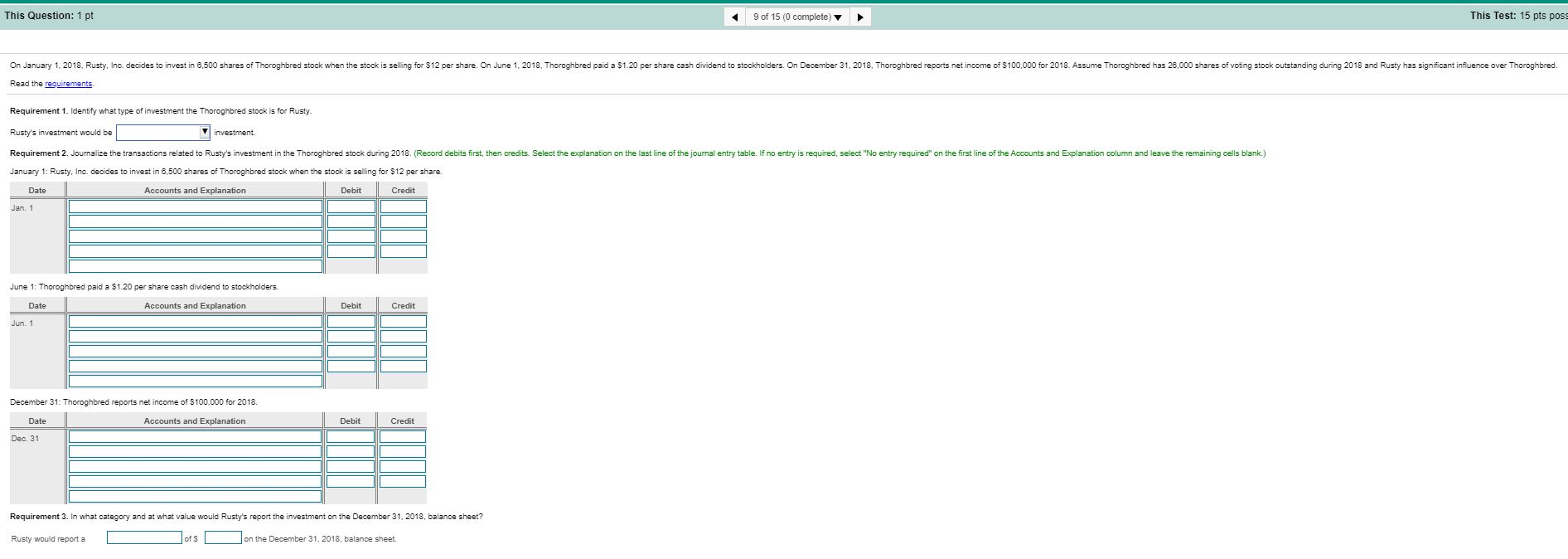

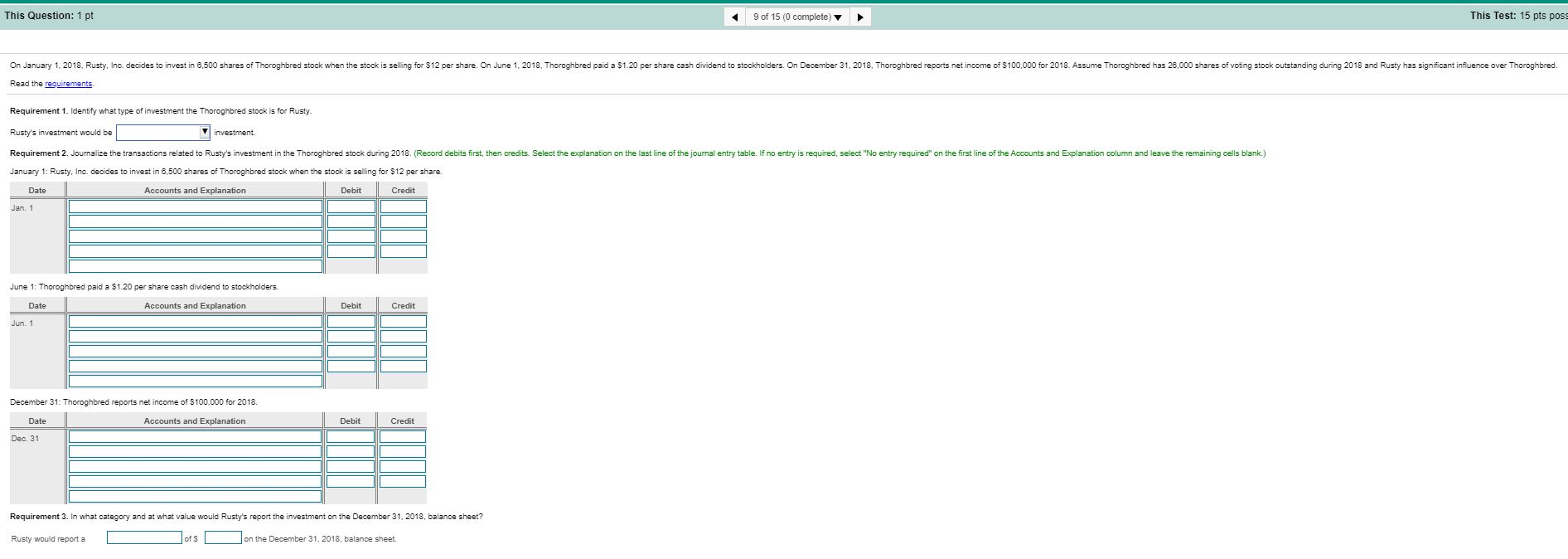

This Question: 1 pt 9 of 15 (0 complete) This Test: 15 pts poss On January 1, 2018. Rusty, Inc. decides to invest in 6,500 shares of Thoroghbred stock when the stock is selling for $12 per share. On June 1. 2018. Thoroghbred paid a $1.20 per share cash dividend to stockholders. On December 31, 2018, Thoroghbred reports net income of $100,000 for 2018. Assume Thoroghbred has 26,000 shares of voting stock outstanding during 2018 and Rusty has significant influence over Thoroghbred. Read the requirements Requirement 1. Identify what type of investment the Thoroghbred stock is for Rusty. Rusty's investment would be investment Requirement 2. Journalize the transactions related to Rusty's investment in the Thoroghbred stock during 2018. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) January 1: Rusty, Inc. decides to invest in 6,500 shares of Thoroghbred stock when the stock is selling for $12 per share. Date Accounts and Explanation Debit Credit Jan. 1 June 1: Thoroghbred paid a $1.20 per share cash dividend to stockholders. Date Accounts and Explanation Debit Credit Jun. 1 December 31: Thoroghbred reports net income of $100.000 for 2018. Date Accounts and Explanation Dec. 31 Debit Credit Requirement 3. In what category and at what value would Rusty's report the investment on the December 31, 2018, balance sheet? Rusty would report a of S on the December 31, 2018, balance sheet. No entry required Available-for-Sale Debt Investments Cash Dividend Receivable Dividend Revenue Equity Investments-Thoroghbred Fair Value Adjustment-Available-for-Sale Fair Value Adjustment, Trading Gain on Disposal Interest Revenue Loss on Disposal Revenue from Investments Trading Debt Investments Unrealized Holding GainAvailable for Sale Unrealized Holding Gain-Trading Unrealized Holding Loss-Available-for-Sale Unrealized Holding Loss-Trading