Answered step by step

Verified Expert Solution

Question

1 Approved Answer

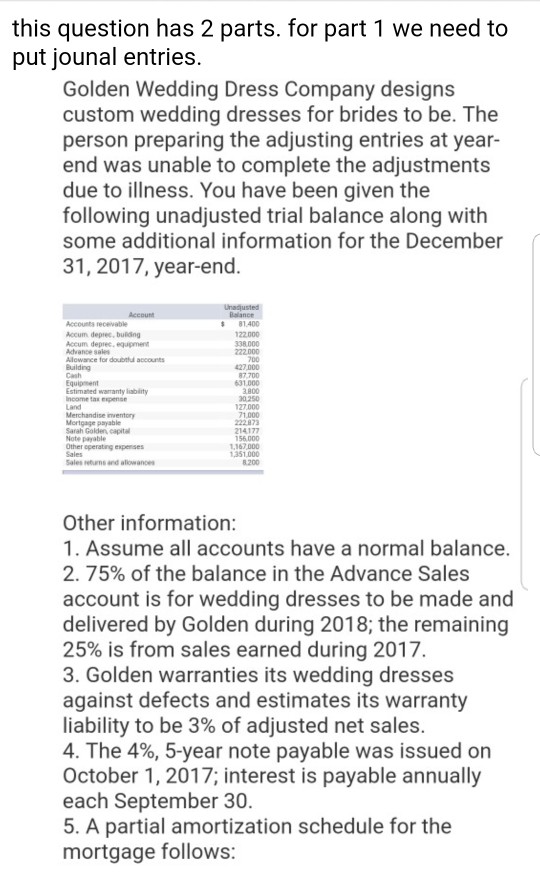

this question has 2 parts. for part 1 we need to put jounal entries. Golden Wedding Dress Company designs custom wedding dresses for brides to

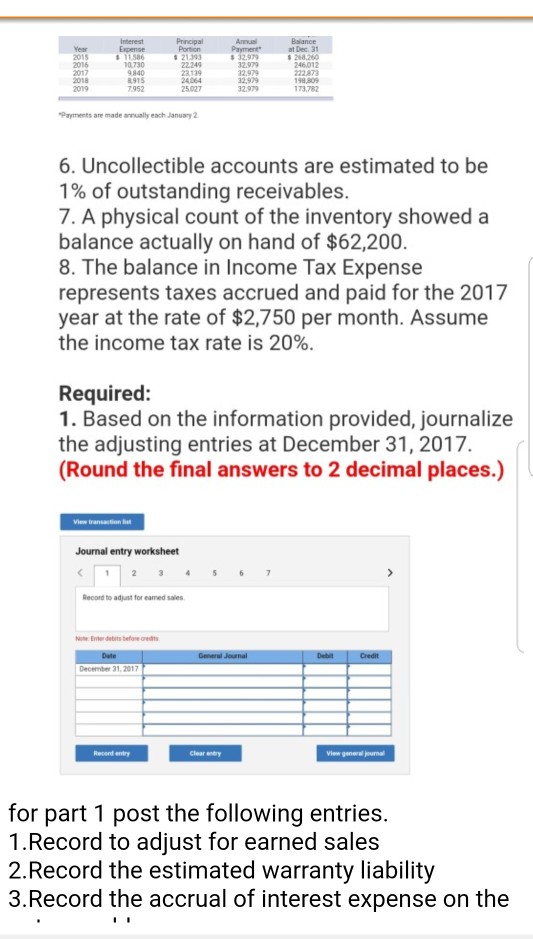

this question has 2 parts. for part 1 we need to put jounal entries. Golden Wedding Dress Company designs custom wedding dresses for brides to be. The person preparing the adjusting entries at year- end was unable to complete the adjustments due to illness. You have been given the following unadjusted trial balance along with some additional information for the December 31, 2017, year-end. Unaqusted Accousts recevable 81.400 Accum deprec, buiding Accum deprec, equpment Advance sales Alowance for doubtful accounts 22.000 338.000 222.000 427000 31.000 3800 0250 27,000 1.000 222873 14177 56.000 1167.000 1351,000 .200 Estimated warranty liablity ncome tax expense Merchandise inventony Sarah Golden capital Note payable Sales Sales retuwns and alw Other information: 1. Assume all accounts have a normal balance. 2.75% of the balance in the Advance Sales account is for wedding dresses to be made and delivered by Golden during 2018; the remaining 25% is from sales earned during 2017. 3. Golden warranties its wedding dresses against defects and estimates its warranty liability to be 3% of adjusted net sales. 4. The 4%, 5-year note payable was issued on October 1, 2017; interest is payable annually each September 30. 5. A partial amortization schedule for the mortgage follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started