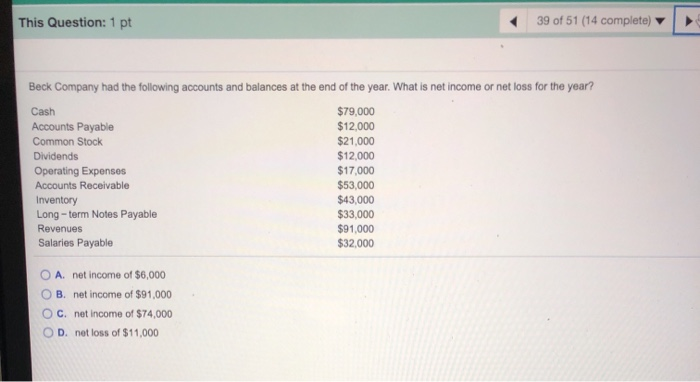

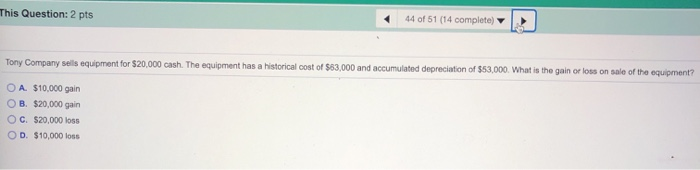

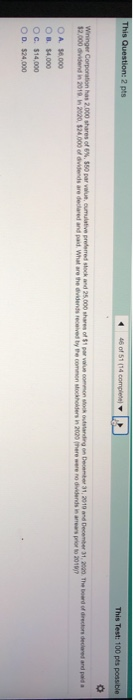

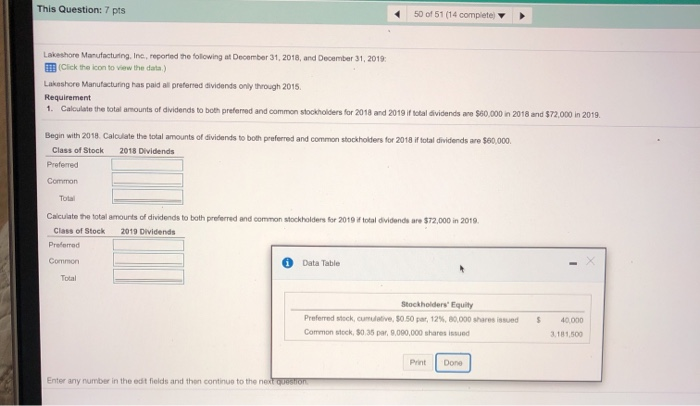

This Question: 1 pt 39 of 51 (14 complete) Beck Company had the following accounts and balances at the end of the year. What is net income or net loss for the year? Cash $79,000 Accounts Payable $12,000 Common Stock $21,000 Dividends $12,000 Operating Expenses $17,000 Accounts Receivable $53,000 Inventory $43,000 Long-term Notes Payable $33,000 Revenues $91,000 Salaries Payable $32,000 O A net income of $6,000 B. net income of $91,000 OC. net income of $74,000 D. net loss of $11,000 This Question: 2 pts 44 of 51 (14 complete) Tony Company seils equipment for $20,000 cash. The equipment has a historical cost of $83,000 and accumulated depreciation of $53,000. What is the gain or loss on sale of the equipment? O A $10,000 gain B. $20,000 gain OG $20,000 loss OD. $10,000 loss This Question: 2 pts 46 of 51114 complete This Test: 100 pts possible Wininger Corporation has 2.000 shares of 6%, 550 par value cumulative preferred stock and 25,000 shares of value common stock outstanding on Dec 31, 2010 and December 31, 2000. The board of director declared and pada $2.000 divided in 2019. i 2020, 524.000 of dividends are declared and paid. What are the dividende received by the common chokers in 2000 here were no dividends in areas prior to 2017 O A 16.000 OB. $4.000 OC. $14,000 OD. $24,000 This Question: 7 pts 50 of 51 (14 completel Lakeshore Manufacturing, Inc., reported the following at December 31, 2018, and December 31, 2019 Click the icon to view the data) Lakeshore Manufacturing has paid al preferred dividends only through 2015 Requirement 1. Calculate the total amounts of dividends to both preferred and common stockholders for 2018 and 2019 if total dividends are $60,000 in 2018 and $72.000 in 2019. Begin with 2018. Calculate the total amounts of dividends to both preferred and common stockholders for 2018 il total dividends are $60,000. Class of Stock 2018 Dividends Preferred Common Total Calculate the total amounts of dividends to both preferred and common stockholders for 2010 total dividends are $72,000 in 2010. Dividends Class of Stock Preferred Common Data Table Total Stockholders' Equity Preferred stock, cumulative, 50.50 par, 12% 30.000 shares issued Common stock, 30.35 par, 9.000.000 shares issued $ 40.000 3.181,500 Print Done Enter any number in the edit fields and then continue to the next 51 of 51114 complete This Test: 100 pts possible O The Dumond Store began business on June 1. During the month of June, Damond hand cash payments of $4.000. Al the end of June, had a $20.000 cash balance Based on this information the cash receipts for the month of June were OA 516,000 OB. $20.000 128.000 OD 14.000