Question

***THIS QUESTION CAN ONLY BE VEIWED ON DESKTOP NOT MOBILE*** Problem 6-1 This is a two part problem (A and B): A. Use the 2020-2022

***THIS QUESTION CAN ONLY BE VEIWED ON DESKTOP NOT MOBILE***

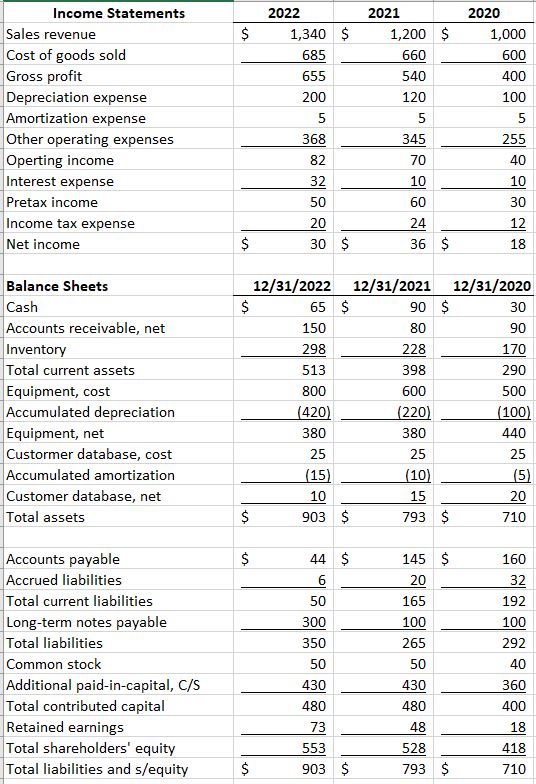

Problem 6-1

This is a two part problem (A and B):

A. Use the 2020-2022 financial statements for Riverside (in your textbook) to compute the listed profitability, liquidity, and solvency metrics. (Note two alternatives for completing Part A of this problem.)

1. You can compute the financial metrics with a hand-held calculator and record your responses in the table presented after the balance sheets in your textbook, then scan the pages and submit your responses.

2. You can access the Excel template uploaded by your instructor containing the same information and program Excel to calculate the ratios.

B. Analyze Riverside's three year trends in profitability, liquidity, and solvency so far as the date permit.

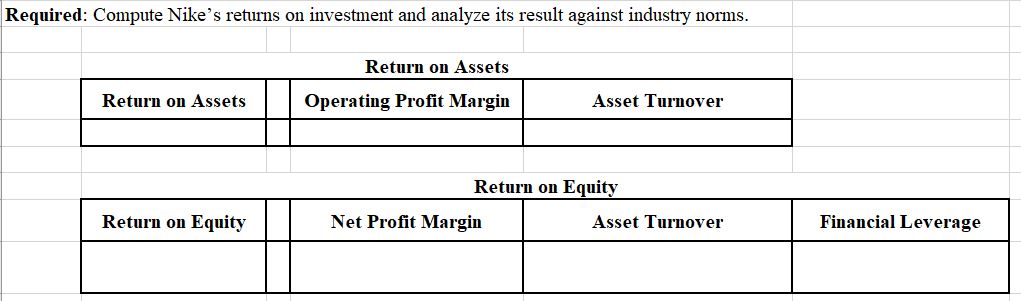

Problem 6-2

As presented in your textbook, Nike Inc. reported 2018 financial statement excerpts (in millions).

Also presented in your textbook are the athletic industry's reported returns on investment and their component measures.

Required:Compute Nike's returns on investment and analyze its result against industry norms using the provided spreadsheet for problem 6-2.

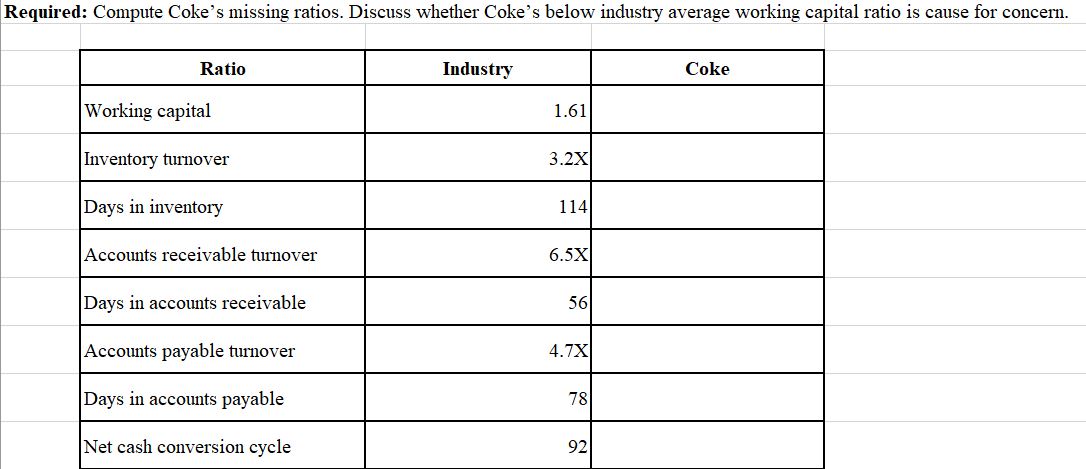

Problem 6-3

As presented in your textbook, the Coca-Cola Company reported 2018 financial statement excerpts (in millions).

Also presented in your textbook are some of the non-alcoholic industry's reported liquidity ratios, and some of Coca-Cola's reported liquidity ratios.

Required: Compute Coke's missing ratios above. Discuss whether Coke's below industry average working capital ratio is cause for concern.

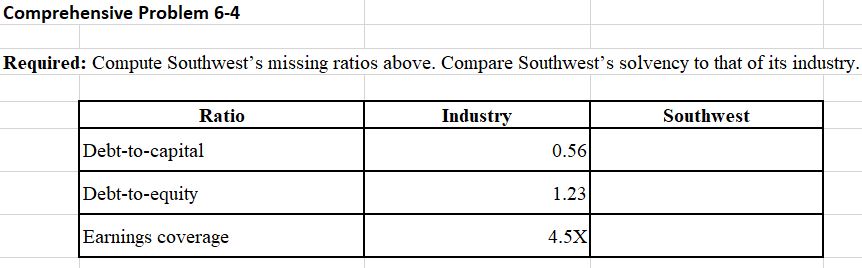

Problem 6-4

As presented in your textbook, Southwest Airlines Inc. reported 2018 financial statement excerpts (in millions).

Also presented in your textbook are certain airline industry solvency ratios.

Required: Using the spreadsheet provided for problem 6-4, compute Southwest's missing ratios. Compare Southwest's solvency to that of its industry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started