Question: This question is about bond valuation in corporate finance. Please show all your workings and answers (a) Wrybill Ltd has an outstanding perpetual bond with

This question is about bond valuation in corporate finance. Please show all your workings and answers

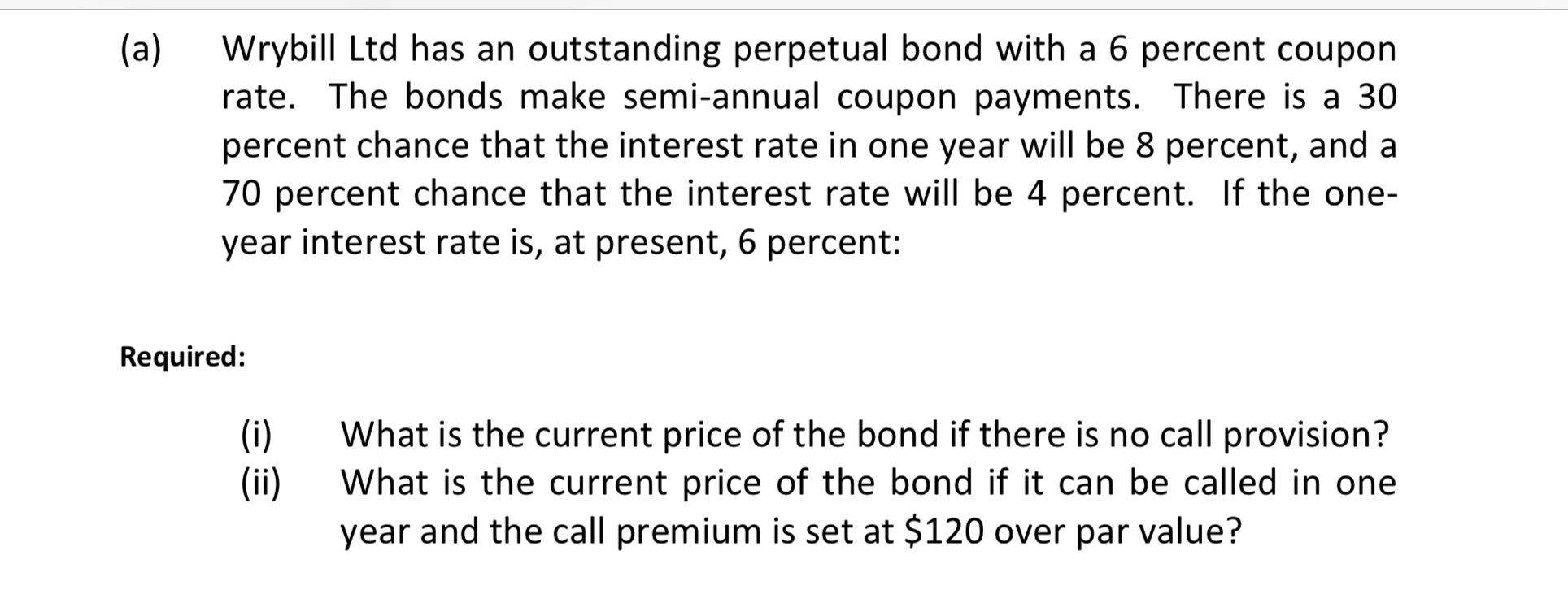

(a) Wrybill Ltd has an outstanding perpetual bond with a 6 percent coupon rate. The bonds make semi-annual coupon payments. There is a 30 percent chance that the interest rate in one year will be 8 percent, and a 70 percent chance that the interest rate will be 4 percent. If the oneyear interest rate is, at present, 6 percent: Required: (i) What is the current price of the bond if there is no call provision? (ii) What is the current price of the bond if it can be called in one year and the call premium is set at $120 over par value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock