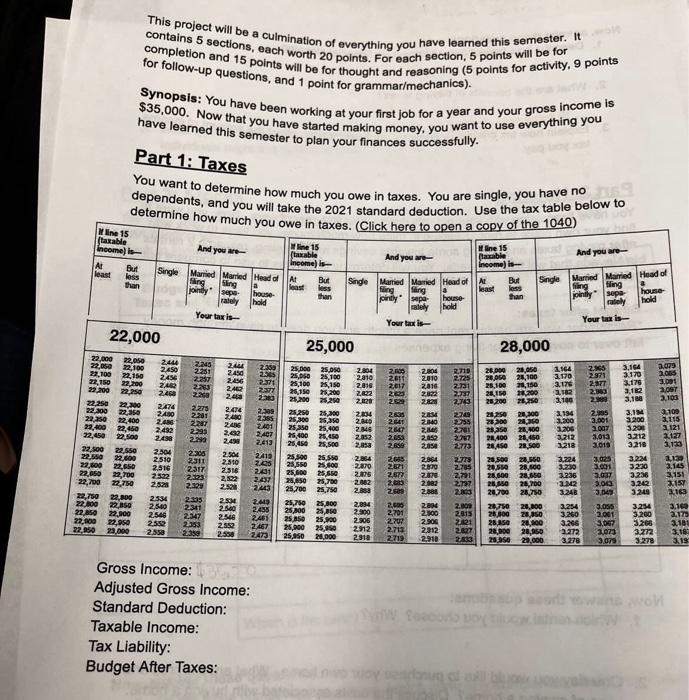

This project will be a culmination of everything you have learned this semester. It completion and 15 points will be for thought and reasoning (5 points for activity. 9 points contains 5 sections, each worth 20 points. For each section, 5 points will be for for follow-up questions, and 1 point for grammar/mechanics). Synopsis: You have been working at your first job for a year and your gross income is have learned this semester to plan your finances successfully. $35,000. Now that you have started making money. you want to use everything you Part 1: Taxes And you inte least Sing You want to determine how much you owe in taxes. You are single, you have no dependents, and you will take the 2021 standard deduction. Use the tax table below to determine how much you owe in taxes. (Click here to open a copy of the 1040) Mine 15 (taxable Income) is line 15 line 15 (taxable And you are acable And you are Al But Income) Income) is less Single Married Married Head of At Sling than Sling But But Single Married Married Head of A Single Married Married Head of least joindy supe less filing filing house- least fling than than house- rately pindly sepa hold house Jointly sepe Biely hold hold rately Your taxis Your tax is Your ta is- 22,000 25,000 28,000 22.000 22,050 22,050 2.444 2245 22,100 2.ASO 2444 2360 25.poo 25.050 2251 3.029 22.100 2.604 2.000 2000 1164 23 R.TID 2.450 3.164 20.000 22,150 2456 25.050 25,100 2257 2005 2016 22,150 32.200 2010 2011 2170 2.725 2.971 3170 21 26,0 20,100 2.482 25,100 25,150 2836 2253 2017 2.131 3.179 25,100 2,150 3.126 2402 237 22.00 3.001 2016 22.250 2.268 25,150 75.200 2.2.22 20 209 2.022 2.77 25 150 20.200 2162 2.19 2200 3,12 2.09 22.250 22.00 25.290 25 250 2 2629 2828 2.10 26.200 T 250 2.100 2. 3,10 2.100 22.00 22.350 2,474 2.278 2014 2480 2009 2201 25.250 22.30 25,00 2.834 240 2835 20 2305 2700 2s 20250 20,300 3.IN 2.100 2.194 22,400 24N 25,00 25.30 2247 2,840 26 2.840 2.755 28200 2010 3.200 2.001 2016 3.200 3,115 22,400 22,450 2.492 2793 2401 25,0 25,400 2015 ZET 2.446 2761 1.200 2007 282 5.200 21121 22,450 22.500 23.350 21.00 2438 2.407 15,400 25.450 2.852 2750 2002 21,450 3212 3.018 2.499 28.400 2127 2.413 26,456 25.500 2.158 2.85 22.00 22.550 2.850 2773 28,450 28,500 2218 3.019 3.218 3,120 22.50 22.000 2304 2300 2.306 2413 2.510 2011 25,000 25.950 2844 26 2.864 2.775 3.224 3.0 20,500 2.510 28.560 3 224 22.00 1199 2.05 22,650 25,580 25,800 2.316 2317 -2.870 2821 2.870 2.765 205 28.500 3.230 2.516 2001 3.230 22,850 2.145 22,700 201 25.000 25.se 2.522 2.000 2,231 2,67 27 3.236 2133 2,592 28.500 28.650 3.09 3.250 3151 22,700 2.750 2,528 23,50 25,700 2.457 2002 2.05 2329 2.882 25700 25,750 2.797 25,650 26,700 2443 3.000 3.20 IS 2.888 2585 2.888 2.800 22,750 20700 28.750 22,100 3.049 3.248 3248 2.1 2.534 2.305 2504 22.00 22.30 249 25,710 25,000 2540 2011 2640 2014 2.co. 2.800 2.000 2.435 3.055 25,800 20,750 2.254 20,000 3.100 22,850 3.254 22.000 25.05 2.300 2548 2,548 2701 2.300 2.815 28 300 28,00 3.260 2001 3.200 2.173 22.00 22.00 2.461 25 se 25 900 2353 2.08 2552 2207 2.506 2.467 221 28,350 20,00 3.268 3.007 32 2.181 22.950 23.000 25,000 25,950 2012 2359 2588 2473 2713 2.312 2027 25.450 26,00 28,950 20.000 2.212 3,073 3.272 2312 2719 2910 2833 20.se 20,000 3.779 3.07 3278 3.19 20,00 2010 23 220 2.500 250 2.552 16 OW Gross Income: Adjusted Gross Income: Standard Deduction: Taxable income: Tax Liability: Budget After Taxes: nogo This project will be a culmination of everything you have learned this semester. It completion and 15 points will be for thought and reasoning (5 points for activity. 9 points contains 5 sections, each worth 20 points. For each section, 5 points will be for for follow-up questions, and 1 point for grammar/mechanics). Synopsis: You have been working at your first job for a year and your gross income is have learned this semester to plan your finances successfully. $35,000. Now that you have started making money. you want to use everything you Part 1: Taxes And you inte least Sing You want to determine how much you owe in taxes. You are single, you have no dependents, and you will take the 2021 standard deduction. Use the tax table below to determine how much you owe in taxes. (Click here to open a copy of the 1040) Mine 15 (taxable Income) is line 15 line 15 (taxable And you are acable And you are Al But Income) Income) is less Single Married Married Head of At Sling than Sling But But Single Married Married Head of A Single Married Married Head of least joindy supe less filing filing house- least fling than than house- rately pindly sepa hold house Jointly sepe Biely hold hold rately Your taxis Your tax is Your ta is- 22,000 25,000 28,000 22.000 22,050 22,050 2.444 2245 22,100 2.ASO 2444 2360 25.poo 25.050 2251 3.029 22.100 2.604 2.000 2000 1164 23 R.TID 2.450 3.164 20.000 22,150 2456 25.050 25,100 2257 2005 2016 22,150 32.200 2010 2011 2170 2.725 2.971 3170 21 26,0 20,100 2.482 25,100 25,150 2836 2253 2017 2.131 3.179 25,100 2,150 3.126 2402 237 22.00 3.001 2016 22.250 2.268 25,150 75.200 2.2.22 20 209 2.022 2.77 25 150 20.200 2162 2.19 2200 3,12 2.09 22.250 22.00 25.290 25 250 2 2629 2828 2.10 26.200 T 250 2.100 2. 3,10 2.100 22.00 22.350 2,474 2.278 2014 2480 2009 2201 25.250 22.30 25,00 2.834 240 2835 20 2305 2700 2s 20250 20,300 3.IN 2.100 2.194 22,400 24N 25,00 25.30 2247 2,840 26 2.840 2.755 28200 2010 3.200 2.001 2016 3.200 3,115 22,400 22,450 2.492 2793 2401 25,0 25,400 2015 ZET 2.446 2761 1.200 2007 282 5.200 21121 22,450 22.500 23.350 21.00 2438 2.407 15,400 25.450 2.852 2750 2002 21,450 3212 3.018 2.499 28.400 2127 2.413 26,456 25.500 2.158 2.85 22.00 22.550 2.850 2773 28,450 28,500 2218 3.019 3.218 3,120 22.50 22.000 2304 2300 2.306 2413 2.510 2011 25,000 25.950 2844 26 2.864 2.775 3.224 3.0 20,500 2.510 28.560 3 224 22.00 1199 2.05 22,650 25,580 25,800 2.316 2317 -2.870 2821 2.870 2.765 205 28.500 3.230 2.516 2001 3.230 22,850 2.145 22,700 201 25.000 25.se 2.522 2.000 2,231 2,67 27 3.236 2133 2,592 28.500 28.650 3.09 3.250 3151 22,700 2.750 2,528 23,50 25,700 2.457 2002 2.05 2329 2.882 25700 25,750 2.797 25,650 26,700 2443 3.000 3.20 IS 2.888 2585 2.888 2.800 22,750 20700 28.750 22,100 3.049 3.248 3248 2.1 2.534 2.305 2504 22.00 22.30 249 25,710 25,000 2540 2011 2640 2014 2.co. 2.800 2.000 2.435 3.055 25,800 20,750 2.254 20,000 3.100 22,850 3.254 22.000 25.05 2.300 2548 2,548 2701 2.300 2.815 28 300 28,00 3.260 2001 3.200 2.173 22.00 22.00 2.461 25 se 25 900 2353 2.08 2552 2207 2.506 2.467 221 28,350 20,00 3.268 3.007 32 2.181 22.950 23.000 25,000 25,950 2012 2359 2588 2473 2713 2.312 2027 25.450 26,00 28,950 20.000 2.212 3,073 3.272 2312 2719 2910 2833 20.se 20,000 3.779 3.07 3278 3.19 20,00 2010 23 220 2.500 250 2.552 16 OW Gross Income: Adjusted Gross Income: Standard Deduction: Taxable income: Tax Liability: Budget After Taxes: nogo