Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this question is based on canadian tax principles (textbook). QUESTION IV (14 Marks) Kenaston Industrial is a Saskatchewan manufacturer of hockey equipment and has a

this question is based on canadian tax principles (textbook).

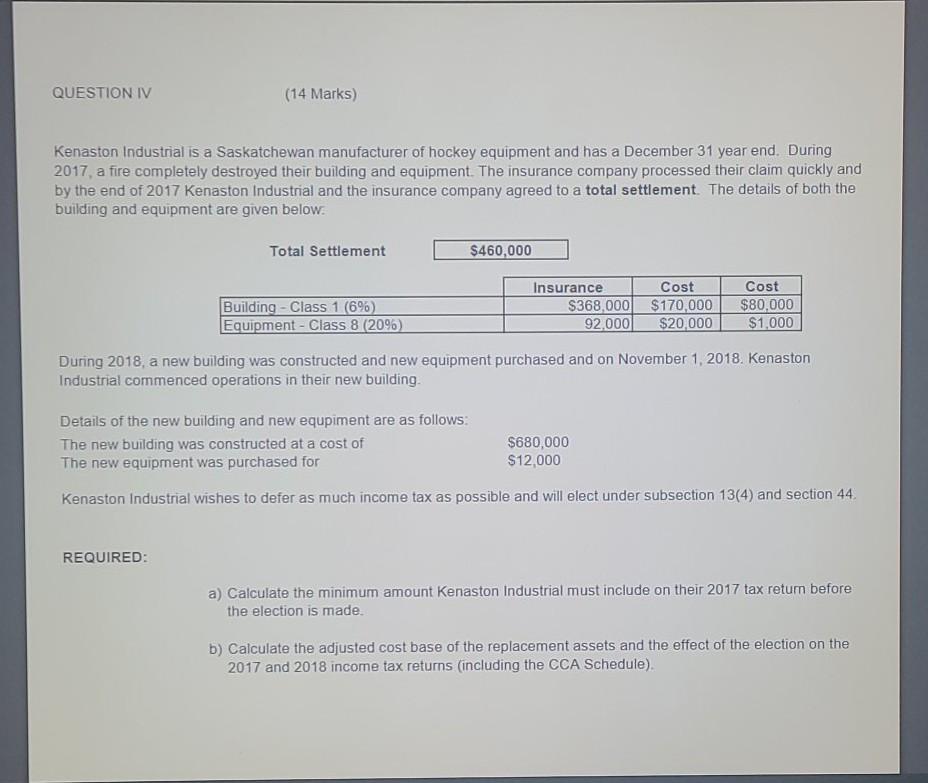

QUESTION IV (14 Marks) Kenaston Industrial is a Saskatchewan manufacturer of hockey equipment and has a December 31 year end. During 2017, a fire completely destroyed their building and equipment. The insurance company processed their claim quickly and by the end of 2017 Kenaston Industrial and the insurance company agreed to a total settlement. The details of both the building and equipment are given below. Total Settlement $460,000 Insurance Cost Cost Building - Class 1 (6%) $368,000 $170,000 $80,000 Equipment - Class 8 (20%) 92,000 $20,000 $1,000 During 2018, a new building was constructed and new equipment purchased and on November 1, 2018. Kenaston Industrial commenced operations in their new building Details of the new building and new equpiment are as follows: The new building was constructed at a cost of The new equipment was purchased for $680,000 $12,000 Kenaston Industrial wishes to defer as much income tax as possible and will elect under subsection 13(4) and section 44 REQUIRED: a) Calculate the minimum amount Kenaston Industrial must include on their 2017 tax return before the election is made. b) Calculate the adjusted cost base of the replacement assets and the effect of the election on the 2017 and 2018 income tax returns (including the CCA Schedule). QUESTION IV (14 Marks) Kenaston Industrial is a Saskatchewan manufacturer of hockey equipment and has a December 31 year end. During 2017, a fire completely destroyed their building and equipment. The insurance company processed their claim quickly and by the end of 2017 Kenaston Industrial and the insurance company agreed to a total settlement. The details of both the building and equipment are given below. Total Settlement $460,000 Insurance Cost Cost Building - Class 1 (6%) $368,000 $170,000 $80,000 Equipment - Class 8 (20%) 92,000 $20,000 $1,000 During 2018, a new building was constructed and new equipment purchased and on November 1, 2018. Kenaston Industrial commenced operations in their new building Details of the new building and new equpiment are as follows: The new building was constructed at a cost of The new equipment was purchased for $680,000 $12,000 Kenaston Industrial wishes to defer as much income tax as possible and will elect under subsection 13(4) and section 44 REQUIRED: a) Calculate the minimum amount Kenaston Industrial must include on their 2017 tax return before the election is made. b) Calculate the adjusted cost base of the replacement assets and the effect of the election on the 2017 and 2018 income tax returns (including the CCA Schedule)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started