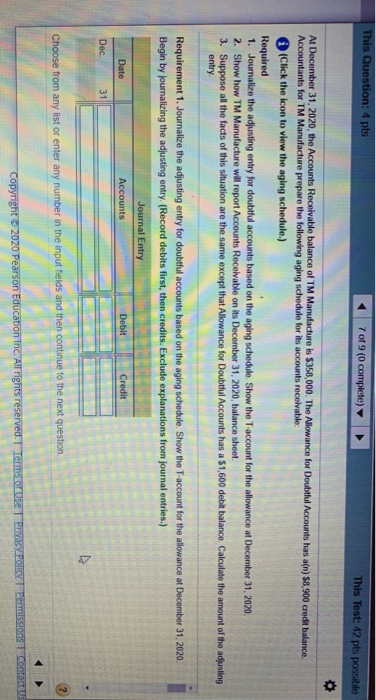

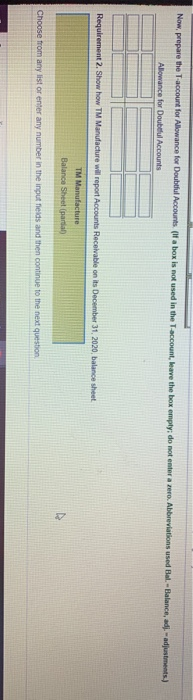

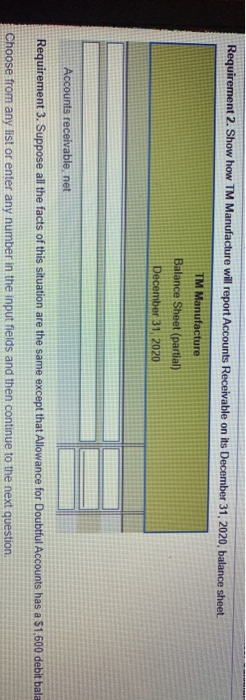

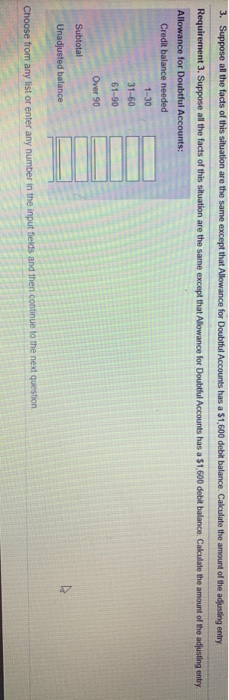

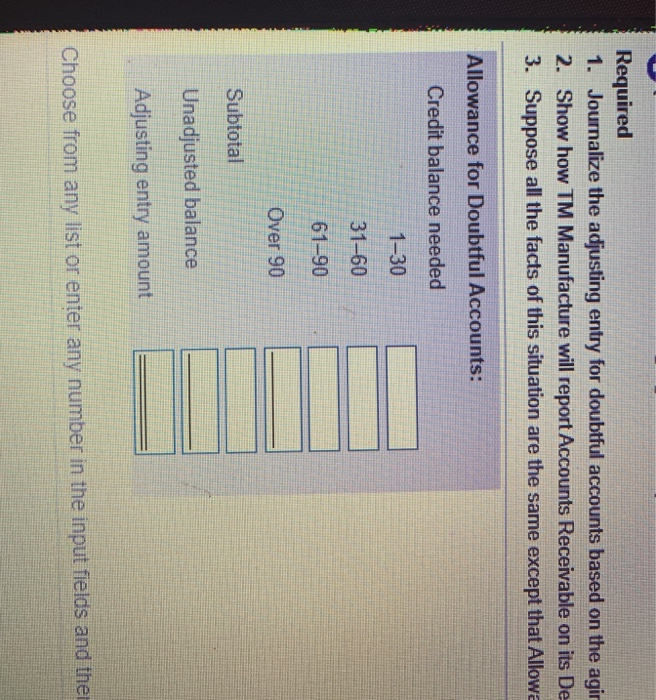

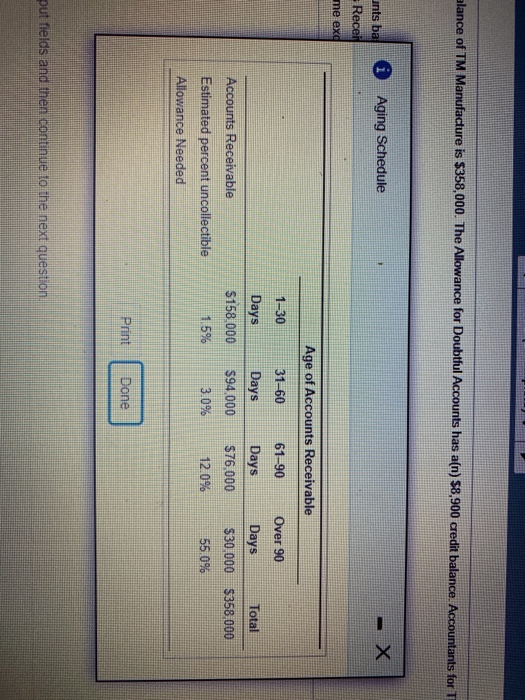

This Question: 4 pts 7 of 9 (0 complete) This Test: 42 pls possible At December 31, 2020, the Accounts Receivable balance of TM Manufacture is $358,000. The Allowance for Doubtful Accounts has a(n) 88,900 credit balance. Accountants for TM Manufacture prepare the following aging schedule for its accounts receivable: (Click the icon to view the aging schedule.) Required 1. Journalize the adjusting entry for doubtful accounts based on the aging schedule. Show the account for the allowance at December 31, 2020, 2. Show how TM Manufacture will report Accounts Receivable on its December 31, 2020, balance sheet 3. Suppose all the facts of this situation are the same except that Allowance for Doubtful Accounts has a $1,600 debit balance Calculate the amount of the adjusting entry Requirement 1. Journalize the adjusting entry for doubtful accounts based on the aging schedule. Show the T-account for the allowance at December 31, 2020. Begin by journalizing the adjusting entry. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit Dec 31 4 Choose from any list or enter any number in the input fields and then continue to the next question Copyright o 2020 Pearson Education Inc. All rights reserved. Terms of Use Privacy Policy Permissions Contact Us Now, prepare the Taccount for Allowance for Doubtful Accounts. (If a box is not used in the Taccount, leave the box empty, do not enter a zero. Abbreviations used Bal.- Balance, adj. -adjustments.) Allowance for Doubtful Accounts Requirement 2. Show how TM Manufacture will report Accounts Receivable on its December 31, 2020, balance sheet TM Manufacture Balance Sheet (partia Choose from any list or enter any number in the input helds and then continue to the next question Requirement 2. Show how TM Manufacture will report Accounts Receivable on its December 31, 2020, balance sheet. TM Manufacture Balance Sheet (partial) December 31, 2020 Accounts receivable net Requirement 3. Suppose all the facts of this situation are the same except that Allowance for Doubtful Accounts has a 51,600 debit bala Choose from any list or enter any number in the input fields and then continue to the next question. 3. Suppose all the facts of this situation are the same except that Allowance for Doubtful Accounts has a 51,600 debit balance Calculate the amount of the adjusting entry Requirement 3. Suppose all the facts of this situation are the same except that Allowance for Doubtful Accounts has a $1,600 debit balance Calculate the amount of the adjusting entry Allowance for Doubtful Accounts: Credit balance needed 1-30 31-60 61-90 Over 90 Subtotal Unadjusted balance Choose from any list or enter any number in the input fields and then continue to the next question Required 1. Journalize the adjusting entry for doubtful accounts based on the agir 2. Show how TM Manufacture will report Accounts Receivable on its De 3. Suppose all the facts of this situation are the same except that Allowa Allowance for Doubtful Accounts: Credit balance needed 1-30 31-60 61-90 Over 90 Subtotal Unadjusted balance Adjusting entry amount Choose from any list or enter any number in the input fields and then alance of TM Manufacture is $358,000. The Allowance for Doubtful Accounts has a[n) $8,900 credit balance. Accountants for T 0 Aging Schedule unts ba Recei me exd Age of Accounts Receivable 1-30 31-60 61-90 Over 90 Days Total Days $158.000 Days $94.000 Days $30.000 Accounts ole $76,000 $358 000 1.5% 3.0% 12.0% 55.0% Estimated percent uncollectible Allowance Needed Print Done put fields and then continue to the next