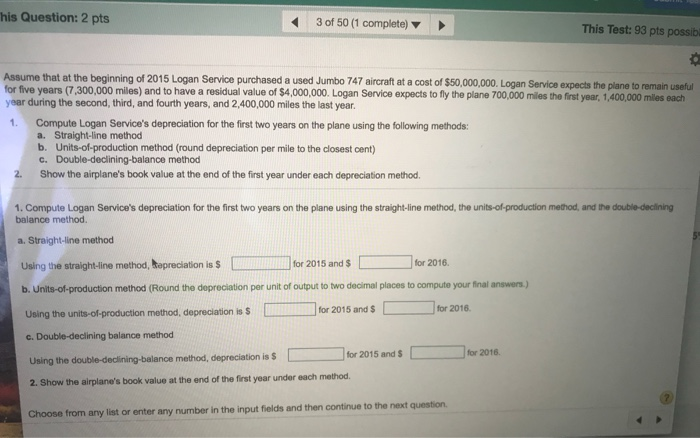

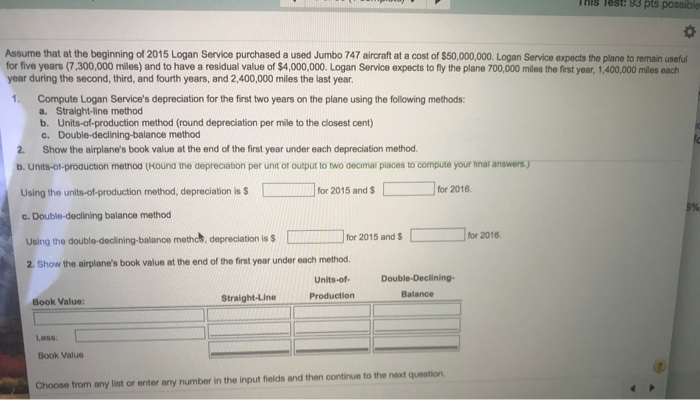

This Question: 2 pts 3 of 50 (1 complete) This Test: 93 pts possibl Assume that at the beginning of 2015 Logan Service purchased a used Jumbo 747 aircraft at a cost of $50,000,000. Logan Service expects the plane to remain useful for five years (7,300,000 miles) and to have a residual value of $4,000,000. Logan Service expects to fly the plane 700,000 miles the first year, 1,400,000 miles each year during the second, third, and fourth years, and 2,400,000 miles the last year. 1. Compute Logan Service's depreciation for the first two years on the plane using the following methods: a. Straight-line method b. Units-of-production method (round depreciation per mile to the closest cent) c. Double-declining-balance method Show the airplane's book value at the end of the first year under each depreciation method. 1. Compute Logan Service's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method Using the straight-line method, apreciation is $ ALL for 2015 and for 2016. b. Units-of-production method (Round the depreciation per unit of output to two decimal places to compute your final answers Using the units-of-production method, depreciation is for 2015 and $ for 2016 c. Double-declining balance method for 2018 for 2015 and $ Using the double-declining balance method, depreciation is 2. Show the airplane's book value at the end of the first year under each method. Choose from any list or enter any number in the input fields and then continue to the next question This Test: 93 pts possible Assume that at the beginning of 2015 Logan Service purchased a used Jumbo 747 aircraft at a cost of $50,000,000. Logan Service expects the plane to remain useful for five years (7,300,000 miles) and to have a residual value of $4,000,000. Logan Service expects to fly the plane 700,000 miles the first year, 1,400,000 miles each year during the second, third, and fourth years, and 2,400,000 miles the last year. Compute Logan Service's depreciation for the first two years on the plane using the following methods: a. Straight-line method b. Units-of-production method (round depreciation per mile to the closest cent) C. Double-declining balance method 2. Show the airplane's book value at the end of the first year under each depreciation method. b. Units-ot-production method (Round the depreciation per unit of output to two decimal places to compute your finar answers.) Using the units-of-production method, depreciation is $ for 2015 and $ for 2016 c. Double-declining balance method Using the double-declining balance methods, depreciation is $ U for 2015 and for 2016 2. Show the airplane's book value at the end of the first year under each method. Units-of- Production Double-Declining Balance Book Value: Straight-Line LOSS: Book Value Choose from any lint or enter any number in the input fields and then continue to the next