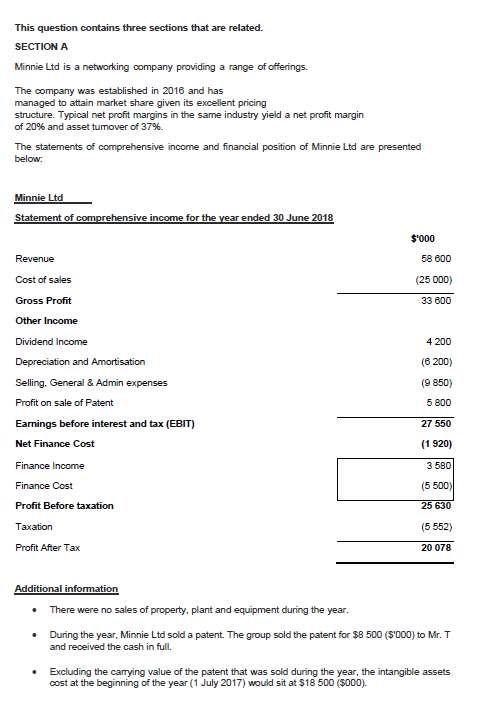

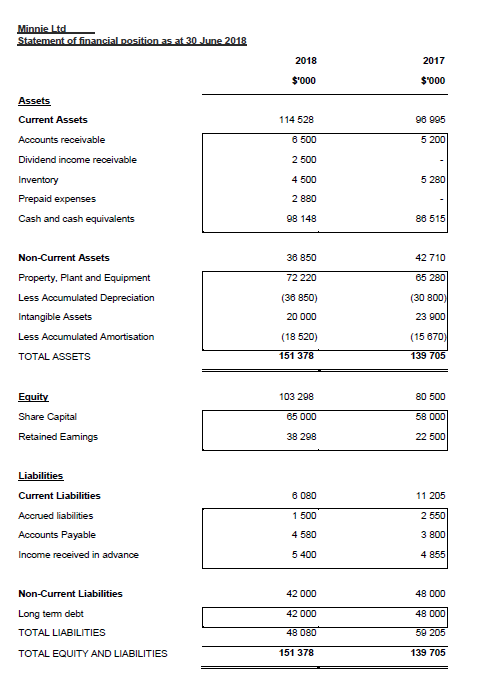

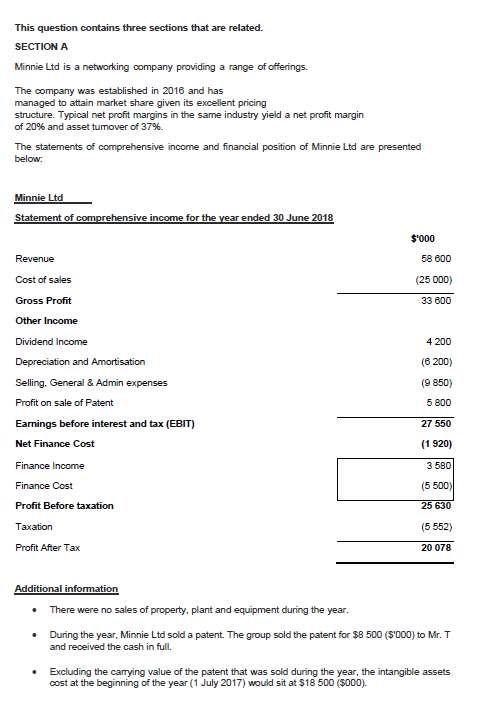

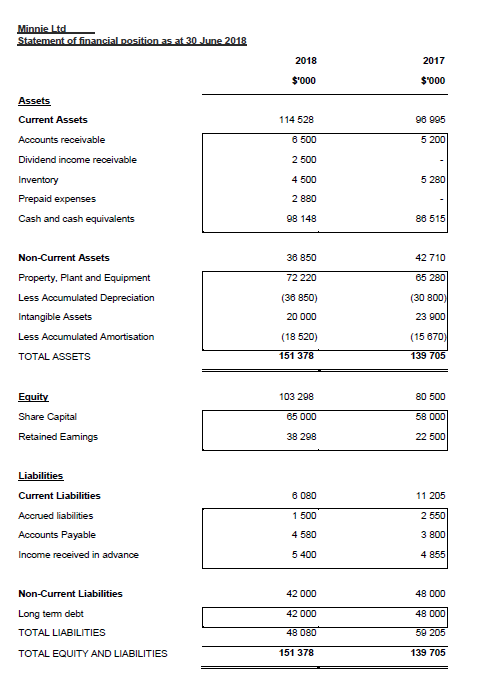

This question contains three sections that are related. SECTION A Minnie Ltd is a networking company providing a range of offerings. The company was established in 2016 and has managed to attain market share given its excellent pricing structure. Typical net profit margins in the same industry yield a net profit margin of 20% and asset tumover of 37%. The statements of comprehensive income and financial position of Minnie Ltd are presented below: Minnie Ltd Statement of comprehensive income for the year ended 30 June 2018 $'000 58 600 (25000) 33 600 4 200 (6 200) Revenue Cost of sales Gross Profit Other Income Dividend Income Depreciation and Amortisation Selling. General & Admin expenses Profit on sale of Patent Earnings before interest and tax (EBIT) Net Finance Cost Finance Income Finance Cost (9850) 5 800 27 550 (1 920) 3 580 (5 500) Profit Before taxation 25 630 Taxation (5 552) Profit After Tax 20 078 Additional information There were no sales of property, plant and equipment during the year. . During the year, Minnie Ltd sold a patent. The group sold the patent for $8 500 (5'000) to Mr. T and received the cash in full. Excluding the carrying value of the patent that was sold during the year, the intangible assets cost at the beginning of the year (1 July 2017) would sit at $18 500 ($000). Minnie Ltd Statement of financial position as at 30 June 2018 2018 $'000 2017 $'000 114 528 98 995 6 500 5 200 Assets Current Assets Accounts receivable Dividend income receivable Inventory Prepaid expenses Cash and cash equivalents 2 500 4 500 5 280 2 880 98 148 88 515 36 850 42 710 72 220 65 280 (30 800) Non-Current Assets Property. Plant and Equipment Less Accumulated Depreciation Intangible Assets Less Accumulated Amortisation TOTAL ASSETS (36 850) 20 000 23 900 (15 670) (18 520) 151 378 139 705 Equity 103 298 80 500 65 000 58 000 Share Capital Retained Eamings 38 298 22 500 8080 11 205 Liabilities Current Liabilities Accrued liabilities Accounts Payable Income received in advance 1 500 2 550 3 800 4 580 5 400 4 855 Non-Current Liabilities 42 000 48 000 48 000 Long term debt TOTAL LIABILITIES 42 000 48 080 59 205 TOTAL EQUITY AND LIABILITIES 151 378 139 705 Prepare the statement of cash flows (i.e. cash flow statement) of Minnie Ltd for the year ended 30 June 2018 This question contains three sections that are related. SECTION A Minnie Ltd is a networking company providing a range of offerings. The company was established in 2016 and has managed to attain market share given its excellent pricing structure. Typical net profit margins in the same industry yield a net profit margin of 20% and asset tumover of 37%. The statements of comprehensive income and financial position of Minnie Ltd are presented below: Minnie Ltd Statement of comprehensive income for the year ended 30 June 2018 $'000 58 600 (25000) 33 600 4 200 (6 200) Revenue Cost of sales Gross Profit Other Income Dividend Income Depreciation and Amortisation Selling. General & Admin expenses Profit on sale of Patent Earnings before interest and tax (EBIT) Net Finance Cost Finance Income Finance Cost (9850) 5 800 27 550 (1 920) 3 580 (5 500) Profit Before taxation 25 630 Taxation (5 552) Profit After Tax 20 078 Additional information There were no sales of property, plant and equipment during the year. . During the year, Minnie Ltd sold a patent. The group sold the patent for $8 500 (5'000) to Mr. T and received the cash in full. Excluding the carrying value of the patent that was sold during the year, the intangible assets cost at the beginning of the year (1 July 2017) would sit at $18 500 ($000). Minnie Ltd Statement of financial position as at 30 June 2018 2018 $'000 2017 $'000 114 528 98 995 6 500 5 200 Assets Current Assets Accounts receivable Dividend income receivable Inventory Prepaid expenses Cash and cash equivalents 2 500 4 500 5 280 2 880 98 148 88 515 36 850 42 710 72 220 65 280 (30 800) Non-Current Assets Property. Plant and Equipment Less Accumulated Depreciation Intangible Assets Less Accumulated Amortisation TOTAL ASSETS (36 850) 20 000 23 900 (15 670) (18 520) 151 378 139 705 Equity 103 298 80 500 65 000 58 000 Share Capital Retained Eamings 38 298 22 500 8080 11 205 Liabilities Current Liabilities Accrued liabilities Accounts Payable Income received in advance 1 500 2 550 3 800 4 580 5 400 4 855 Non-Current Liabilities 42 000 48 000 48 000 Long term debt TOTAL LIABILITIES 42 000 48 080 59 205 TOTAL EQUITY AND LIABILITIES 151 378 139 705 Prepare the statement of cash flows (i.e. cash flow statement) of Minnie Ltd for the year ended 30 June 2018