This question has three parts, a,b and c. Please fill in the blanks and show work:

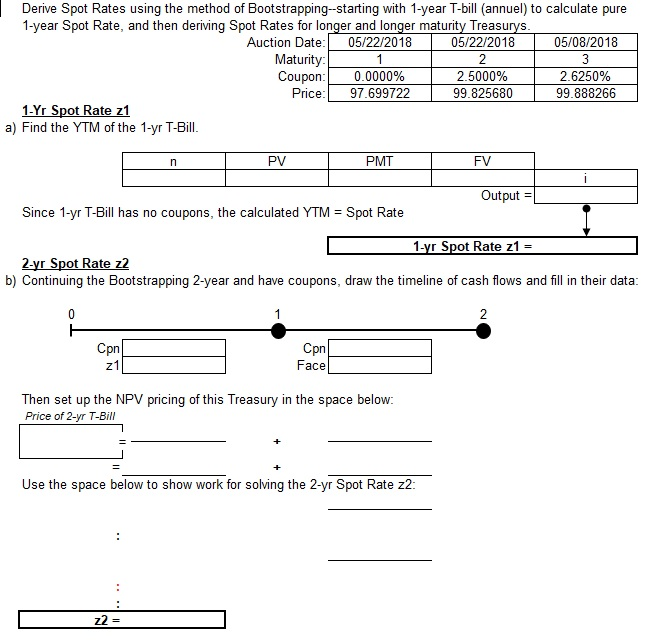

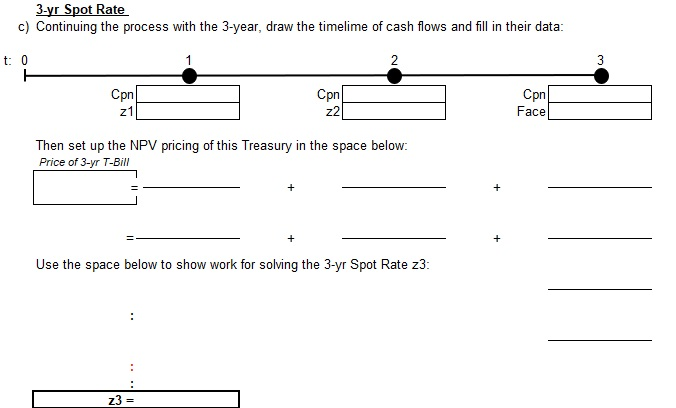

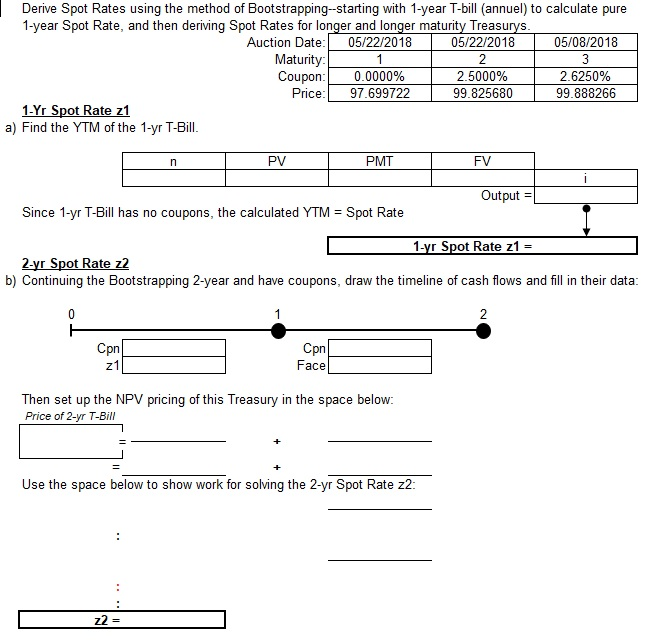

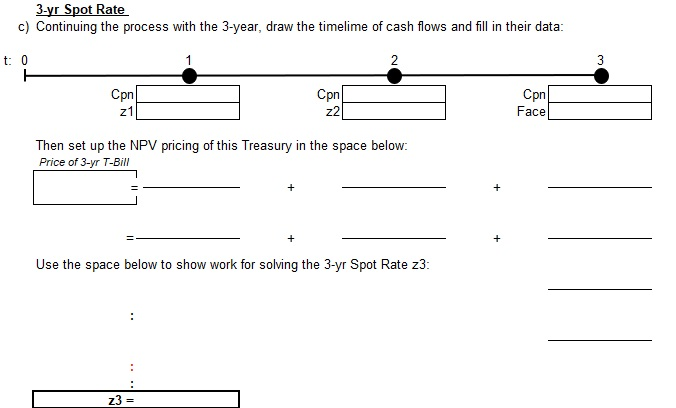

Derive Spot Rates using the method of Bootstrapping-starting with 1-year T-bill (annuel) to calculate pure 1-year Spot Rate, and then deriving Spot Rates for longer and longer maturity Treasurys. 05/22/2018 Auction Date: 05/22/2018 05/08/2018 Maturity: Coupon: Price: 1 2 3 0.0000% 2.5000% 2.6250% 97.699722 99.825680 99.888266 1-Yr Spot Rate z1 a) Find the YTM of the 1-yr T-Bill PMT PV FV n Output Since 1-yr T-Bill has no coupons, the calculated YTM Spot Rate 1-yr Spot Rate z1 2-yr Spot Rate z2 b) Continuing the Bootstrapping 2-year and have coupons, draw the timeline of cash flows and fill in their data: 0 2 Cpn z1 Face Then set up the NPV pricing of this Treasury in the space below: Price of 2-yr T-Bill Use the space below to show work for solving the 2-yr Spot Rate z2 z2 3-yr Spot Rate c) Continuing the process with the 3-year, draw the timelime of cash flows and fill in their data t 0 3 Cpn Face Cpn Cpn z1 z2 Then set up the NPV pricing of this Treasury in the space below Price of 3-yr T-Bill Use the space below to show work for solving the 3-yr Spot Rate z3: z3 = |||| Derive Spot Rates using the method of Bootstrapping-starting with 1-year T-bill (annuel) to calculate pure 1-year Spot Rate, and then deriving Spot Rates for longer and longer maturity Treasurys. 05/22/2018 Auction Date: 05/22/2018 05/08/2018 Maturity: Coupon: Price: 1 2 3 0.0000% 2.5000% 2.6250% 97.699722 99.825680 99.888266 1-Yr Spot Rate z1 a) Find the YTM of the 1-yr T-Bill PMT PV FV n Output Since 1-yr T-Bill has no coupons, the calculated YTM Spot Rate 1-yr Spot Rate z1 2-yr Spot Rate z2 b) Continuing the Bootstrapping 2-year and have coupons, draw the timeline of cash flows and fill in their data: 0 2 Cpn z1 Face Then set up the NPV pricing of this Treasury in the space below: Price of 2-yr T-Bill Use the space below to show work for solving the 2-yr Spot Rate z2 z2 3-yr Spot Rate c) Continuing the process with the 3-year, draw the timelime of cash flows and fill in their data t 0 3 Cpn Face Cpn Cpn z1 z2 Then set up the NPV pricing of this Treasury in the space below Price of 3-yr T-Bill Use the space below to show work for solving the 3-yr Spot Rate z3: z3 = ||||