Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this question has several parts. the appropriate tables are also displayed. INTEGRATED CASE D'LEON INC., PART I FINANCIAL STATEMENTS AND TAXES with 4 years of

this question has several parts. the appropriate tables are also displayed.

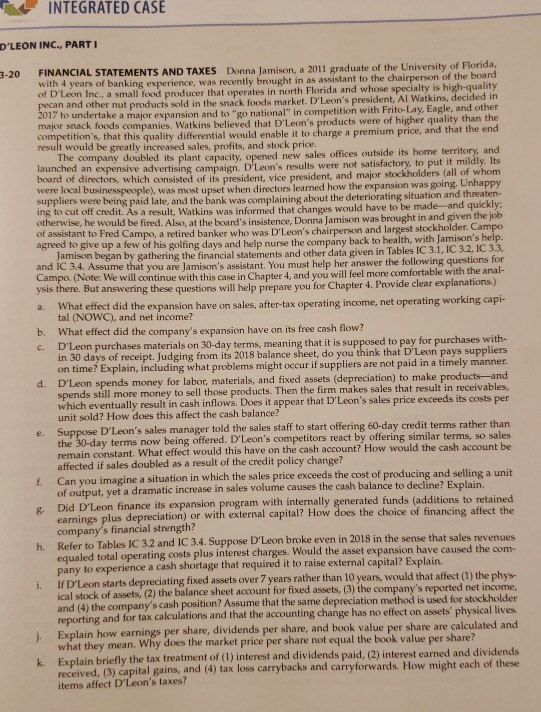

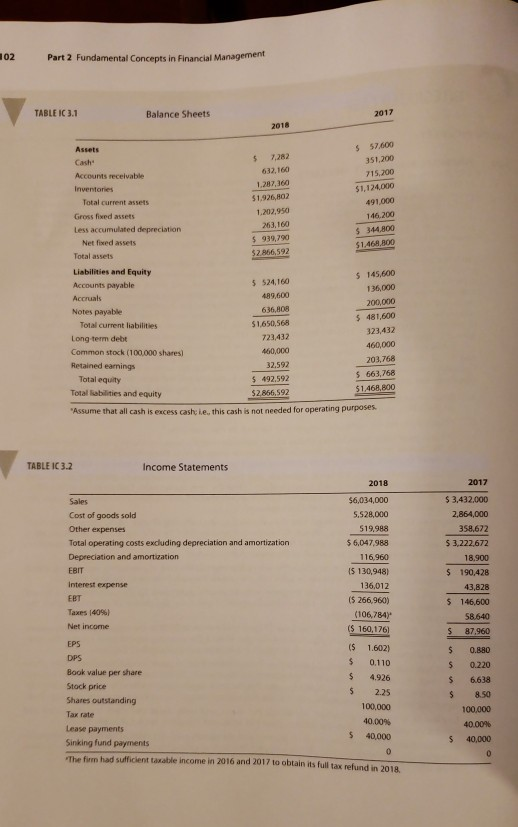

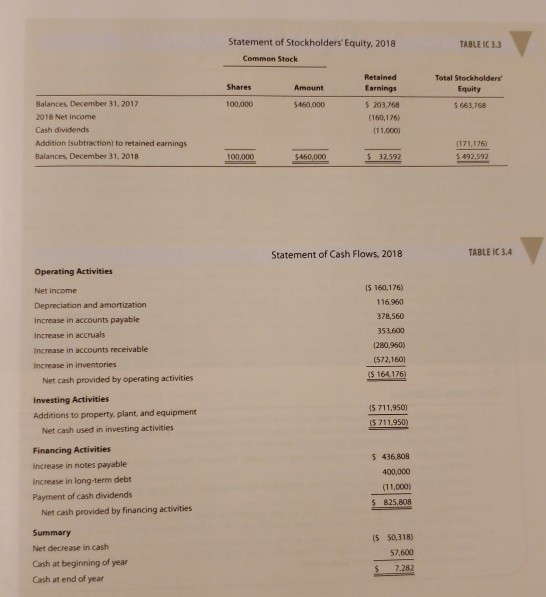

INTEGRATED CASE D'LEON INC., PART I FINANCIAL STATEMENTS AND TAXES with 4 years of banking experience, of D'Leon Inc., a small food producer that operates i 3-20 n, a 2011 graduate of the University of F was recently brought in as assistant to the chairperson of the Donna Jamiso north Florida and whose specialt n and other nut products sold in the snack foods market. D'Leon's president, Al Watkins, d 017 to undertake a major expansion and to "go national" in competition with Frito- major snack foods tition with Frito-Lay, Eagle, and other arge a premium price, and that the end nies. Watkins believed that D'Leon's products were of higher quality than the s, that this quality differential would enable it to would be greatly increased sales, profits, and stock price new sales offices outside its home territory, and Its launched an expensive advertising campaign. D'Leon's results were not to consisted of its president, vice president, and major stockholders (all of whom PPy about the deteriorating situation and threaten- have to be made-and quickly otherwise, he would be fired. Also, at the board's insistence, Donna Jamison was brought in and given the job ), was most upset when directors learned how the suppliers were being paid late, and the bank ing to cut off credit. As a result, Watkins was informed that changes would was complaining assistant to Fred Campo, a retired banker who was D'Leon's agreed to give up a few of his chairperson and largest stockholder. Cam golfing days and help nurse the company back to health, with Jamison's help. gathering the financial statements and other data given in Tables IC 3.1, IC 3.2, IC 33, p her answer the following questions for Campo. (Note: We will continue with this case in Chapter 4, and you will feel more comfortable with the anal- Jamison and IC 3.4. Assume that u are Jamison's assistant. You must hel t answering these questions will help prepare you for Chapter 4. Provide clear explanations.) a. What effect did the expansion have on sales, after-tax operating income, net operating working capi- tal (NOWC), and net income? What effect did the D'Leon purchases materials on 30-day terms, meaning that it is supposed to p b. company's expansion have on its free cash flow? ay for purchases with- c. in 30 days of receipt. Judging from its 2018 balance sheet, do you t k that D'Leon p on time? Explain, including what problems might occur if suppliers are not paid in a timely manne d. D'Leon spends money for labor, materials, and fixed assets (depreciation) to make produ y to sell those products. Then the firm makes sales that result in receivables, spends still more mone which eventually result in cash inflows. Does it appear that D'Leon's sales price exceeds its costs per unit sold? How does this affect the cash balance? Suppose D'Leon's sales manager told the sales staff to start offering 60-day credit terms rather than e. the 30-day terms now being offered. D'Leon's competitors react by offering similar terms, so sa remain constant. What effect would this have on the cash account? How would the cash account be ected if sales doubled as a result of the credit policy change? Can you imagine a situation in which the sales price exceeds the cost of producing and selling a unit of a dramatic increase in sales volume causes the cash balance to decline? Explain. output, yet Did D'Leon finance earnings plus depreciation) or with external capital? How does the choice of fin company's financial strength? ram with internally generated funds (additions to retained ancing affect the 8. ts expansion prog h. Refer to Tables IC 3.2 and IC 3.4. Suppose D'Leon broke even in 2018 in the sense that sales re revenues equal led total operating costs plus interest charges. Would the asset expansion have caused the com- to e a cash shortage that required it to raise external capital? Explain. i. If D'Leon starts depreciating fixed assets over 7 years rather than 10 years, would that affect (1) the phys- d for stockholder how earnings per share, dividends per share, and book value per share are calculated and ical stock of assets, (2) the balance sheet account for fixed assets, (3) the and (4) the company's cash position? Assume that the same ssume that the same depreciation method is use reporting and for tax calculations and that the accounting change has no effect on assets' physical lives Ex what they mean. Why does the market price per share not equal the book value per share? Explain briefly the tax treatment of (1) interest and dividends paid, (2) interest earned and dividends received, (3) capital gains, and (4) tax loss carrybacks and carryforwards. Ho k. might each of these items affect D'Leon's taxes? 02 Part 2 Fundamental Concepts in Financial Management TABLE IC 3.1 Balance Sheets 2017 2018 57,600 351,200 715,200 $1,124,000 491,000 146.200 5 344,800 1468,800 Cash Accounts receivable $ 7,282 632,160 Total current assets Gross fixed assets Less accumulated depreciation $1,926,802 1.202,950 263,160 $ 939,790 $2.866,592 Net fixed assets Total assets Liabilities and Equity Accounts payable s 145,600 136,000 200,000 $ 481,600 323,432 $24,160 489,600 636,808 1,650,568 723,432 460,000 32.592 492.592 2,866,592 Notes payable Total current liabilities Long term debt Common stock (100,000 shares) Retained earnings 203,768 5 663,768 1,468,800 Total equity Total ikabilities and equity Assume that all cash is excess cashe i.e, this cash is not needed for operating purposes TABLE IC 3.2 Income Statements 2018 34,000 5,528,000 19.988 $ 6,047,988 116,960 15 130,948) 136,012 (S 266,960) 106,784) S 160,176 (S 1.602) $ 0.110 $ 4926 5 2.25 100,000 40.00% 5 40,000 2017 $3,432,000 Sales Cost of goods sold Other expenses Total operating costs exdluding depreciation and amortization Depreciation and amortization EBIT Interest expense EBT Taxes 140%) Net income EPS DPS Book value per share Stock price Shares outstanding Tax rate Lease payments Sinking fund payments 358.672 $ 3,222672 18.900 $ 190,428 43,828 5 146,600 58.640 $ 87.960 $ 0.880 5 0.220 $ 6638 $ 8.50 100,000 40.00% 40,000 The firm had sufficient taxable income in 2016 and 2017 to obtain its full tax refund in 2018 Statement of Stockholders Equity, 2018 TABLE IC 3.3 Common Stock Retained Earnings $ 203,768 (160,176) 111,000) Total Stockholders Equity Shares Amount Balances. December 31, 2017 2018 Net income Cash dividends 100,000 5460,000 5 663,768 Adstion subrectioni to retained eamings 171,176) $ 492,592 Balances, December 31, 2018 100,000 5460,000 5 32.592 Statement of Cash Flows, 2018 TABLE IC 3.4 Operating Activities Net income Depreciation and amortization Increase in accounts payable Increase in accruals Increase in accounts receivable Increase in inventories 15 160,176) 116.960 378,560 353,600 (280.960) 572,160] 164 176 $ 164.176) Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment S 5 711,950) Net cash used in investing activities Financing Activities increase in notes payable Increase in long-term debt Payment of cash dividends $ 436,808 400,000 (11,000) 5 825,808 Net cash provided by financing activities Summary Net decrease in cash Cash at beginning of year Cash at end of year (S 50,318) 57,600 5 7.282

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started