Question

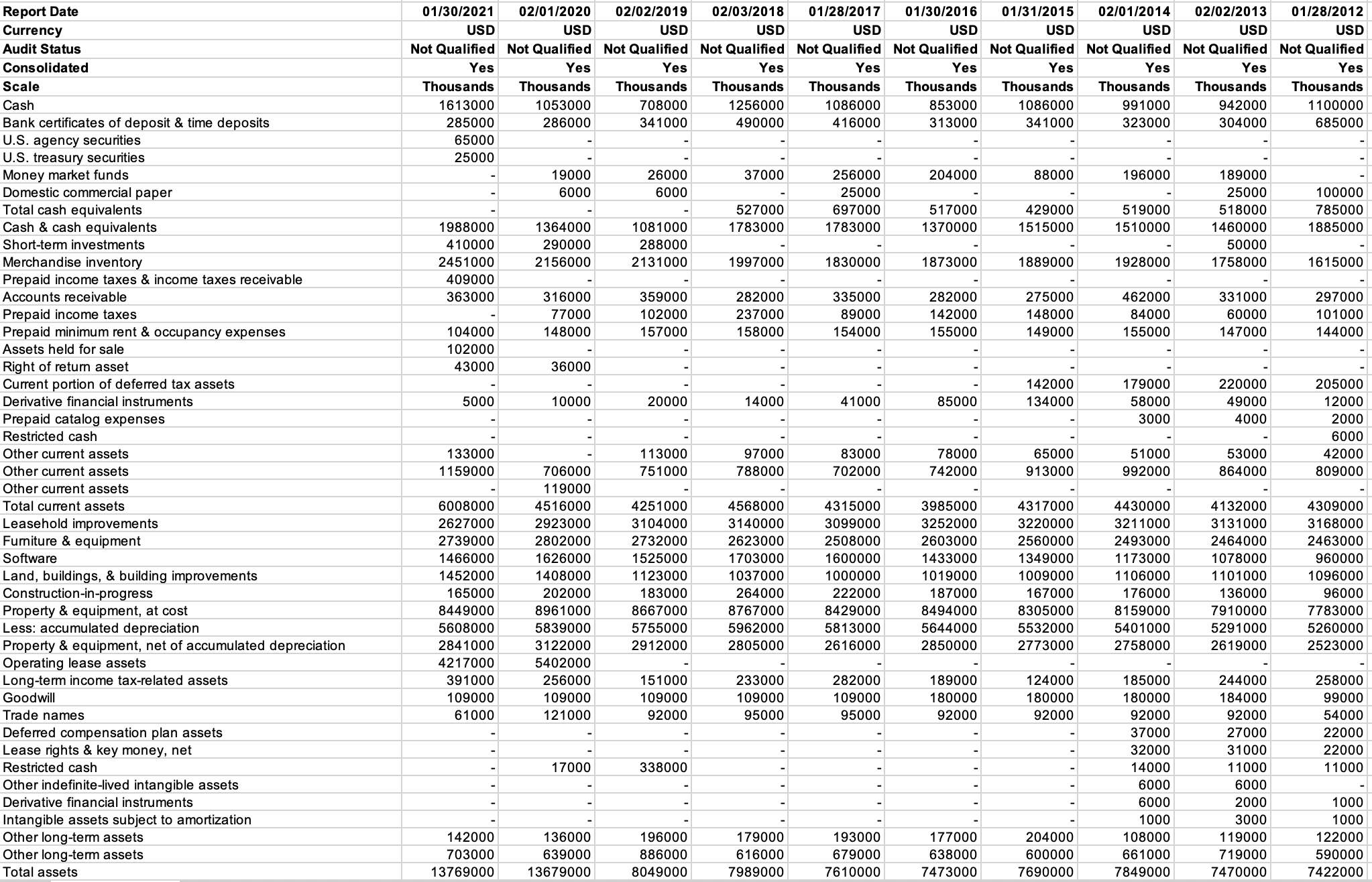

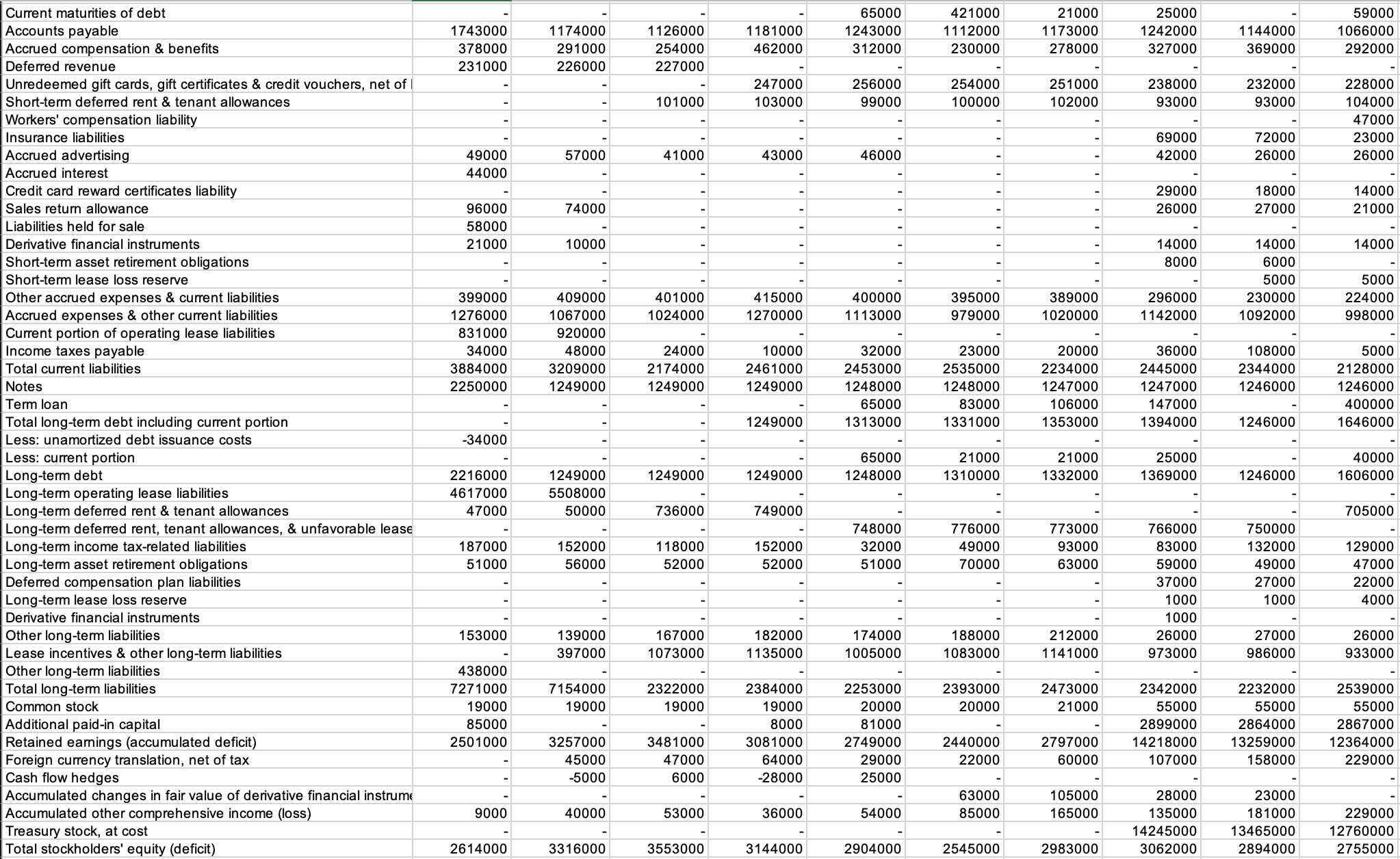

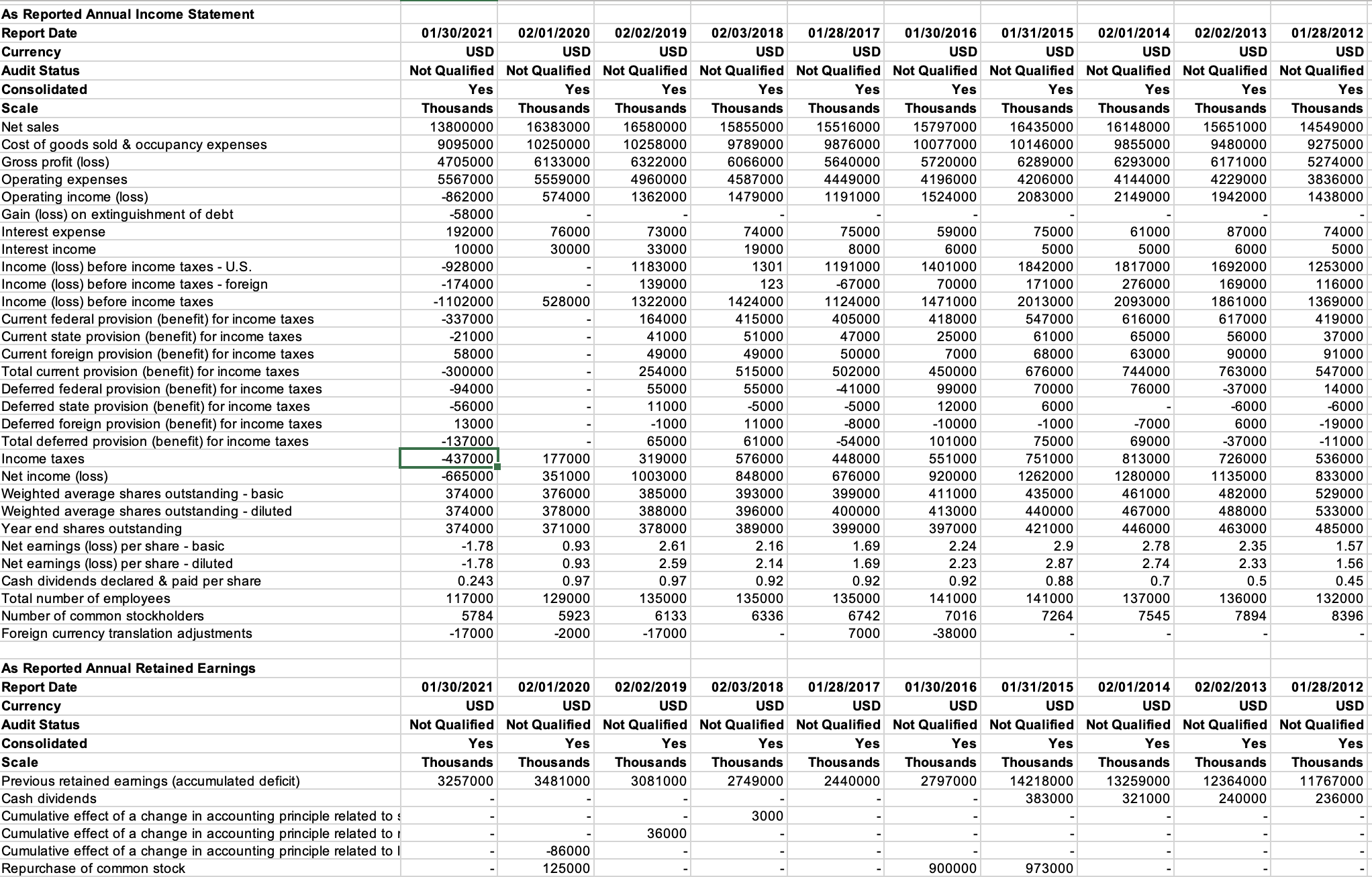

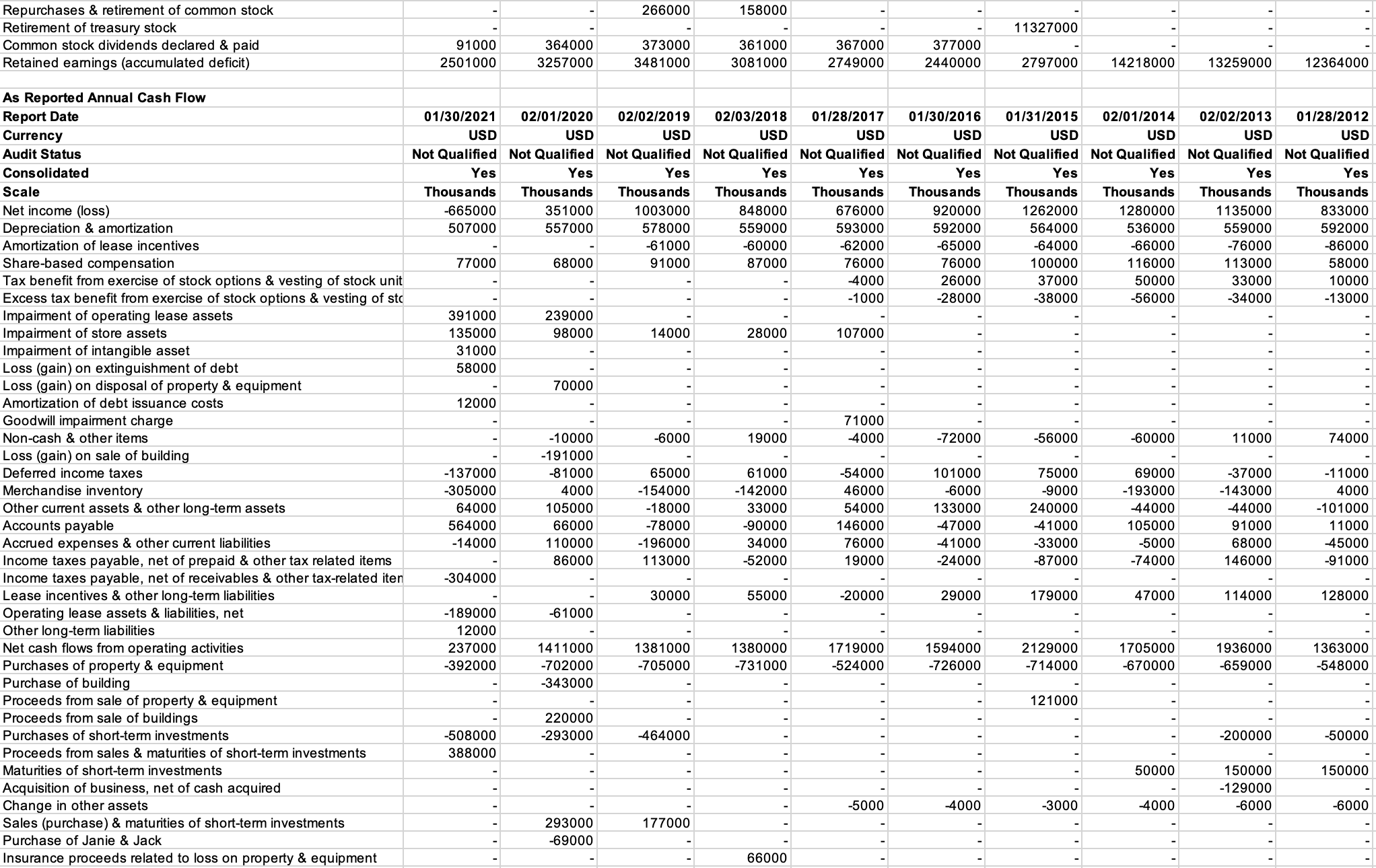

(this question has very big data thank you for your time!!!) Follow the instructions in excel to calculate the ratio of GAP for the most

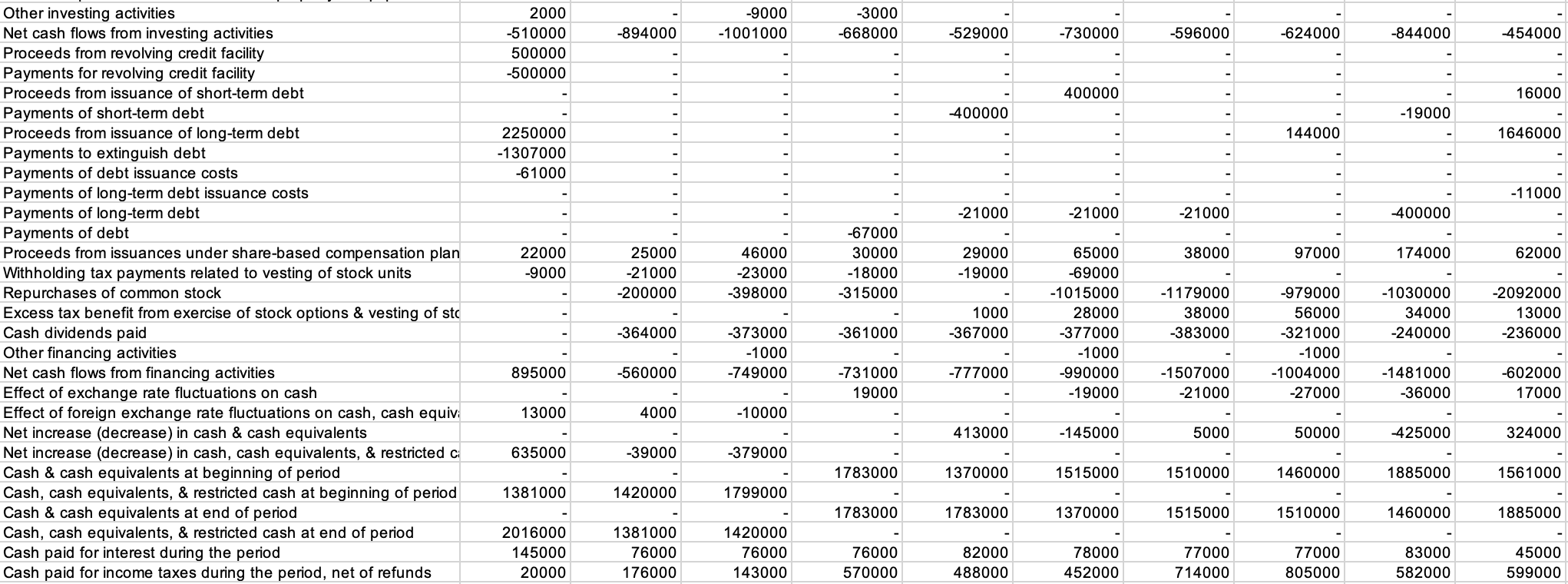

(this question has very big data thank you for your time!!!) Follow the instructions in excel to calculate the ratio of GAP for the most recent year. Calculate the ratios listed for the most recent financial year. Ratios: Note that not all ratios can be calculated for every company. If you can't find the missing data in a footnote etc. then you should make a footnote (in the table) saying "The X ratio cannot be calculated due to missing information on Y". A. profit margin B. Return on equity C. Gross profit margin D. Asset turnover rate E. Sales days of accounts receivable F. Inventory sales days G. Days to pay for inventory H. Assets and liabilities J. interest income multiple K. Price-to-earnings ratio

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Current maturities of debt & - & - & - & - & 65000 & 421000 & 21000 & 25000 & - & 59000 \\ \hline Sales return allowance & 96000 & 74000 & - & - & - & - & - & 26000 & 27000 & 21000 \\ \hline Notes & 2250000 & 1249000 & 1249000 & 1249000 & 1248000 & 1248000 & 1247000 & 1247000 & 1246000 & 1246000 \\ \hline Term loan & - & - & - & - & 65000 & 83000 & 106000 & 147000 & - & 400000 \\ \hline Foreign currency translation, net of tax & - & 45000 & 47000 & 64000 & 29000 & 22000 & 60000 & 107000 & 158000 & 229000 \\ \hline Cash flow hedges & - & -5000 & 6000 & -28000 & 25000 & - & - & - & - & \\ \hline Accumulated changes in fair value of derivative financial instrume & - & - & - & - & - & 63000 & 105000 & 28000 & 23000 & - \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Current maturities of debt & - & - & - & - & 65000 & 421000 & 21000 & 25000 & - & 59000 \\ \hline Sales return allowance & 96000 & 74000 & - & - & - & - & - & 26000 & 27000 & 21000 \\ \hline Notes & 2250000 & 1249000 & 1249000 & 1249000 & 1248000 & 1248000 & 1247000 & 1247000 & 1246000 & 1246000 \\ \hline Term loan & - & - & - & - & 65000 & 83000 & 106000 & 147000 & - & 400000 \\ \hline Foreign currency translation, net of tax & - & 45000 & 47000 & 64000 & 29000 & 22000 & 60000 & 107000 & 158000 & 229000 \\ \hline Cash flow hedges & - & -5000 & 6000 & -28000 & 25000 & - & - & - & - & \\ \hline Accumulated changes in fair value of derivative financial instrume & - & - & - & - & - & 63000 & 105000 & 28000 & 23000 & - \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Current maturities of debt & - & - & - & - & 65000 & 421000 & 21000 & 25000 & - & 59000 \\ \hline Sales return allowance & 96000 & 74000 & - & - & - & - & - & 26000 & 27000 & 21000 \\ \hline Notes & 2250000 & 1249000 & 1249000 & 1249000 & 1248000 & 1248000 & 1247000 & 1247000 & 1246000 & 1246000 \\ \hline Term loan & - & - & - & - & 65000 & 83000 & 106000 & 147000 & - & 400000 \\ \hline Foreign currency translation, net of tax & - & 45000 & 47000 & 64000 & 29000 & 22000 & 60000 & 107000 & 158000 & 229000 \\ \hline Cash flow hedges & - & -5000 & 6000 & -28000 & 25000 & - & - & - & - & \\ \hline Accumulated changes in fair value of derivative financial instrume & - & - & - & - & - & 63000 & 105000 & 28000 & 23000 & - \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Current maturities of debt & - & - & - & - & 65000 & 421000 & 21000 & 25000 & - & 59000 \\ \hline Sales return allowance & 96000 & 74000 & - & - & - & - & - & 26000 & 27000 & 21000 \\ \hline Notes & 2250000 & 1249000 & 1249000 & 1249000 & 1248000 & 1248000 & 1247000 & 1247000 & 1246000 & 1246000 \\ \hline Term loan & - & - & - & - & 65000 & 83000 & 106000 & 147000 & - & 400000 \\ \hline Foreign currency translation, net of tax & - & 45000 & 47000 & 64000 & 29000 & 22000 & 60000 & 107000 & 158000 & 229000 \\ \hline Cash flow hedges & - & -5000 & 6000 & -28000 & 25000 & - & - & - & - & \\ \hline Accumulated changes in fair value of derivative financial instrume & - & - & - & - & - & 63000 & 105000 & 28000 & 23000 & - \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started