Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question has two parts: A: B: Sugarland Industries reported a net income of $810.750 on December 31, 2018 At the beginning of the year,

This question has two parts:

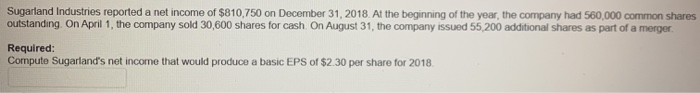

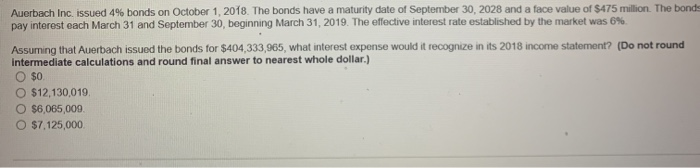

Sugarland Industries reported a net income of $810.750 on December 31, 2018 At the beginning of the year, the company had 560,000 common shares outstanding. On April 1, the company sold 30,600 shares for cash On August 31, the company issued 55,200 additional shares as part of a merger Required: Compute Sugarland's net income that would produce a basic EPS of $2.30 per share for 2018 Auerbach Inc, issued 4% bonds on October 1, 2018. The bonds have a maturity date of September 30, 2028 and a face value of $475 million. The bonds pay interest each March 31 and September 30, beginning March 31, 2019. The effective interest rate established by the market was 6% Assuming that Auerbach issued the bonds for $404,333,965, what interest expense would it recognize in its 2018 income statement? (Do not round Intermediate calculations and round final answer to nearest whole dollar.) O $0 O $12,130,019 O $6,065,000 O $7,125,000 A:

B:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started