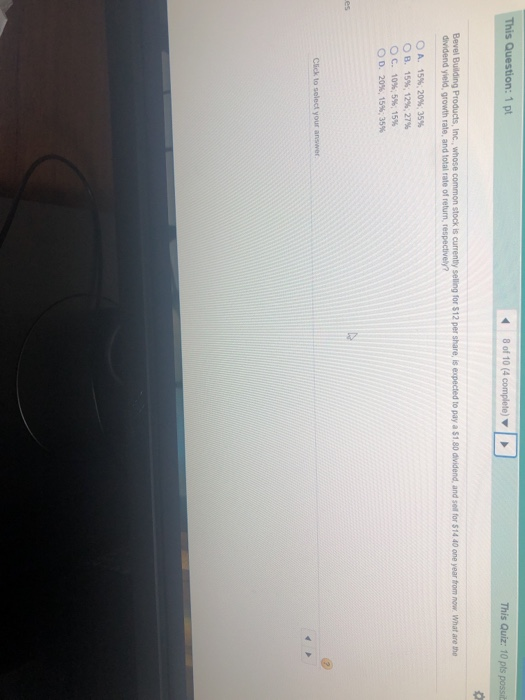

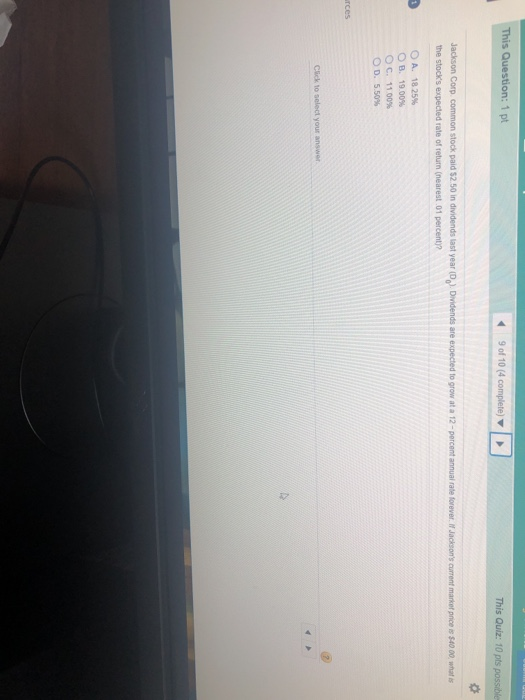

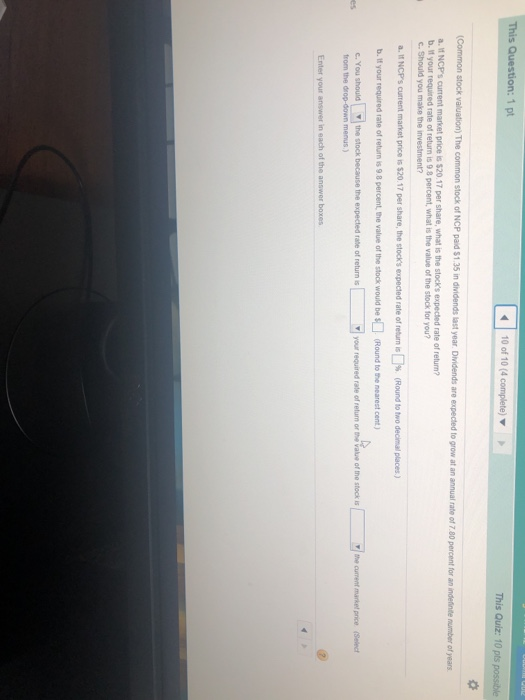

This Question: 1 pt Th How is preferred stock similar to bonds? O A. Preferred stockholders receive a dividend payment (much like interest payments to bondholders) that is usually fixed O B. Dividend payments to preferred shareholders (much like bond interest payments to bondholders) are tax deductible O C. Investors can sue the firm if preferred dividend payments are not paid (much like bondholders can sue for non-payment of interest payments) O D. Preferred stock is not like bonds in any way Click to select your answer This Quiz: 10 pts possib a. What is your expected return? a. Your expected return is percent. (Round to two decimal places) preferred stock is This Question: 1 pt This Quiz: 10 pts possit Bevel Building Products, Inc, whose common stock is currently selling for $12 per share, is expected to pay a $1.80 dividend, and selt for $14 .40 one year from now What are the dividend yield, growth rate, and total rate of return, respectively? A. 15% 20% 35% B. 15%, 12%, 27% O c. 10%5% 15% D. 20% 15% 35% Click to select your answer This Question: 1 pt This Quiz: 10 pts possible ackson Corp. common stock paid $2.50 in dividends last year (D). Dividends are expected to grow at a 12-percent annual rate forever. IN Jackson's current market price i $40 00 what OA, 18 25% B. 19 00% C, 1100% OD, 5.50% Click to select your answer This Question: 1 pt 10 of 10( This Quiz: 10 pts possible Common stock valuation) The common stock of NCP paid $1.35 in dividends last year Dividends are ex a. If NCP's current market price is $20.17 per share, what is the stock's expected rate of returm b. If your required rate of return is 9.8 percent, what is the value of the stock for you? pected to grow at an annual rate of 7.80 percent for an inderinte number of years c. Should you make the investment? a. t Nors current market price ts S20 17 per share, the stocks expected rate of return is [ % (Round to two decimal places.) b. if your required rate of returm is 98 percent, the value of the stock would be s(Round to the nearest cent your required rate of retum or the vaue of the stock i current market price (Select C. You should the stock because the expected rate of return is es from the drop-down menus.)