Answered step by step

Verified Expert Solution

Question

1 Approved Answer

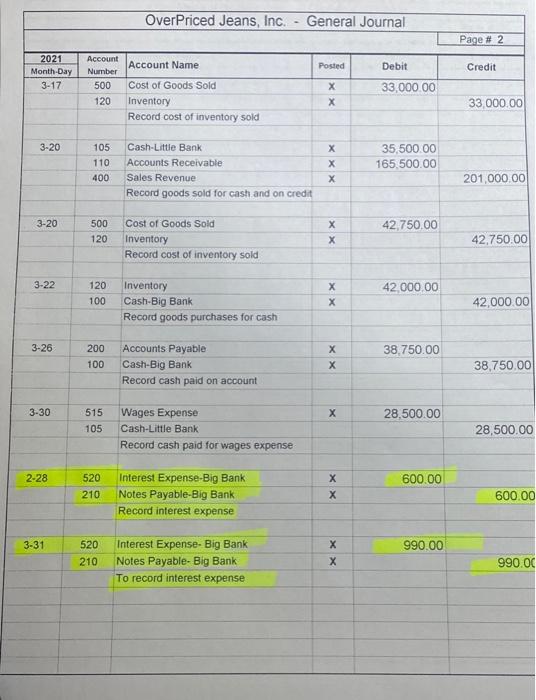

this question asks for us to post an adjusted entry of the first highlighted area. i did post it in the journal , but realize

this question asks for us to post an adjusted entry of the first highlighted area.

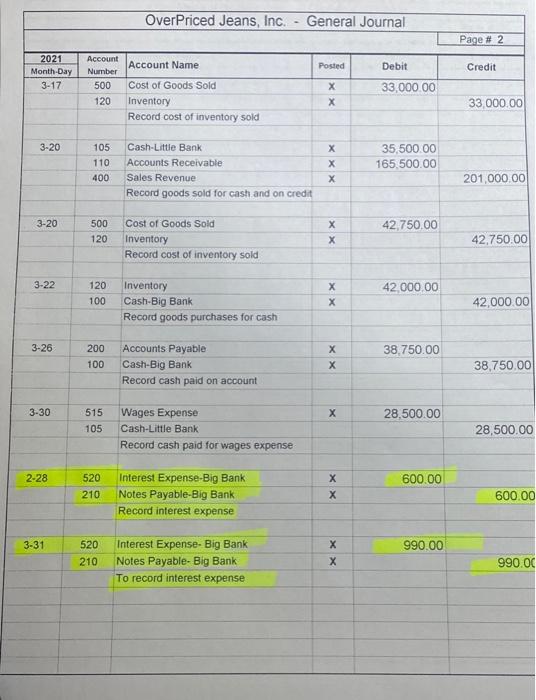

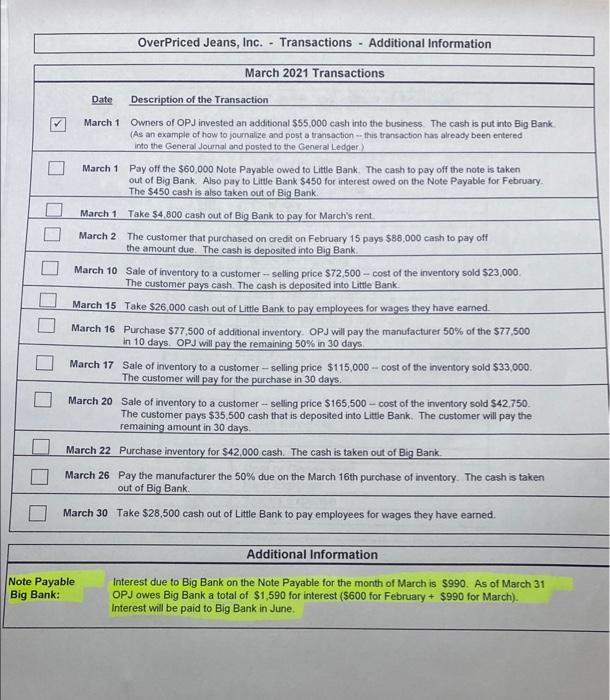

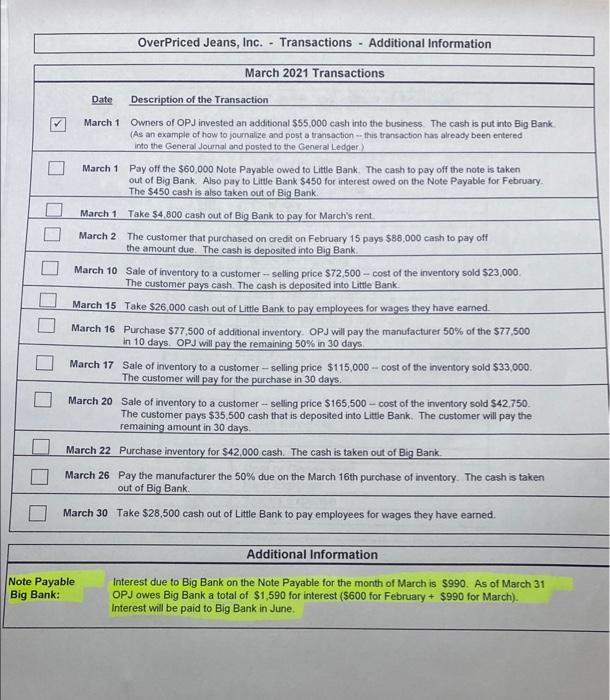

Over Priced Jeans, Inc. - Transactions - Additional Information - March 2021 Transactions Date Description of the Transaction March 1 Owners of OPJ invested an additional $55,000 cash into the business. The cash is put into Big Bank (As an example of how to journalize and post a transaction -- this transaction has already been entered into the General Journal and posted to the General Ledger March 1 Pay off the $60.000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February The $450 cash is also taken out of Big Bank. March 1 Take $4.800 cash out of Big Bank to pay for March's rent March 2 The customer that purchased on credit on February 15 pays $88,000 cash to pay off the amount due. The cash is deposited into Big Bank March 10 Sale of inventory to a customer-selling price $72,500 -- cost of the inventory sold $23,000 The customer pays cash. The cash is deposited into Little Bank. March 15 Take $26,000 cash out of Little Bank to pay employees for wages they have earned March 16 Purchase $77,500 of additional inventory OPJ will pay the manufacturer 50% of the 577,500 in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of Inventory to a customer-selling price $115,000 - cost of the inventory sold $33,000. The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer-selling price $165,500 - cost of the inventory sold 542,750 The customer pays $35,500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days March 22 Purchase inventory for $42.000 cash. The cash is taken out of Big Bank March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank. March 30 Take $28,500 cash out of Little Bank to pay employees for wages they have earned Additional Information Note Payable Big Bank: Interest due to Big Bank on the Note Payable for the month of March is $990. As of March 31 OPJ owes Big Bank a total of $1,590 for interest ($600 for February + $990 for March). a Interest will be paid to Big Bank in June. Over Priced Jeans, Inc. - General Journal Page # 2 Account Name Posted 2021 Month-Day 3-17 Debit Credit Account Number 500 120 33,000.00 Cost of Goods Sold Inventory Record cost of inventory sold 33 000.00 3-20 105 110 400 Cash-Little Bank Accounts Receivable Sales Revenue Record goods sold for cash and on credit 35,500.00 165,500.00 XXX 201,000.00 3-20 500 120 Cost of Goods Sold Inventory Record cost of inventory sold X X 42.750.00 42.750.00 3-22 120 100 42,000.00 Inventory Cash-Big Bank Record goods purchases for cash XX 42,000.00 3-26 200 100 Accounts Payable Cash-Big Bank Record cash paid on account X X 38,750.00 38.750,00 3-30 515 105 28,500.00 Wages Expense Cash-Little Bank Record cash paid for wages expense 28,500.00 2-28 600.00 520 210 Interest Expense-Big Bank Notes Payable-Big Bank Record interest expense X X 600.00 3-31 520 210 Interest Expense- Big Bank Notes Payable-Big Bank To record interest expense XX 990.00 990.00 i did post it in the journal , but realize i shouldnt list february in the march journal. so , would i group those together and post it as one 3-31 for $1590? thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started