Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is based on the Find_SR_Again tab of spreadsheet. a) Fill in the highlighted cells using appropriate formulas. b) Can you explain why

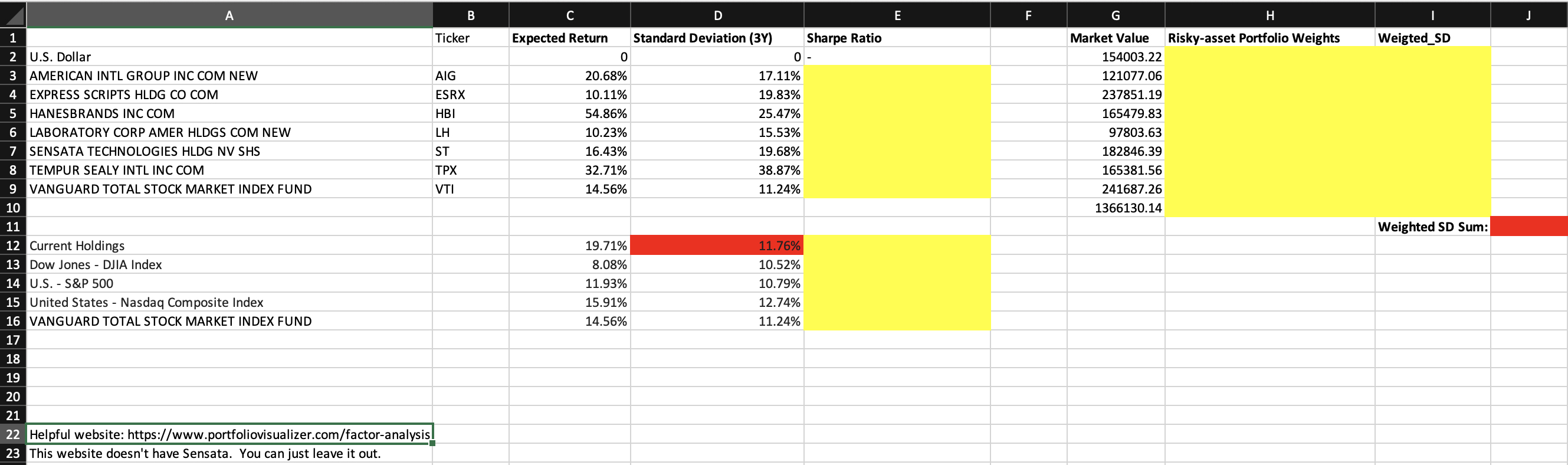

This question is based on the "Find_SR_Again tab of spreadsheet. a) Fill in the highlighted cells using appropriate formulas. b) Can you explain why the two numbers highlighted in red are different? c) Calculate the Fama-French 3-factor loadings and alpha for the portfolio. Ignore Sensata. (You're responsible for understanding the how the calculations work, but this website can do the computation for you: https://www.portfoliovisualizer.com /factor-analysis.) d) Repeat part (c), but now leave VTI out of the portfolio. VTI is an index fund; explain why it might make sense to leave out VTI if you are trying to analyze performance. A 1 2 U.S. Dollar 3 AMERICAN INTL GROUP INC COM NEW 4 EXPRESS SCRIPTS HLDG CO COM 5 HANESBRANDS INC COM 6 LABORATORY CORP AMER HLDGS COM NEW 7 SENSATA TECHNOLOGIES HLDG NV SHS 8 TEMPUR SEALY INTL INC COM 9 VANGUARD TOTAL STOCK MARKET INDEX FUND 10 11 12 Current Holdings 13 Dow Jones - DJIA Index 14 U.S. - S&P 500 15 United States - Nasdaq Composite Index 16 VANGUARD TOTAL STOCK MARKET INDEX FUND 17 18 19 20 21 22 Helpful website: https://www.portfoliovisualizer.com/factor-analysis 23 This website doesn't have Sensata. You can just leave it out. B Ticker AIG ESRX HBI LH ST TPX VTI C Expected Return 0 20.68% 10.11% 54.86% 10.23% 16.43% 32.71% 14.56% 19.71% 8.08% 11.93% 15.91% 14.56% D Standard Deviation (3Y) 0 17.11% 19.83% 25.47% 15.53% 19.68% 38.87% 11.24% 11.76% 10.52% 10.79% 12.74% 11.24% Sharpe Ratio E F H Market Value Risky-asset Portfolio Weights 154003.22 121077.06 237851.19 165479.83 97803.63 182846.39 165381.56 241687.26 1366130.14 G Weigted_SD Weighted SD Sum: J

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Fill in the highlighted cells Expected Return SUMB3B9C11C17 02068010937701011015400305486016548001...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started