Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question has 2 parts. The first part will provide you with the answers for the second part. Perform the calculations needed to compute

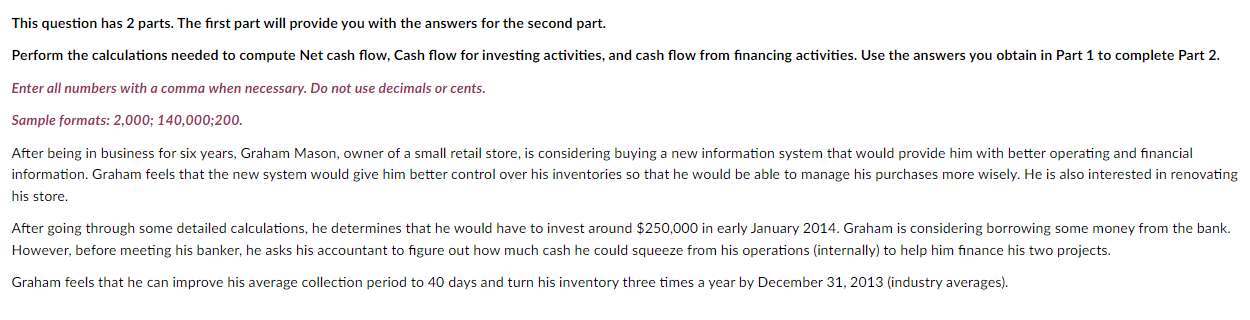

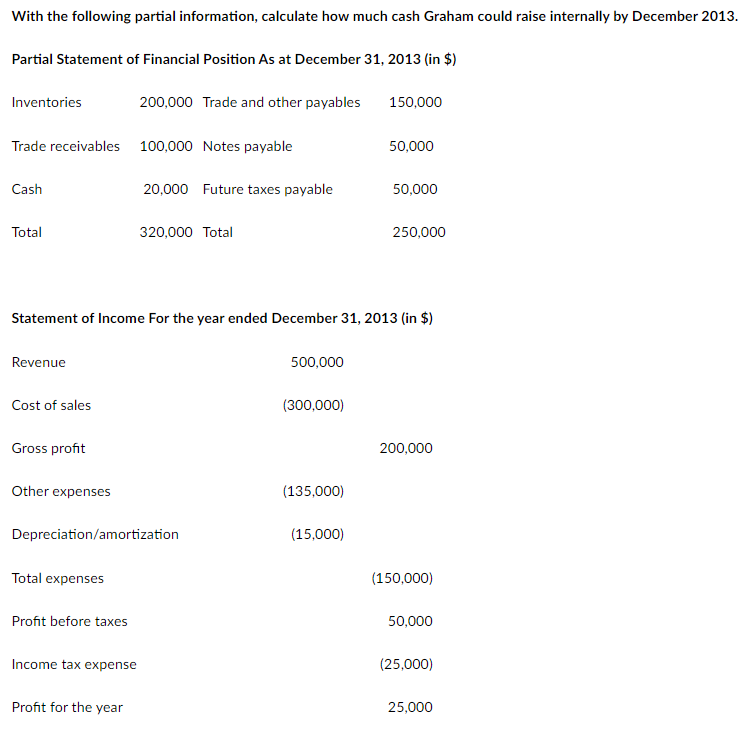

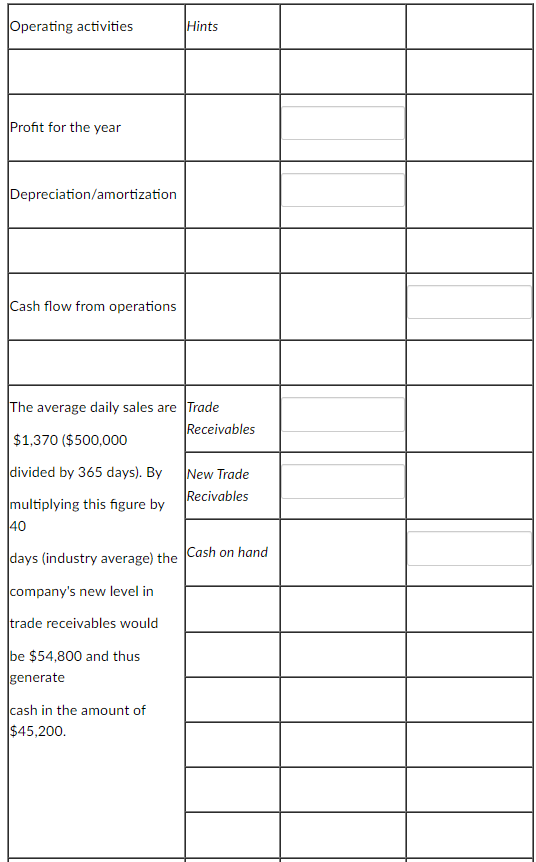

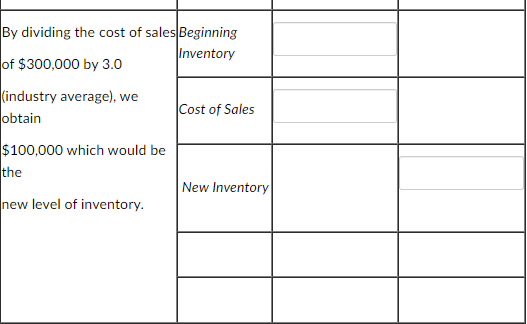

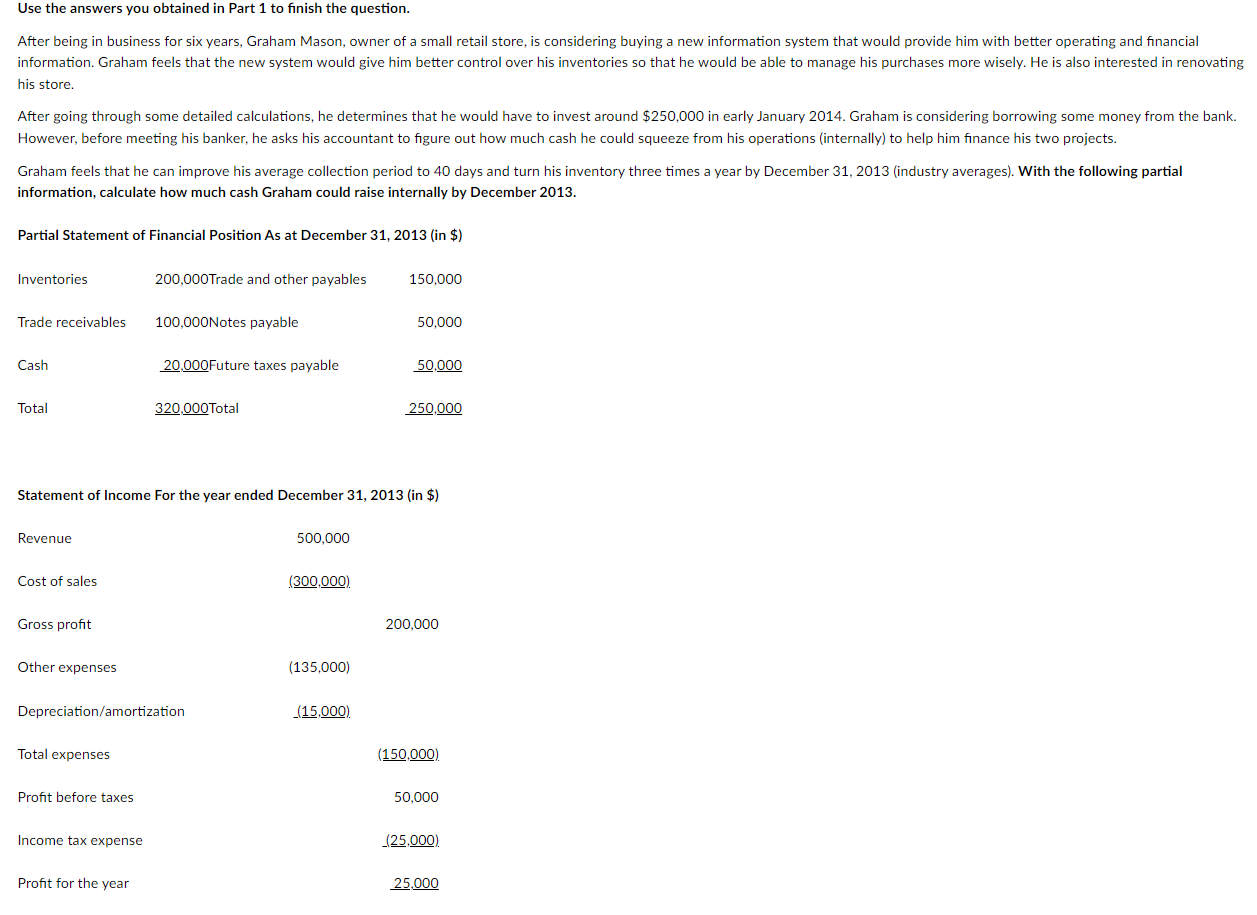

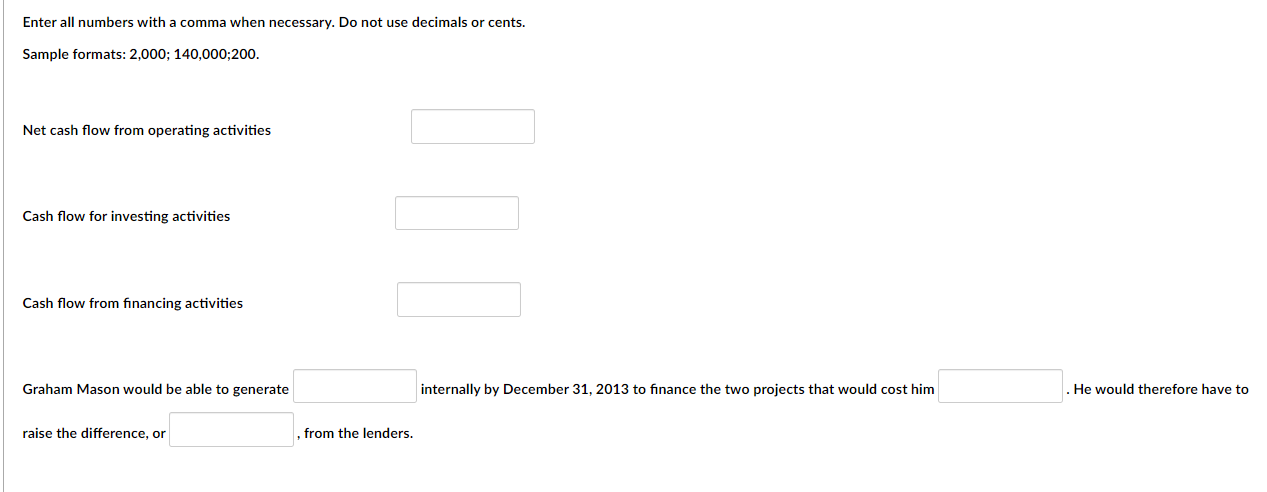

This question has 2 parts. The first part will provide you with the answers for the second part. Perform the calculations needed to compute Net cash flow, Cash flow for investing activities, and cash flow from financing activities. Use the answers you obtain in Part 1 to complete Part 2. Enter all numbers with a comma when necessary. Do not use decimals or cents. Sample formats: 2,000; 140,000;200. After being in business for six years, Graham Mason, owner of a small retail store, is considering buying a new information system that would provide him with better operating and financial information. Graham feels that the new system would give him better control over his inventories so that he would be able to manage his purchases more wisely. He is also interested in renovating his store. After going through some detailed calculations, he determines that he would have to invest around $250,000 in early January 2014. Graham is considering borrowing some money from the bank. However, before meeting his banker, he asks his accountant to figure out how much cash he could squeeze from his operations (internally) to help him finance his two projects. Graham feels that he can improve his average collection period to 40 days and turn his inventory three times a year by December 31, 2013 (industry averages). With the following partial information, calculate how much cash Graham could raise internally by December 2013. Partial Statement of Financial Position As at December 31, 2013 (in $) Inventories 200,000 Trade and other payables 150,000 Trade receivables 100,000 Notes payable 50,000 Cash 20,000 Future taxes payable 50,000 Total 320,000 Total 250,000 Statement of Income For the year ended December 31, 2013 (in $) Revenue Cost of sales Gross profit Other expenses Depreciation/amortization Total expenses Profit before taxes Income tax expense Profit for the year 500,000 (300,000) 200,000 (135,000) (15,000) (150,000) 50,000 (25,000) 25,000 Operating activities Hints Profit for the year Depreciation/amortization Cash flow from operations The average daily sales are Trade Receivables $1,370 ($500,000 divided by 365 days). By New Trade Recivables multiplying this figure by 40 days (industry average) the Cash on hand company's new level in trade receivables would be $54,800 and thus generate cash in the amount of $45,200. By dividing the cost of sales Beginning Inventory of $300,000 by 3.0 (industry average), we Cost of Sales obtain $100,000 which would be the new level of inventory. New Inventory Use the answers you obtained in Part 1 to finish the question. After being in business for six years, Graham Mason, owner of a small retail store, is considering buying a new information system that would provide him with better operating and financial information. Graham feels that the new system would give him better control over his inventories so that he would be able to manage his purchases more wisely. He is also interested in renovating his store. After going through some detailed calculations, he determines that he would have to invest around $250,000 in early January 2014. Graham is considering borrowing some money from the bank. However, before meeting his banker, he asks his accountant to figure out how much cash he could squeeze from his operations (internally) to help him finance his two projects. Graham feels that he can improve his average collection period to 40 days and turn his inventory three times a year by December 31, 2013 (industry averages). With the following partial information, calculate how much cash Graham could raise internally by December 2013. Partial Statement of Financial Position As at December 31, 2013 (in $) Inventories 200,000 Trade and other payables 150,000 Trade receivables 100,000Notes payable 50,000 Cash 20,000Future taxes payable 50,000 Total 320,000 Total 250,000 Statement of Income For the year ended December 31, 2013 (in $) Revenue Cost of sales Gross profit Other expenses Depreciation/amortization Total expenses Profit before taxes Income tax expense Profit for the year 500,000 (300,000) 200,000 (135,000) (15,000) (150,000) 50,000 (25,000) 25,000 Enter all numbers with a comma when necessary. Do not use decimals or cents. Sample formats: 2,000; 140,000;200. Net cash flow from operating activities Cash flow for investing activities Cash flow from financing activities Graham Mason would be able to generate raise the difference, or from the lenders. internally by December 31, 2013 to finance the two projects that would cost him . He would therefore have to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started