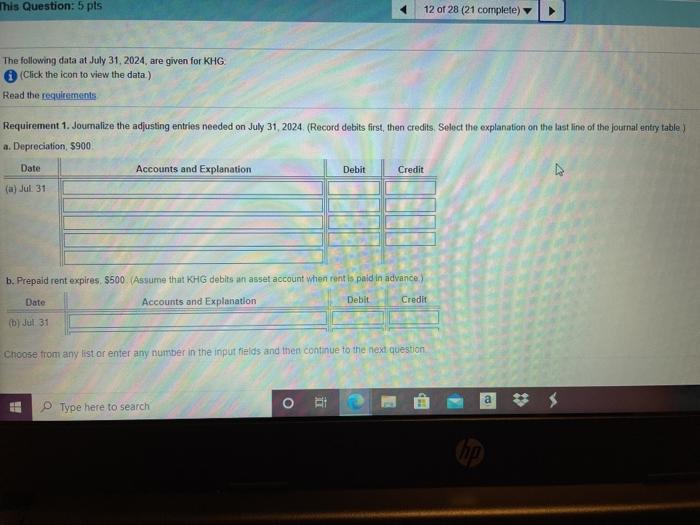

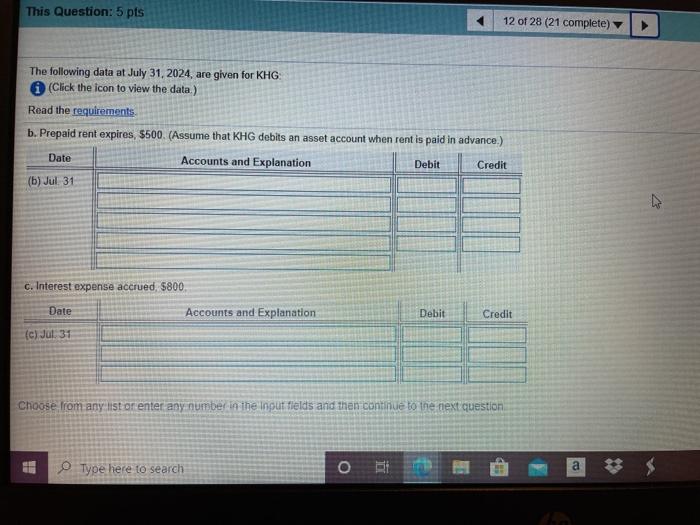

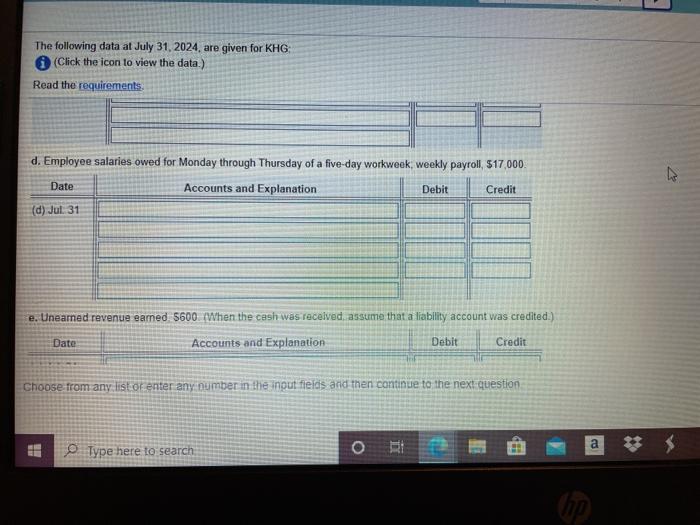

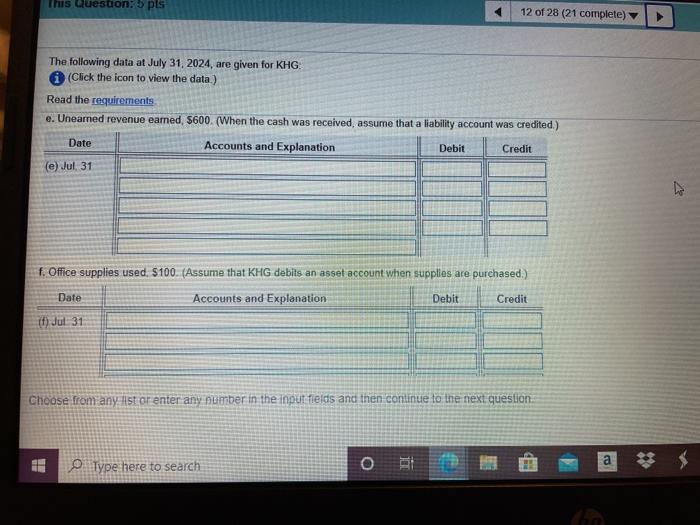

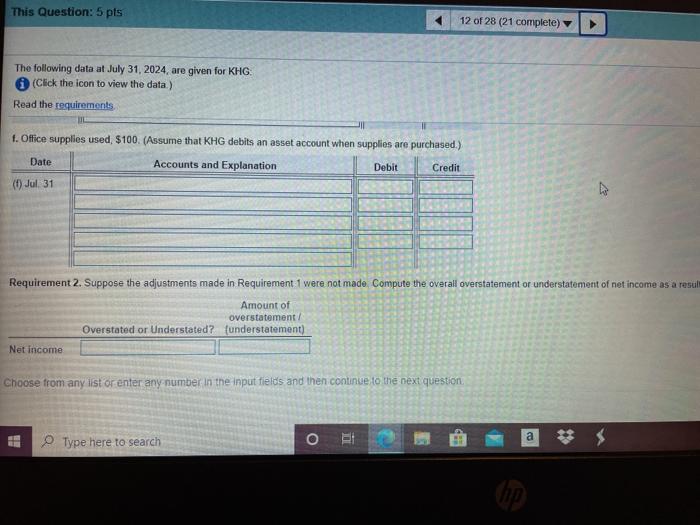

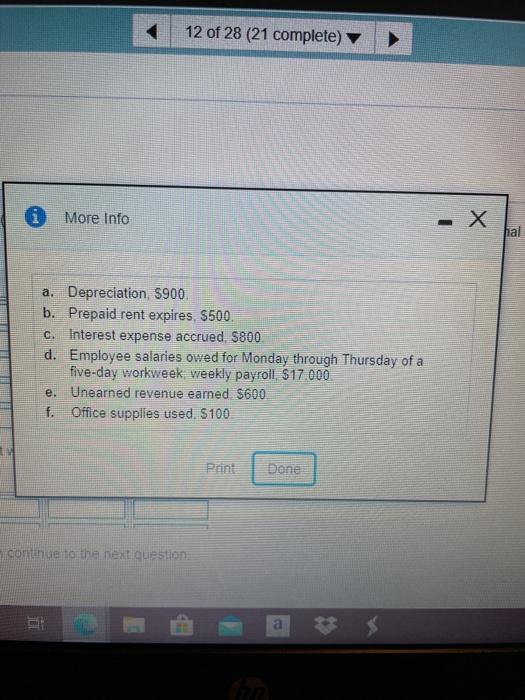

This Question: 5 pts 12 of 28 (21 complete) The following data at July 31, 2024, are given for KHG (Click the icon to view the data) Read the requirements Requirement 1. Joumalize the adjusting entries needed on July 31, 2024. (Record debits first, then credits Select the explanation on the last line of the journal entry table) a. Depreciation, 5900 Date Accounts and Explanation Debit Credit v (a) Jul 31 b. Prepaid rent expires. $500. Assume that KHG debits an asset account when rent is paid in advance Date Accounts and Explanation Debit Credit (b) Jul 31 Choose from any list or enter any number in the input fields and then continue to the next question i a Type here to search This Question: 5 pts 12 of 28 (21 complete) The following data at July 31, 2024, are given for KHG (Click the icon to view the data) Read the requirements b. Prepaid rent expires, $500. (Assume that KHG debits an asset account when rent is paid in advance.) Date Accounts and Explanation Debit Credit (b) Jul 31 6. Interest expense accrued $800 Date Accounts and Explanation Debit Credit (c) Jul 31 Choose from any list or enter any number in the input fields and then continue to the next question Type here to search The following data at July 31, 2024, are given for KHG (Click the icon to view the data.) Read the requirements. 4 d. Employee salaries owed for Monday through Thursday of a five-day workweek, weekly payroll, $17.000. Date Accounts and Explanation Debit Credit (d) Jul 31 e. Uneamed revenue eamed 5600. When the cash was received assume that a liability account was credited) Date Accounts and Explanation Debit Credit Choose from any list of enter any number in the input fields and then continue to the next question a O Type here to search This duesuoni. pts 12 of 28 (21 complete) The following data at July 31, 2024, are given for KHG i (Click the icon to view the data) Read the requirements e. Unearned revenue earned, $600. (When the cash was received, assume that a liability account was credited) Date Accounts and Explanation Debit Credit (e) Jul 31 v f. Office supplies used. $100. (Assume that KHG debits an asset account when supplies are purchased) Date Accounts and Explanation Debit Credit (1) Jul 31 Choose from any list or enter any number in the input fields and then continue to the next question 13 Type here to search This Question: 5 pts 12 of 28 (21 complete) The following data at July 31, 2024, are given for KHG (Click the icon to view the data.) Read the requirements f. Office supplies used, $100. (Assume that KHG debits an asset account when supplies are purchased.) Date Accounts and Explanation Debit Credit (1) Jul 31 Requirement 2. Suppose the adjustments made Requirement 1 were not made Compute the overall overstatement or understatement of net income as a resul Amount of overstatement/ Overstated or Understated? (understatement) Net income Choose from any list or enter any number in the input fields and then continue to the next question Type here to search a OPI 12 of 28 (21 complete) More Info hal a. Depreciation, 5900 b. Prepaid rent expires, $500 c. Interest expense accrued $800 d. Employee salaries owed for Monday through Thursday of a five-day workweek weekly payroll $17.000 e. Unearned revenue earned $600 f. Office supplies used $100 Done continue to the next question a