Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question has multiple parts. You must answer all parts for full credit. Assume you decide to invest in a new point-of-sale system. You expect

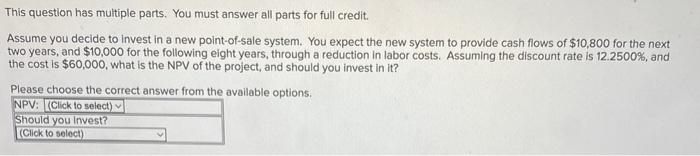

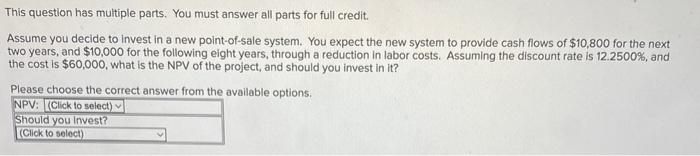

This question has multiple parts. You must answer all parts for full credit. Assume you decide to invest in a new point-of-sale system. You expect the new system to provide cash flows of $10,800 for the next two years, and $10,000 for the following eight years, through a reduction in labor costs. Assuming the discount rate is 12.2500%, and the cost is $60,000, what is the NPV of the project, and should you invest in it? Please choose the correct answar from the available options

This question has multiple parts. You must answer all parts for full credit. Assume you decide to invest in a new point-of-sale system. You expect the new system to provide cash flows of $10,800 for the next two years, and $10,000 for the following eight years, through a reduction in labor costs. Assuming the discount rate is 12.2500%, and the cost is $60,000, what is the NPV of the project, and should you invest in it? Please choose the correct answar from the available options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started