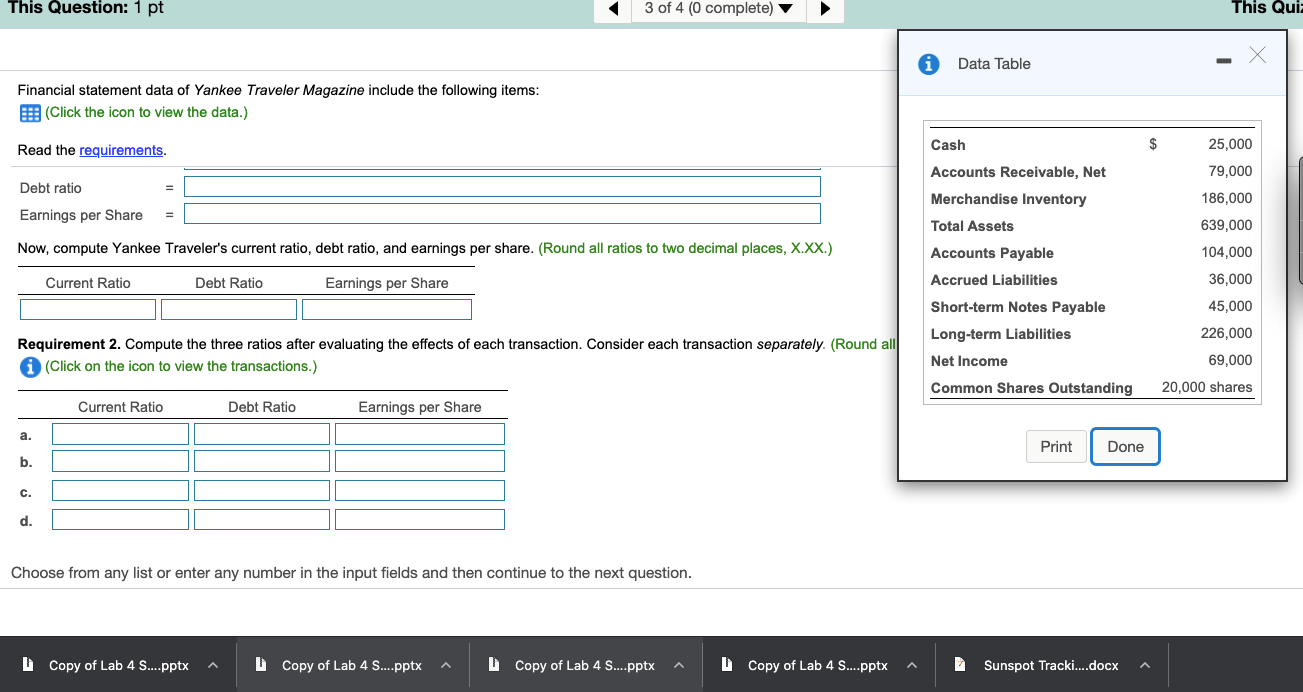

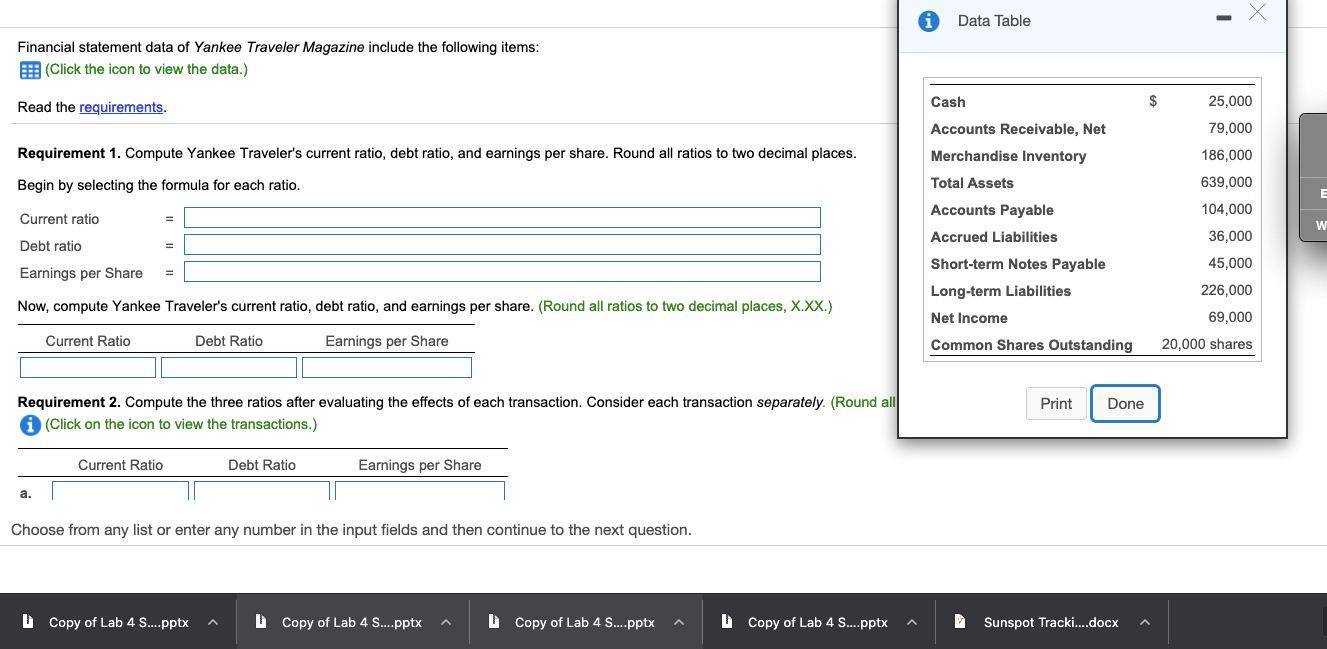

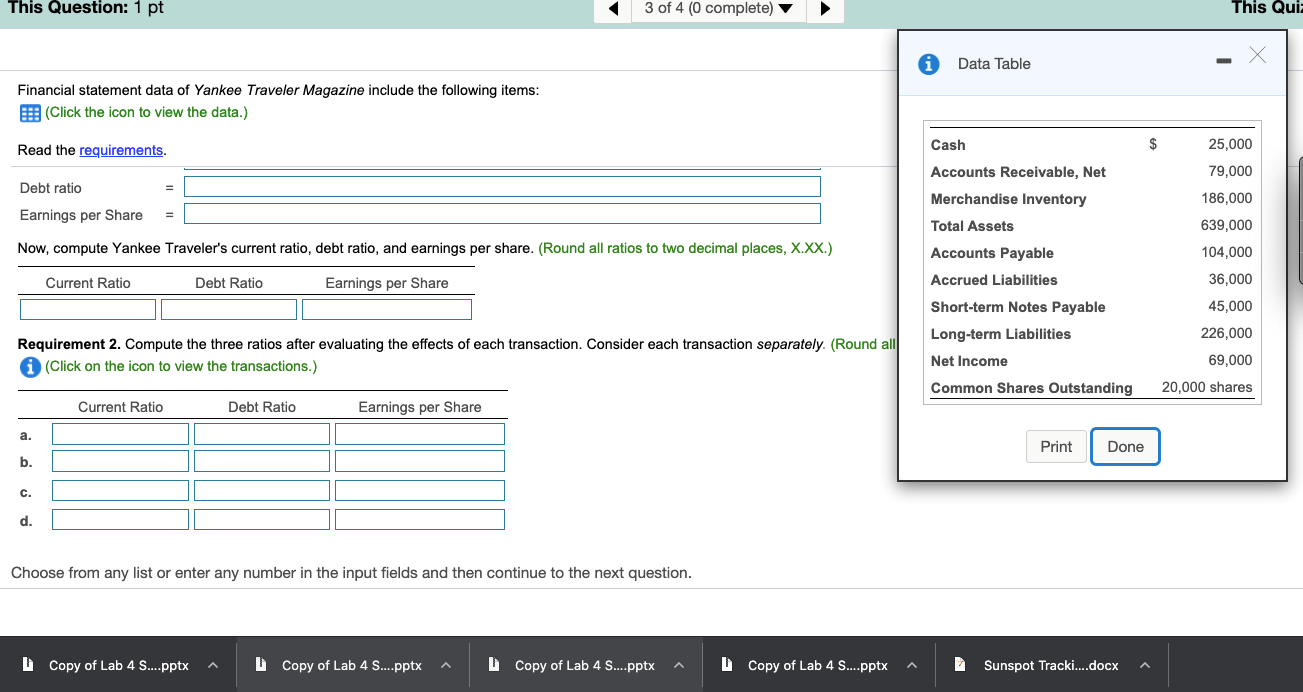

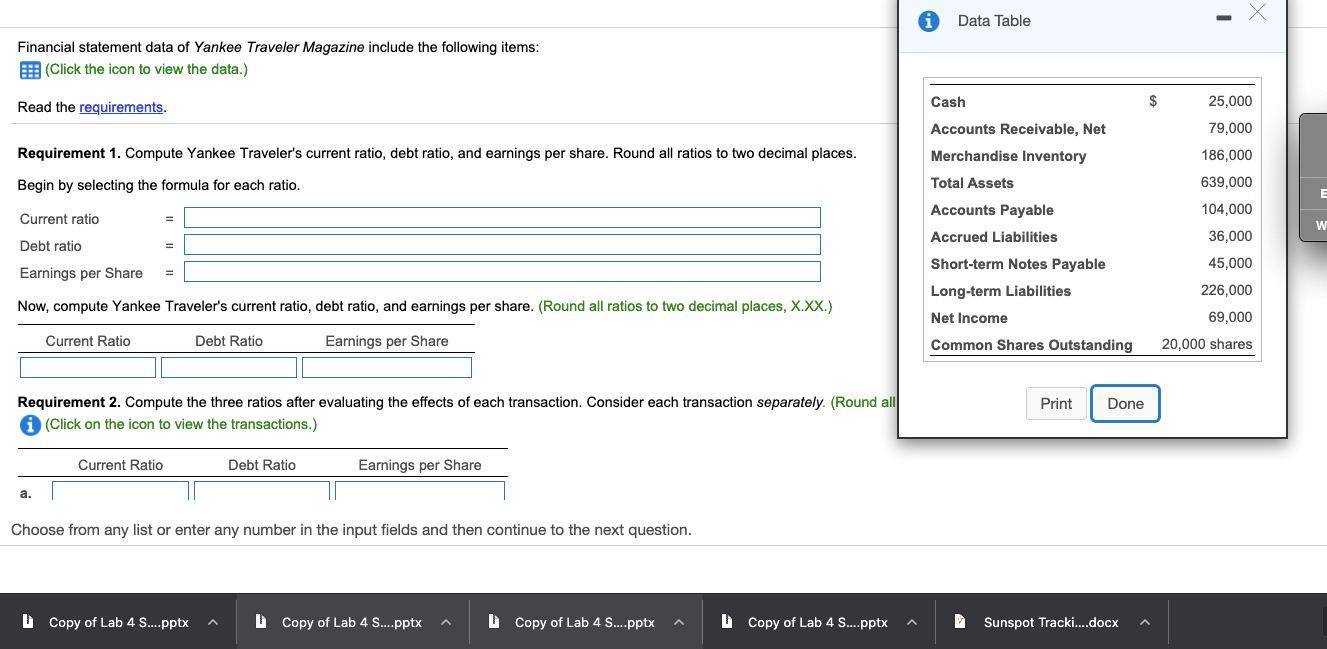

This Question: 1 pt 3 of 4 (0 complete) This Quie Data Table Financial statement data of Yankee Traveler Magazine include the following items: (Click the icon to view the data.) Read the requirements. Cash 25,000 79,000 Debt ratio 186,000 Earnings per Share 639,000 Now, compute Yankee Traveler's current ratio, debt ratio, and earnings per share. (Round all ratios to two decimal places, X.XX.) 104,000 Current Ratio Debt Ratio Earnings per Share Accounts Receivable, Net Merchandise Inventory Total Assets Accounts Payable Accrued Liabilities Short-term Notes Payable Long-term Liabilities Net Income Common Shares Outstanding 36,000 45,000 226,000 Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Round all (Click on the icon to view the transactions.) 69,000 20,000 shares Current Ratio Debt Ratio Earnings per Share a. Print Done Done c. d. Choose from any list or enter any number in the input fields and then continue to the next question. Copy of Lab 4 S....pptx D Copy of Lab 4 S....pptx Copy of Lab 4 S....pptx Copy of Lab 4 S.....pptx Sunspot Tracki....docx - Data Table Financial statement data of Yankee Traveler Magazine include the following items: (Click the icon to view the data.) Cash Read the requirements. Accounts Receivable, Net Requirement 1. Compute Yankee Traveler's current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. Merchandise Inventory 25,000 79,000 186,000 639,000 104,000 Begin by selecting the formula for each ratio. Current ratio 36,000 Debt ratio Total Assets Accounts Payable Accrued Liabilities Short-term Notes Payable Long-term Liabilities Net Income 45,000 Earnings per Share Now, compute Yankee Traveler's current ratio, debt ratio, and earnings per share. (Round all ratios to two decimal places, X.XX.) 226,000 69,000 Current Ratio Debt Ratio Earnings per Share Common Shares Outstanding 20,000 shares Print Done Requirement 2. Compute the three ratios after evaluating the effects of each transaction. Consider each transaction separately. (Round all (Click on the icon to view the transactions.) Current Ratio Debt Ratio Earnings per Share a. Choose from any list or enter any number in the input fields and then continue to the next question. U Copy of Lab 4 S....pptx L Copy of Lab 4 S....pptx Copy of Lab 4 S....pptx D Copy of Lab 4 S....pptx Sunspot Tracki....docx