1,404, but there were no disposals of property/equipment. 1 The company purchased $125 in new investments (including both short and long-term), and sold no investments during the year. 2 The company made payments of $3 on its capital lease obligations, and incurred new capital lease obligations of $8. 3 The company made no payments on its long-term liabilities. Any change in this account reflects new long-term liabilities incurred. :The company sold stock during the year, and there were no additional transactions affecting the common stock account. 5 The company purchased treasury stock during the year, and there were no additional transactions affecting the treasury stock account. 5 The company paid dividents of $40 in 2017, and declared dividends of $45, 7 The company paid dividents of $45 in 2018, and declared dividends of $50. 2017 Tial Balance Account Tithe Cash and cash equivelents Shot term investments DebitCredit S 364 s 155 S 218 Accounts receivable 500 S 307 S 3,363 Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation and amortization Long-term investments Goodwili Intangible ossets, net of accumulated amortization Accumutated amortization of intangible assets Other assets Curtent installments of capital lease obligations Accounts payeble Accrued pbyroll, bonus and other benefits due team members Dividends payable Other current liabilitles S200 563 S 710 S99 152 295 436 45 2 Long-termcepital lease obligations, jess cuneet instattments 62 58 s Osher iong term tiabitities 4 Cormmon tock siTisasuny Stock S1.152 521 Other long-term liabilities Common Stock Treasury Stock Retained carnings (beginning of year 658 S2.904 s 1,521 15,389 S 1,152 Dividends Sales Cost of Goods Sold Selting, general and administrative expenses Pre-opening expenses Relocation, store closure and lease termination Investment and other income ncome tax expense 40 S9,973 S: :4,472 567 16 17 5342 5 22,02322.023 Additional Inforsation ere wereoo dispozals of 2018 Trial Balance Account Title Debit Gedit 718 200 Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumutated depreciation and amortization Long term investments Goodwitt ntangible assets, net of accumutated amortization Accumutated smortization of intangible assets Orher assets Current instaliments of capital lease obligations Accounts payable Accrued payroll, bonus and other benetits due team members Dividends payable Other current diabilities Long-term capital lease obiigstions, less current Instalilments Osher tong-tem tiabilties Common Stock 792 170 5 4,762 375 $ 1413 5 710 5 30 5 182 473 50 65 1342 3, N 5.224 2017 Rera ned earnings ibag Dividends 45 Other long-term tiabilities Common Stock Treasury Stock Retained earnings tbeginning of yean Dividends Sates Cost of Goods Sold Selling. senersi and administrative expenses Pre-opening expenses Retocation, store closure and lease termination Investment and otherincome income tax expense 1,342 s3,19 2017 16,061 1214 45 S4,632 125 S24852 $ 24ES B Additional Information: 0 The company purchased new equipment for $1,404, but there were no disposals of property/equipment. 1 The company purchased $125 in new investments (including both short and long-term), and sold no investments during the year. 2 The company made payments of $3 on its capital lease obligations, and incurred new capital lease obligations of $8. 3 The company made no payments on its long-term liabilities. Any change in this account reflects new long-term liabilities incurred. :The company sold stock during the year, and there were no additional transactions affecting the common stock account. 5 The company purchased treasury stock during the year, and there were no additional transactions affecting the treasury stock account. 5 The company paid dividents of $40 in 2017, and declared dividends of $45, 7 The company paid dividents of $45 in 2018, and declared dividends of $50

This project is due Sunday night, any help is greatly appreciated thanks!! Which parts are unclear? I can explain

This project is due Sunday night, any help is greatly appreciated thanks!! Which parts are unclear? I can explain