Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question considers long-run policies in Argentina, the home country, relative to Brazil. Assume Argentina's money growth rate is currently 4% and its inflation

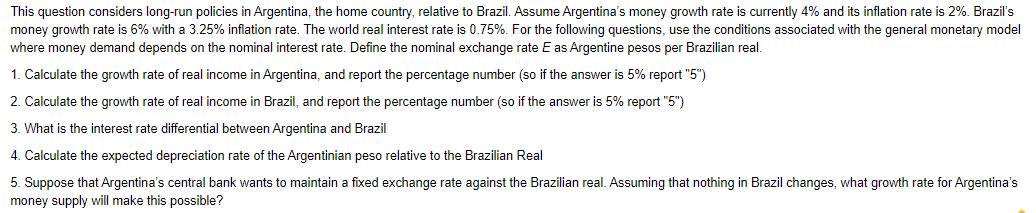

This question considers long-run policies in Argentina, the home country, relative to Brazil. Assume Argentina's money growth rate is currently 4% and its inflation rate is 2%. Brazil's money growth rate is 6% with a 3.25% inflation rate. The world real interest rate is 0.75%. For the following questions, use the conditions associated with the general monetary model where money demand depends on the nominal interest rate. Define the nominal exchange rate E as Argentine pesos per Brazilian real. 1. Calculate the growth rate of real income in Argentina, and report the percentage number (so if the answer is 5% report "5") 2. Calculate the growth rate of real income in Brazil, and report the percentage number (so if the answer is 5% report "5") 3. What is the interest rate differential between Argentina and Brazil 4. Calculate the expected depreciation rate of the Argentinian peso relative to the Brazilian Real 5. Suppose that Argentina's central bank wants to maintain a fixed exchange rate against the Brazilian real. Assuming that nothing in Brazil changes, what growth rate for Argentina's money supply will make this possible?

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Growth rate of real income in Argentina Money growth rate Inflation rate 4 2 2 2 Growth rate of real income in Brazil Money growth rate Infla...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started