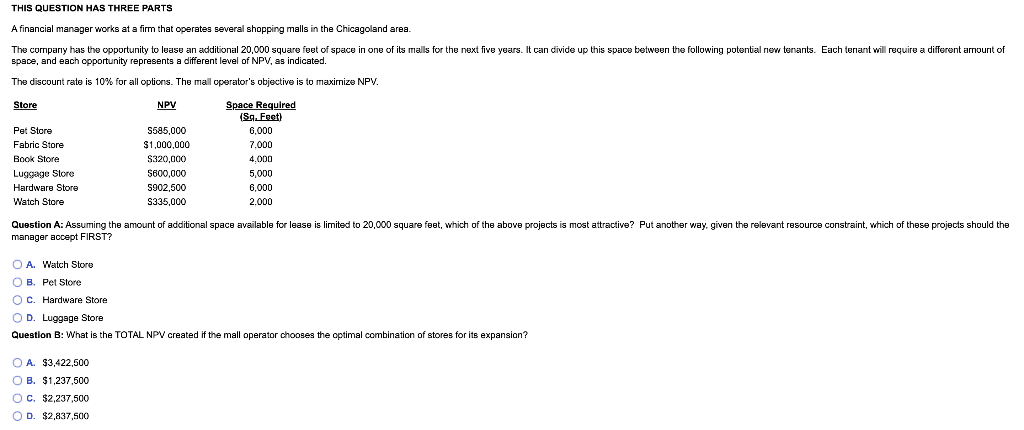

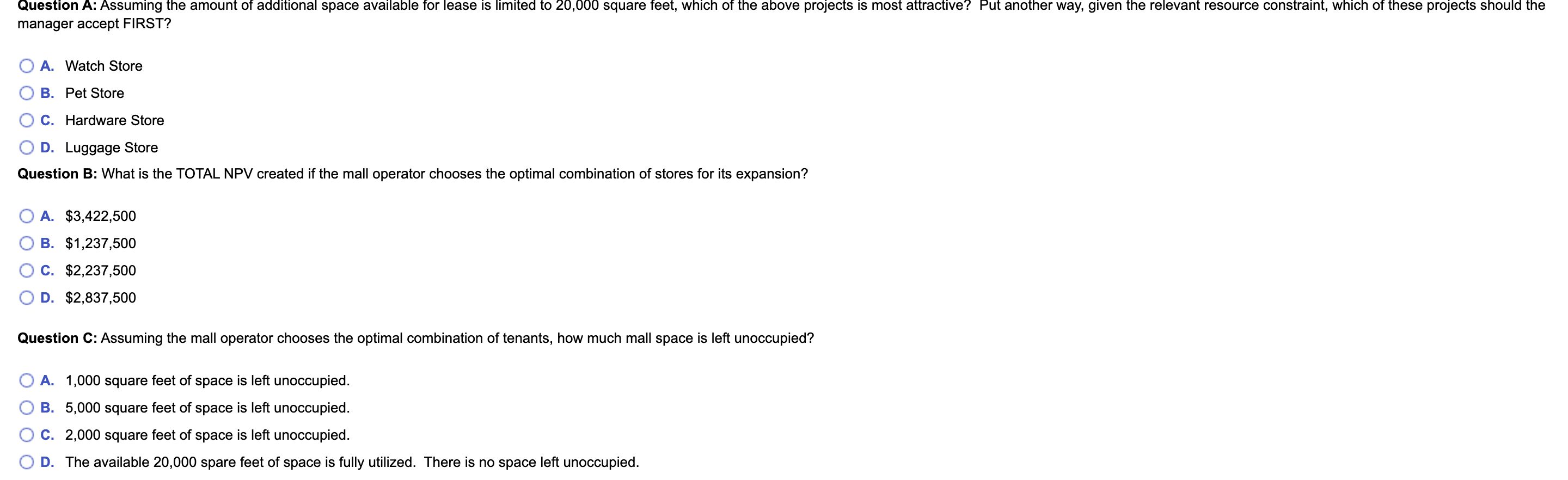

THIS QUESTION HAS THREE PARTS A financial manager works at a firm that operates several shopping malls in the Chicagoland area. The company has the opportunity to lease an additional 20,000 square feet of space in one of its malls for the next five years. It can divide up this space between the following potential new tenants. Each tenant will require a different amount of space, and each opportunity represents a different level of NPV, as indicated. The discount rate is 10% for all options. The mall operator's objective is to maximize NPV. Store NPV Pet Store Fabric Store Book Store Luggage Store Hardware Store Watch Store S585,000 $1,000,000 $320,000 5600,000 S902.500 S335,000 Space Required (Sq. Feet) 6,000 7.000 4.000 5,000 6,000 2.000 Question A: Assuming the amount of additional space available for lease is limited to 20,000 square feet, which of the above projects is most attractive? Put another way, given the relevant resource constraint, which of these projects should the manager accept FIRST? O A. Watch Store OB. Pet Store O C. Hardware Store OD. Luggage Store Question B: What is the TOTAL NPV created if the mall operator chooses the optimal combination of stores for its expansion? OA. $3,422,500 OB. $1.237.500 O C. $2,237,500 OD. $2,837,500 Question A: Assuming the amount of additional space available for lease is limited to 20,000 square feet, which of the above projects is most attractive? Put another way, given the relevant resource constraint, which of these projects should the manager accept FIRST? A. Watch Store B. Pet Store C. Hardware Store D. Luggage Store Question B: What is the TOTAL NPV created if the mall operator chooses the optimal combination of stores for its expansion? A. $3,422,500 B. $1,237,500 C. $2,237,500 D. $2,837,500 Question C: Assuming the mall operator chooses the optimal combination of tenants, how much mall space is left unoccupied? A. 1,000 square feet of space is left unoccupied. B. 5,000 square feet of space is left unoccupied. C. 2,000 square feet of space is left unoccupied. D. The available 20,000 spare feet of space is fully utilized. There is no space left unoccupied