Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question eramines the effect of advertising in the media industry. Two media firms, A and B, compete in a market described by the

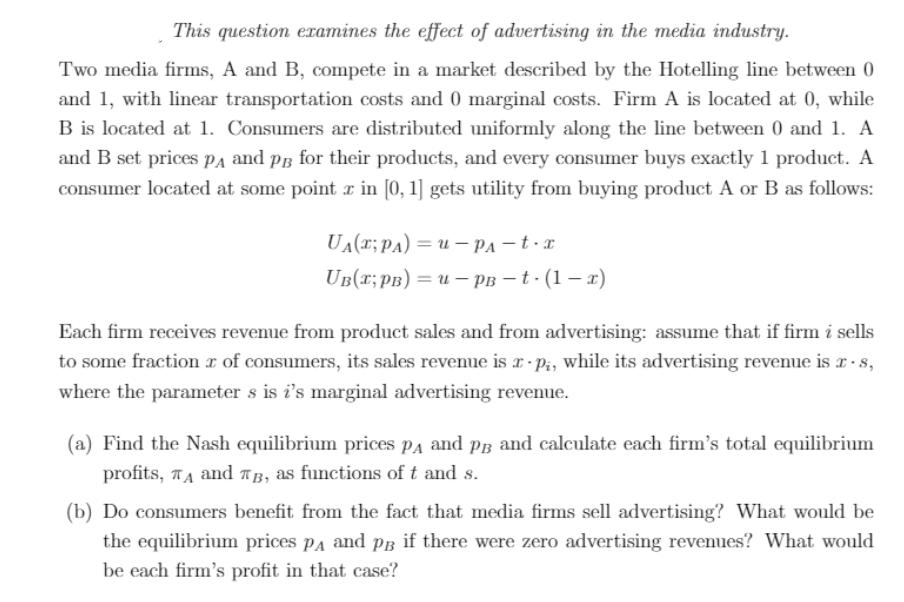

This question eramines the effect of advertising in the media industry. Two media firms, A and B, compete in a market described by the Hotelling line between 0 and 1, with linear transportation costs and 0 marginal costs. Firm A is located at 0, while B is located at 1. Consumers are distributed uniformly along the line between 0 and 1. A and B set prices PA and pg for their products, and every consumer buys exactly 1 product. A consumer located at some point r in [0, 1] gets utility from buying product A or B as follows: UA(; PA) = u - PA -t.x UB(x;PB) = u PB - t- (1 x) Each firm receives revenue from product sales and from advertising: assume that if firm i sells to some fraction r of consumers, its sales revenue is r Pi, while its advertising revenue is r -s, where the parameter s is i's marginal advertising revenue. (a) Find the Nash equilibrium prices pA and pB and calculate each firm's total equilibrium profits, 7A and TB, as functions of t and s. (b) Do consumers benefit from the fact that media firms sell advertising? What would be the equilibrium prices pA and pB if there were zero advertising revenues? What would be each firm's profit in that case?

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a 0 x 1 A B Suppose indifferent consumer location x then u pA t ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started