Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question considers individualised commodity taxation. The economy has two representative households (A and B) and one representative firm. The households sell labour (LA

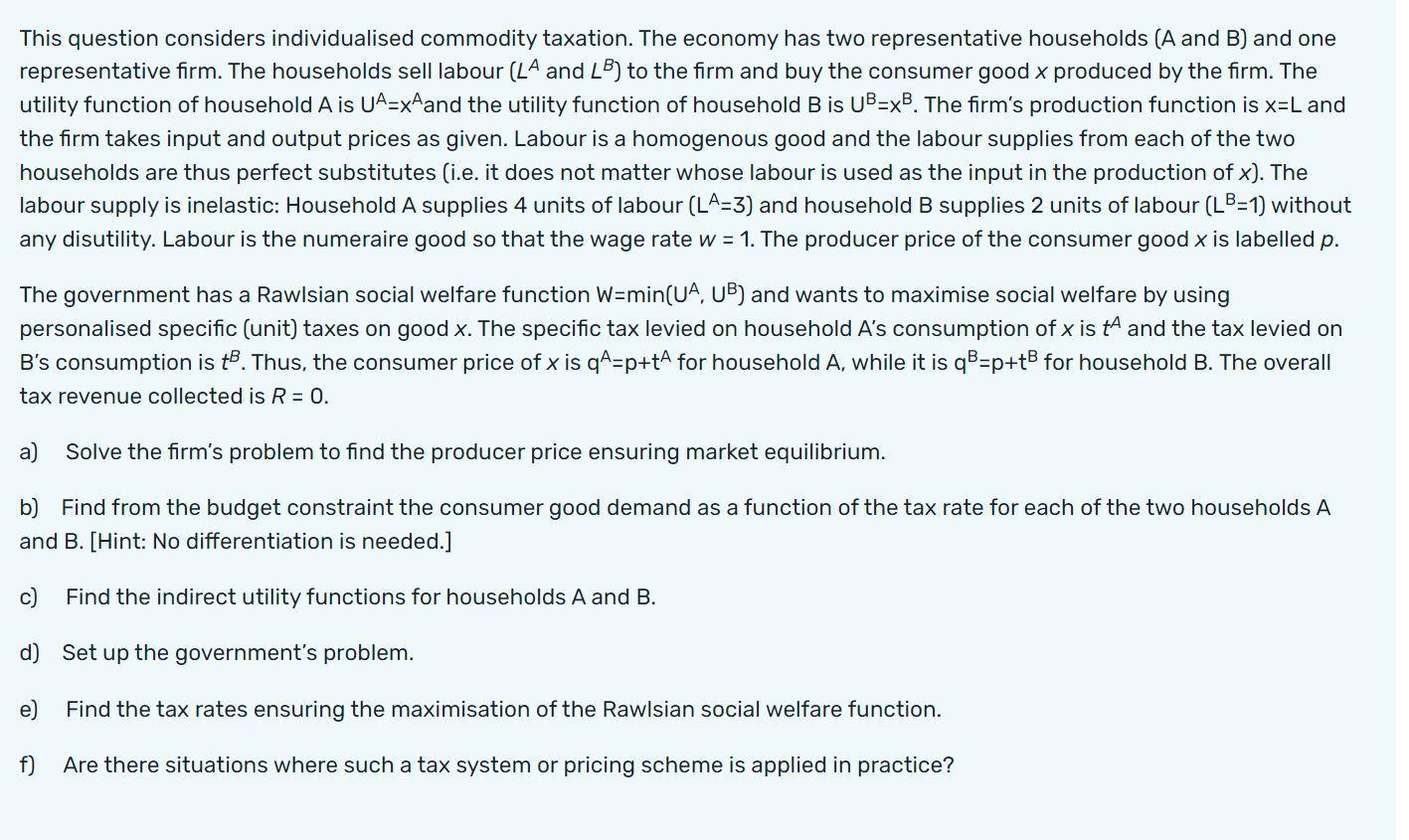

This question considers individualised commodity taxation. The economy has two representative households (A and B) and one representative firm. The households sell labour (LA and LB) to the firm and buy the consumer good x produced by the firm. The utility function of household A is UA-x^and the utility function of household B is UB=xB. The firm's production function is x=L and the firm takes input and output prices as given. Labour is a homogenous good and the labour supplies from each of the two households are thus perfect substitutes (i.e. it does not matter whose labour is used as the input in the production of x). The labour supply is inelastic: Household A supplies 4 units of labour (LA=3) and household B supplies 2 units of labour (LB=1) without any disutility. Labour is the numeraire good so that the wage rate w = 1. The producer price of the consumer good x is labelled p. The government has a Rawlsian social welfare function W=min(UA, UB) and wants to maximise social welfare by using personalised specific (unit) taxes on good x. The specific tax levied on household A's consumption of x is t and the tax levied on B's consumption is t. Thus, the consumer price of x is q^=p+t^ for household A, while it is qB-p+tB for household B. The overall tax revenue collected is R = 0. a) Solve the firm's problem to find the producer price ensuring market equilibrium. b) Find from the budget constraint the consumer good demand as a function of the tax rate for each of the two households A and B. [Hint: No differentiation is needed.] c) Find the indirect utility functions for households A and B. d) Set up the government's problem. Find the tax rates ensuring the maximisation of the Rawlsian social welfare function. f) Are there situations where such a tax system or pricing scheme is applied in practice? e)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The firms problem is to produce the consumer good x using labor as input at a price that ensures m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started