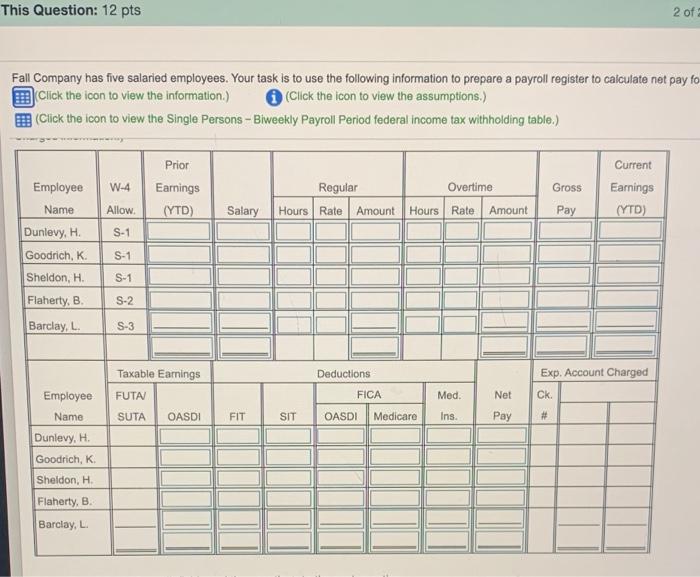

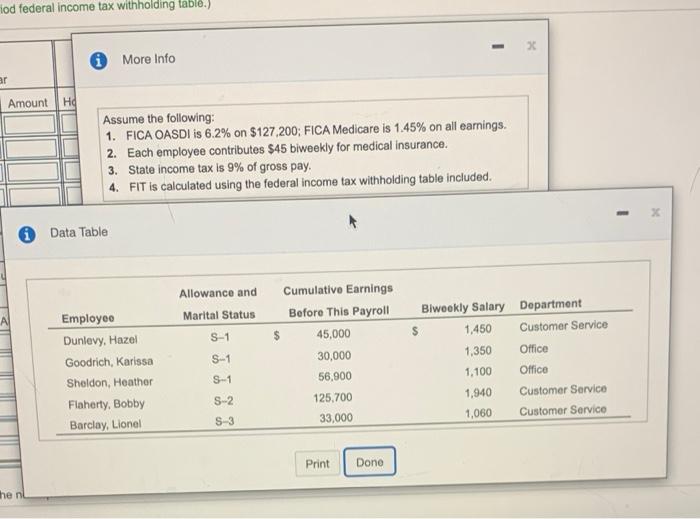

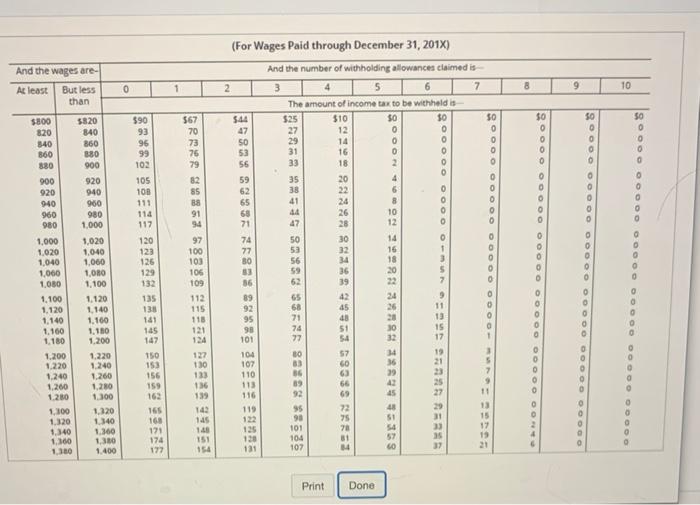

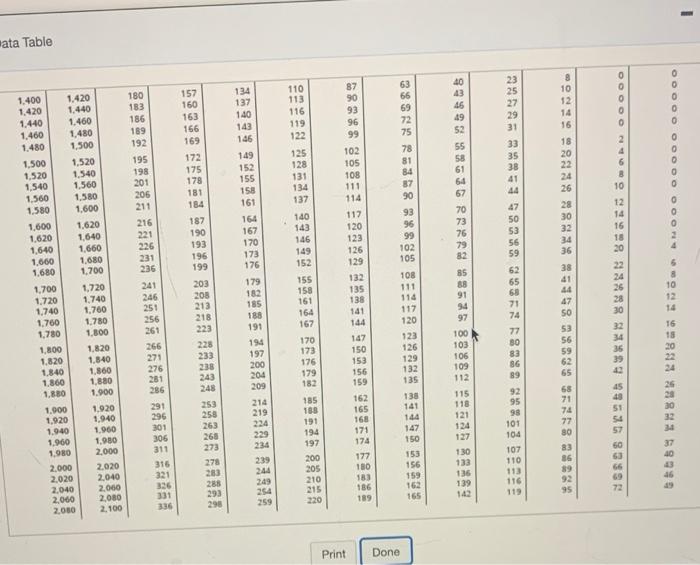

This Question: 12 pts 2 of Fall Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay fo Click the icon to view the information.) (Click the icon to view the assumptions.) (Click the icon to view the Single Persons - Biweekly Payroll Period federal income tax withholding table.) W-4 Prior Earnings (YTD) Gross Regular Hours Rate Amount Overtime Hours Rate Amount Current Earnings (YTD) Allow Salary Employee Name Dunlevy, H. Goodrich, K. Pay S-1 S-1 Sheldon, H. S-1 Flaherty, B. S-2 Barclay, L. S-3 Exp. Account Charged Taxable Earnings FUTA Deductions FICA Med. Net Ck. Employee Name SUTA OASDI FIT SIT OASDI Medicare Ins. Pay # Dunlevy, H. Goodrich, K Sheldon, H. Flaherty, B. Barclay, L. lod federal income tax withholding table.) - 3 6 More Info ar Amount Hd Assume the following: 1. FICA OASDI is 6.2% on $127.200; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $45 biweekly for medical insurance. 3. State income tax is 9% of gross pay. 4. FIT is calculated using the federal income tax withholding table included. Data Table Allowance and Marital Status S-1 Cumulative Earnings Before This Payroll $ 45,000 30,000 56,900 1,350 Employee Dunlevy, Hazel Goodrich, Karissa Sheldon, Heather Flaherty, Bobby Barclay, Lionel S-1 Blweekly Salary Department $ 1.450 Customer Service Office 1.100 Office 1,940 Customer Service 1,060 Customer Service S-1 S-2 125,700 S-3 33,000 Print Done he ne (For Wages Paid through December 31, 2018) And the wages are At least 1 2 10 9 But less than And the number of withholding allowances claimed is 3 4 5 6 The amount of income tax to be withheld is $10 50 10 50 12 0 10 14 | | 14 0 16 10 18 2 0 $800 820 340 860 880 5820 840 860 380 c 11 0 0 0 10 9 0 - 6 0 0 920 105 103 111 114 117 n SmmE 4 6 8 0 0 0 bon cao 0 10 0 0 3 0 9 2 O 900 920 940 960 1960 1,000 1,020 1.040 1,060 1.030 1.100 1.120 1.140 1.160 1.180 1.200 1.220 1.240 1.200 1.280 1,100 1.320 1,340 1.300 1380 0 129 132 135 130 181 nn G88 nn LDS GS 0 9 11 13 o 112 115 118 12 124 o rr%3 147 1,020 1,040 1,060 100 1.100 1.120 1.140 1,160 10 1.200 1.220 1.240 1.260 1,280 1.300 1,320 1 340 1.360 13 1.400 17 1 1 , ooooooooooooooooo 150 153 156 159 163 122 130 133 104 102 110 11 116 3 5 7 9 11 13 15 17 139 14 145 1.40 151 1 oooooL 165 119 1 123 174 177 Print Done ata Table 0 180 183 186 189 197 157 160 163 166 169 134 137 140 143 146 10 12 14 16 oooo 0 0 0 0 172 175 178 181 184 149 152 159 158 161 110 113 116 119 122 125 128 131 134 137 140 143 146 149 152 102 105 108 111 114 2 4 6 8 10 B 12 187 190 %%%adm 129 179 1.400 1.420 1.440 1.460 1.480 1.500 1.520 1.540 1.560 1.580 1.600 1.620 1,640 1.660 1,680 1,700 1.720 1,740 1.760 1,780 1.82 1.840 1.860 1.880 1.900 1.920 1.040 1.960 1.980 2.000 2.020 2,040 2,060 20 12 111 1.420 1.440 1.460 1.480 1.500 1,520 1.540 1.560 1,600 1,620 1.640 1.660 1.680 1.700 1,720 1.740 1,760 1.780 1.800 1.820 1.840 1.860 1.880 1.900 1.920 1,940 1.960 10 2.000 2.020 2,040 2.000 2,080 2.100 14 12 191 155 158 161 164 167 117 120 923 126 129 132 139 %%%&g 1944 197 200 170 173 176 179 182 132 135 138 141 144 147 150 153 156 159 162 165 160 171 174 177 180 13 186 189 n agour ha ooooo. , 209 100 103 106 109 112 115 118 121 134 127 138 141 144 147 150 278 28 205 210 215 220 153 156 159 162 165 136 139 143 107 110 113 116 113 95 331 336 Print Done