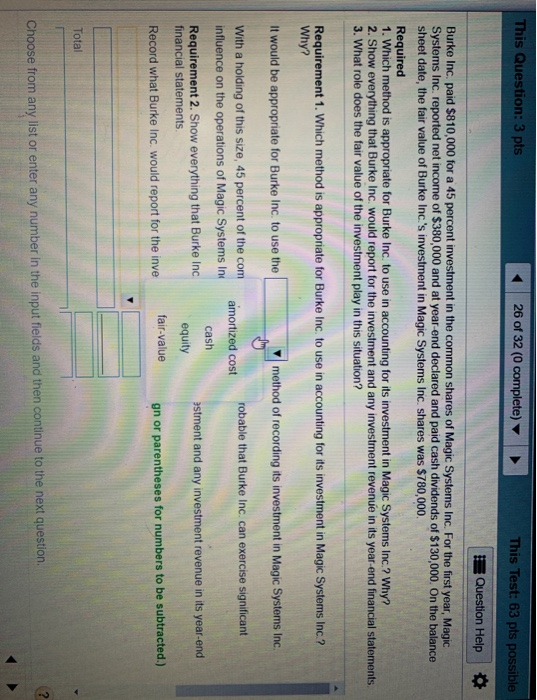

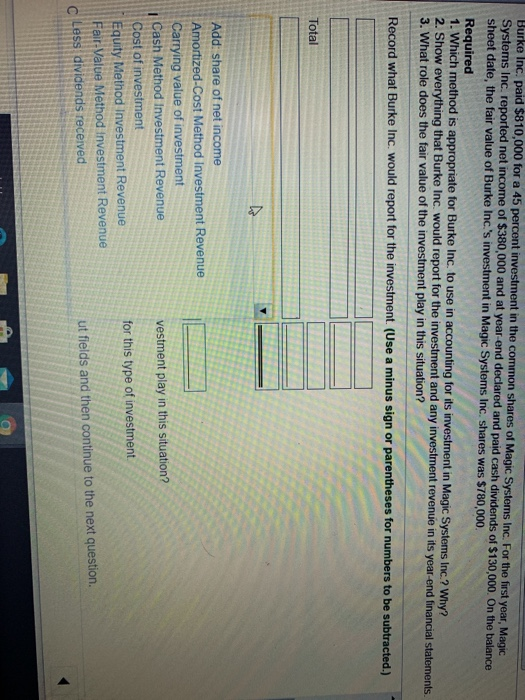

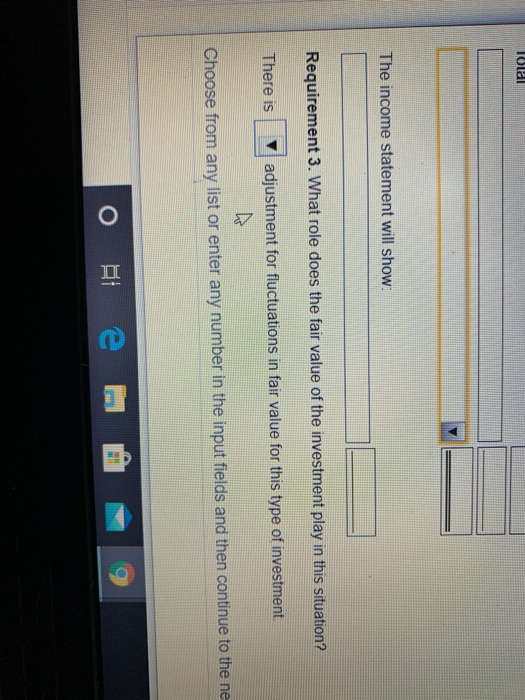

This Question: 3 pts 26 of 32 (0 complete) This Test: 63 pts possible Question Help Burke Inc. paid $810,000 for a 45 percent investment in the common shares of Magic Systems Inc. For the first year, Magic Systems Inc. reported net income of $380,000 and at year end declared and paid cash dividends of $130,000. On the balance sheet date, the fair value of Burke Inc.'s investment in Magic Systems Inc. shares was $780,000 Required 1. Which method is appropriate for Burke Inc. to use in accounting for its investment in Magic Systems Inc. Why? 2. Show everything that Burke Inc. would report for the investment and any investment revenue in its year-end financial statements 3. What role does the fair value of the investment play in this situation? Requirement 1. Which method is appropriate for Burke Inc. to use in accounting for its investment in Magic Systems Inc.? Why? It would be appropriate for Burke Inc. to use the method of recording its investment in Magic Systems Inc. robable that Burke Inc. can exercise significant amortized cost cash With a holding of this size, 45 percent of the com influence on the operations of Magic Systems in Requirement 2. Show everything that Burke Inc financial statements Record what Burke Inc. would report for the inve 3stment and any investment revenue in its year-end equity fair-value gn or parentheses for numbers to be subtracted.) Total Choose from any list or enter any number in the input fields and then continue to the next question Burke Inc. paid $810,000 for a 45 percent investment in the common shares of Magic Systems Inc. For the first year, Magic Systems Inc. reported net income of $380,000 and at year end declared and paid cash dividends of $130,000. On the balance sheet date, the fair value of Burke Inc.'s investment in Magic Systems Inc. shares was $780,000 Required 1. Which method is appropriate for Burke Inc. to use in accounting for its investment in Magic Systems Inc.? Why? 2. Show everything that Burke Inc. would report for the investment and any investment revenue in its year-end financial statements 3. What role does the fair value of the investment play in this situation? Record what Burke Inc. would report for the investment. (Use a minus sign or parentheses for numbers to be subtracted.) Total vestment play in this situation? Add: share of net income Amortized-Cost Method Investment Revenue Carrying value of investment Cash Method Investment Revenue Cost of investment Equity Method Investment Revenue Fair-Value Method investment Revenue c Less dividends received for this type of investment ut fields and then continue to the next question. Toll The income statement will show: Requirement 3. What role does the fair value of the investment play in this situation? There is adjustment for fluctuations in fair value for this type of investment ho Choose from any list or enter any number in the input fields and then continue to the ne Bi e