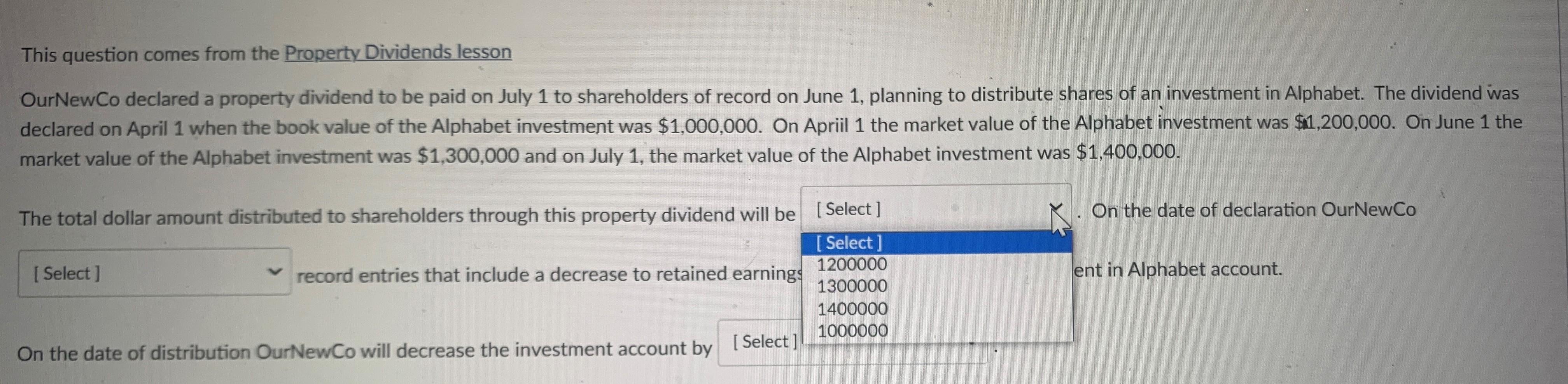

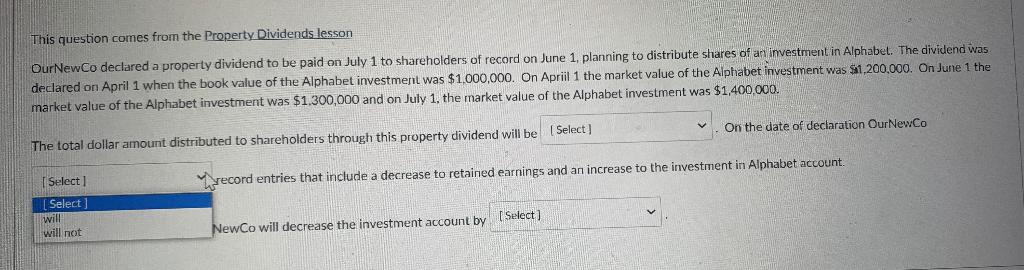

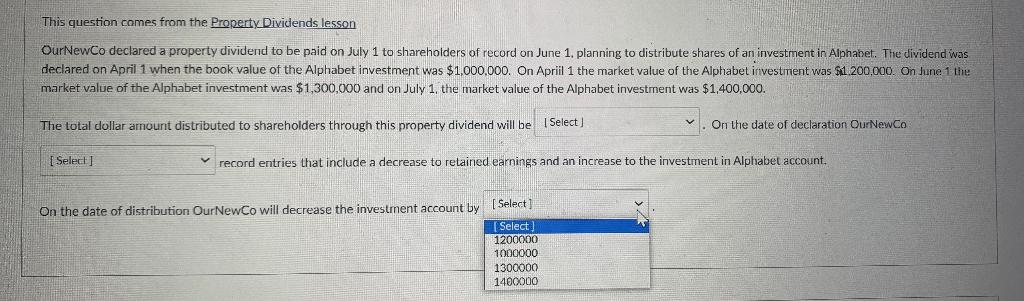

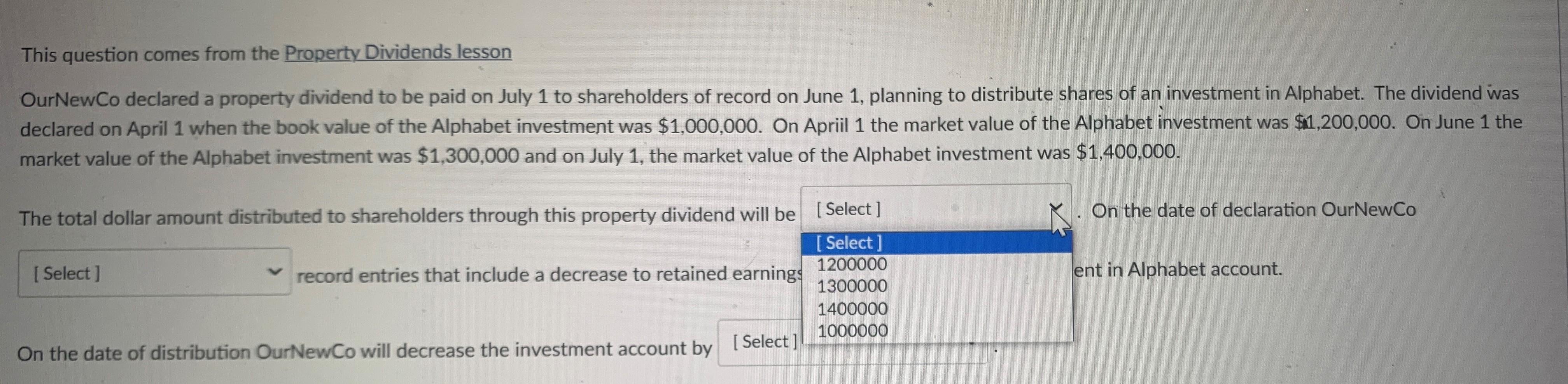

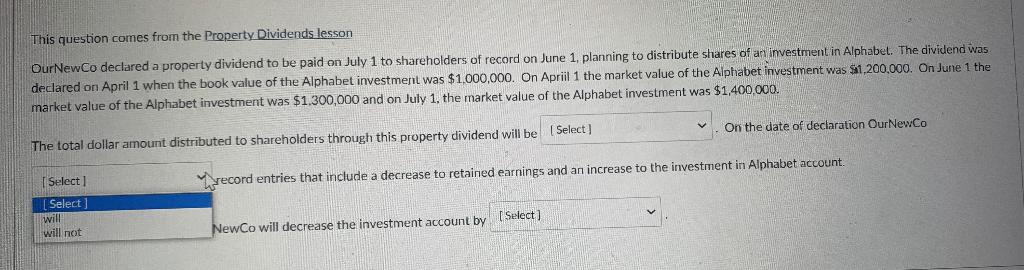

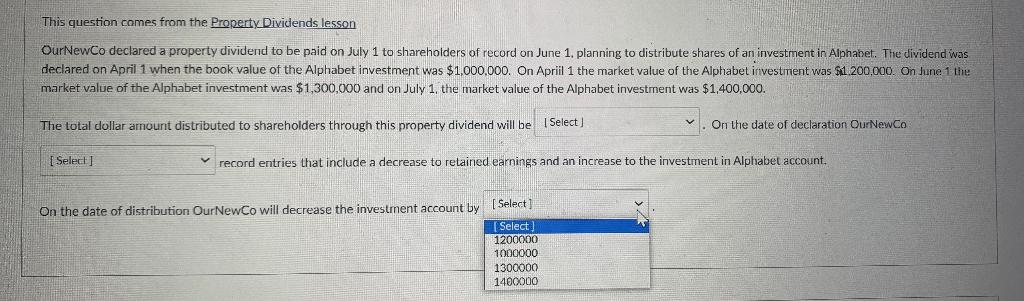

This question comes from the Property Dividends lesson declared on April 1 when the book value of the Alphabet investment was $1,000,000. On Apriil 1 the market value of the Alphabet investment was 1 the market value of the Alphabet investment was $1,300,000 and on July 1 , the market value of the Alphabet investment was $1,400,000. The total dollar amount distributed to shareholders through this property dividend will be recordentriesthatincludeadecreasetoretainedearning On the date of distribution OurNewCo will decrease the investment account by [Select] This question comes from the Property Dividends lesson OurNewCo declared a property dividend to be paid on July 1 to shareholders of record on June 1 , planning to distribute shares of an investment in Alphabet. The dividend was declared on April 1 when the book value of the Alphabet investment was $1,000,000. On Apriil 1 the market value of the Alphabet investment was $1,200,000. On June 1 the market value of the Alphabet investment was $1,300,000 and on July 1 , the market value of the Alphabet investment was $1,400,000. The total dollar amount distributed to shareholders through this property dividend will be On the date of declaration DurNewCo record entries that include a decrease to retained earnings and an increase to the investment in Alphabet account. NewCo will decrease the investment account by This question comes from the Property Dividends lesson OurNewCo declared a property dividend to be paid on July 1 to shareholders of record on June 1. planning to distribute shares of an investment in Alphahet. The dividend was declared on April 1 when the book value of the Alphabet investment was $1,000,000. On Apriil 1 the market value of the Alphabet irivestment was \$1,200,000. On June 1 the market value of the Alphabet investment was $1,300,000 and on July 1 , the market value of the Alphabet investment was $1,400,000. The total dollar amount distributed to shareholders through this property dividend will be On the date of declaration OurNewCo record entries that include a decrease to retained earnings and an increase to the investment in Alphabet account. On the date of distribution OurNewCo will decrease the investment account by