this question has 3 parts, please help !

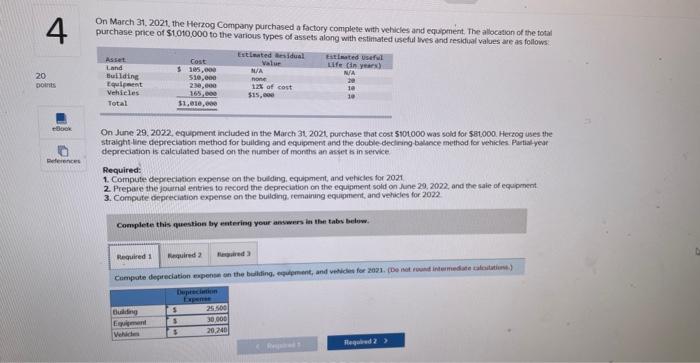

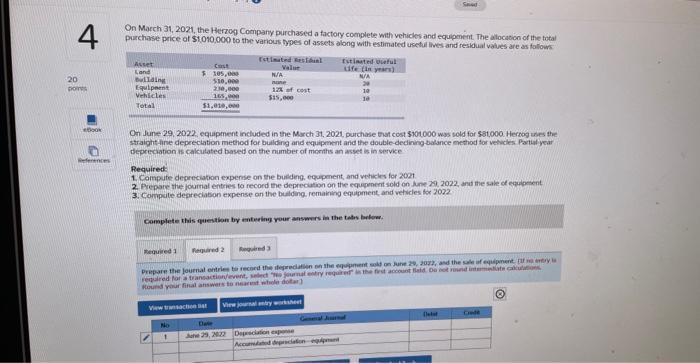

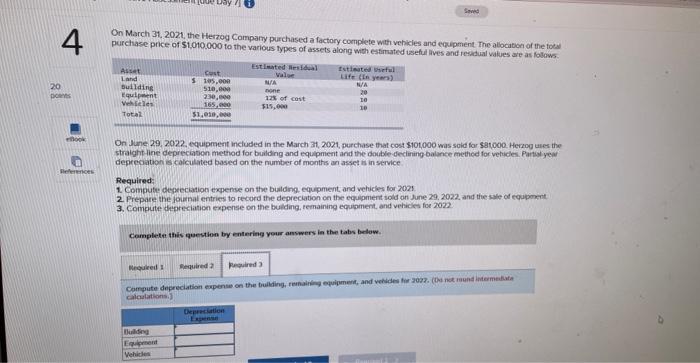

On March 31, 202t, the Herzog Company purchased a factory complete with vehicles and equpment. The allocation of the total. purchase price of $1.010,000 to the various types of assets along with estirnated useful tives and residial values are as follows: On June 29. 2022, equipment included in the March 31. 2021, purchase that cost 5101000 was sold for 581,000 . Here0g uses the straight -ine depreciation method for building and equipenent and the double-dectrang-balince method for vehictes. Patial yeur depreciation is calculated based on the number of months an asset is in setvice. Required: 1. Compute depreciation expense on the bulding, equipment, and velicles for 2021 2. Prepare the jouinal entries to record the depreciation on the equipment sold on June 29,2022, and the saie of equpment 3. Compute depreciation expense on the building. remaining equiment, and vehicles for 2022 Complete this question by eatering your answers in Ihe tabs belew. On March 31, 2021, the Herzog Company purchased a factory complete with vehicks and equement. The allocation of ihe total purchase price of $1,010,000 to the varyous fypes of ascets along with estmated uneetul ines and residual values are as follows On June 29, 2022, equiptnent included in the March 31, 2021, purchase that cost 5101000 was sold for 894000 theroog uses the straight thine depeeclation method for bulding and equipenent and the double-dedining-balance method for vehickes. Partiat year ifepreciation is calculated based on the number of moriths an asset is in service Required: 1. Compufe depreciation expense on the buldeng, equpenent, and vohicles for 200t. 2. Prepare the foumiat enteries to recond the depreciation on the equ equnent sold on lune 29, 2022, and the sale of eegipesent. 2. Compate depreciabon expense an the bulding. remaining equpment, and veticles for 3022 Complete this question by anteing rour answers in the tabs belome. On March 31. 2021, the Herzog Company purchased a factory complete with vehicies and equpment The albcaboe of the foex purchase price of 51,010.000 to the various types of assets along with esfinated useful lives and residual values are as folows. On Jane 29, 2022, equipment included in the March 31, 2021, purchase that cost $101,000 was sold for 39t000. Herrog utes the deprecatoon is calculated based on the number of months an asset is in service Required; 1. Compute depreciation expense on the building. equipment, and vehickes for 7021 2. Prepare the joinal entries to record the depreciation on the equigment sold on June 29, 2022. and the sale of equposen. 3. Compute diepreciation expense on the bulding, remaining equament, and vehicks for 2022 Complete this question by entering your answers in the tabs below. Compute depreciation expense on the bulling, tenaling equigment, and venides for a0z?. (Dod not raund intermeikate calcatations