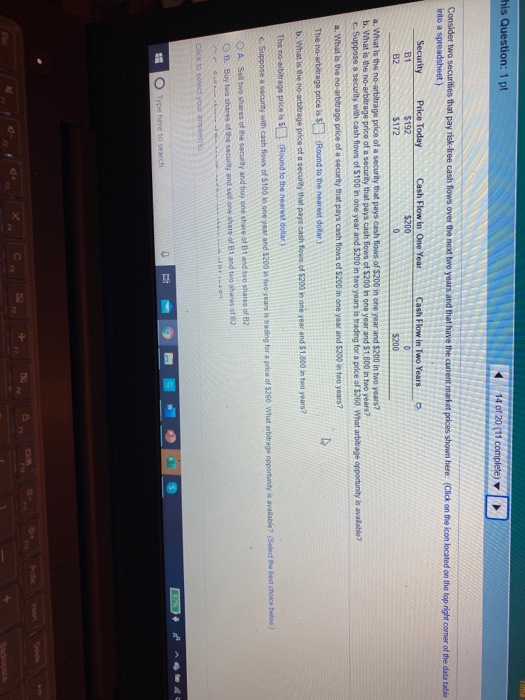

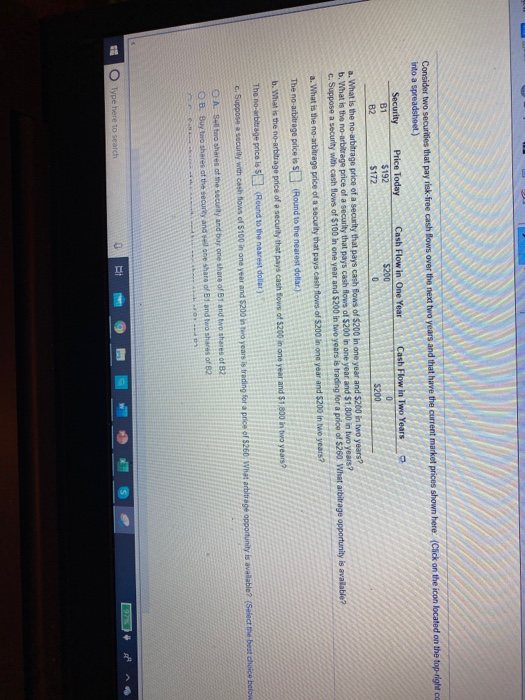

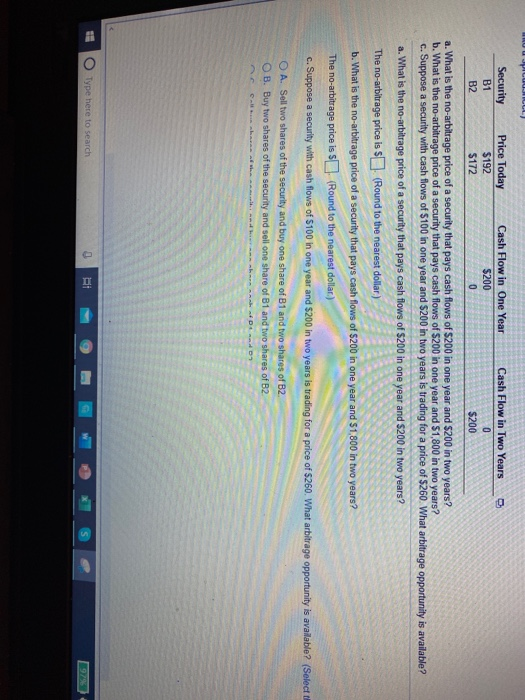

This Question: 1 pt 14 of 20 (11 complete) Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: (Click on the icon located on the top right comer of the data table into a spreadsheet) Security Price Today Cash Flow in One Year Cash Flow In Two Years $192 $200 B2 a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? b. What is the no-arbitrage price of a security that pays cash flow of $200 in one year and $1,800 in two years? c. Suppose a security with cash flows of S100 n one year and $200 in two years is trading for a price of 5260 What arbitrage opportunity is available a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and 5200 in two years? The no-arbitrage price is (Round to the nearest dollar) b. What is the no-arbitrage price of a security that pays cash flow of 5200 in one year and 51.800 in two years? The no-arbitrage price is Round to the nearest dollar) Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260 What arbitrage opportunity is available? (Select the best choice below) O A So two shares of the security and buy one she 01 and wo shares of 82 OB Buy two shares of the security and sell share of B1 and to shares of 62 Click to select your answers). O Type here to search Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: (Click on the icon located on the top right co into a spreadsheet) Security Price Today Cash Flow in One Year Cash Flow in Two Years B1 $200 5172 5200 5 192 B2 a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? b. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1.800 in two years? c. Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available? a. What is the no-arbitrage price of a security that pays cash flowers of $200 in one year and $200 in two years? The no-arbitrage price is SL Round to the nearest dollar) b. What is the no-arbitrage price of a security that pays cash fows of $200 in one year and $1,800 in two years? The no-arbitrage price is 5 (Round to the nearest dollar) c. Suppose a secuilly with cash flow of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available? (Select the best choice below O A Sell too shares of the security and buy one share of B1 and two shares of B2 O B. Buy to shares of the security and one share of B1 and to shares of B2 1 Type here to search C ash Flow in Two Years Security B1 B2 Price Today $192 172 Cash Flow in One Year S200 $200 a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? b. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1,800 in two years? c. Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available? a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? The no-arbitrage price is $ (Round to the nearest dollar) b. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1,800 in two years? The no-arbitrage price is S . (Round to the nearest dollar.) c. Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available? (Select O A. Sell two shares of the security and buy one share of B1 and two shares of B2 OB. Buy two shares of the security and sell one share of B1 and two shares of B2 -Di anda? O Type here to search