Answered step by step

Verified Expert Solution

Question

1 Approved Answer

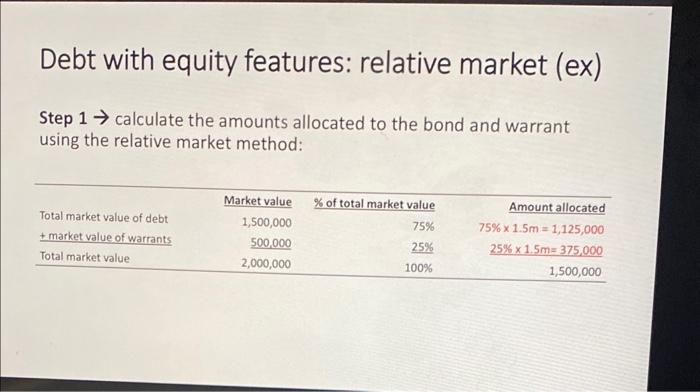

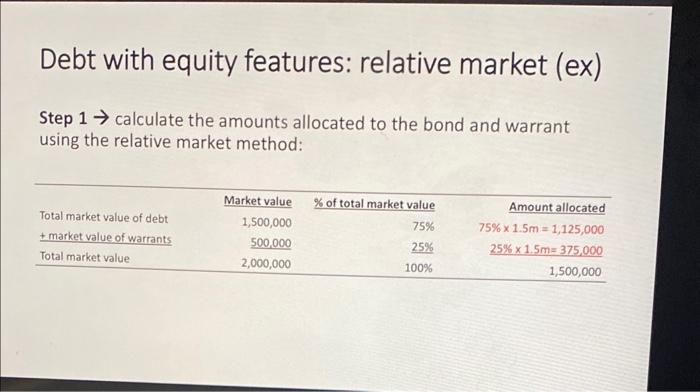

this question is amswered but I don't understand how they got 75 and 25% please explain Debt with equity features: relative market (ex) Step 1

this question is amswered but I don't understand how they got 75 and 25%

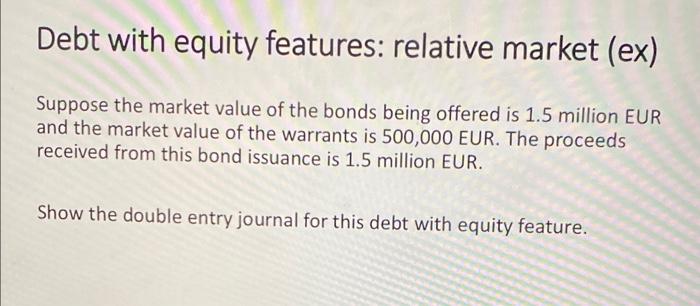

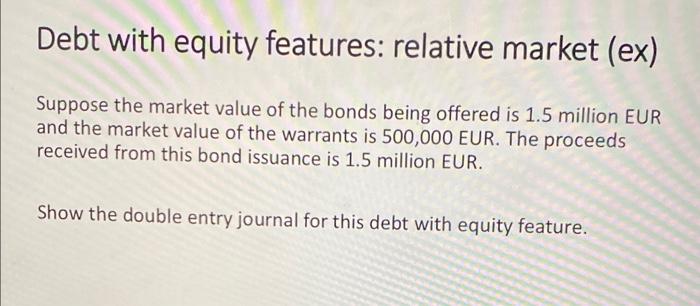

Debt with equity features: relative market (ex) Step 1 calculate the amounts allocated to the bond and warrant using the relative market method: Debt with equity features: relative market (ex) Suppose the market value of the bonds being offered is 1.5 million EUR and the market value of the warrants is 500,000 EUR. The proceeds received from this bond issuance is 1.5 million EUR. Show the double entry journal for this debt with equity feature please explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started