Question

This question is based on TVM question 2 (see next page). The point is to convince you that at 12 percent discount rate, it would

This question is based on TVM question 2 (see next page). The point is to convince you that at 12 percent discount rate, it would make more sense to buy than to lease.

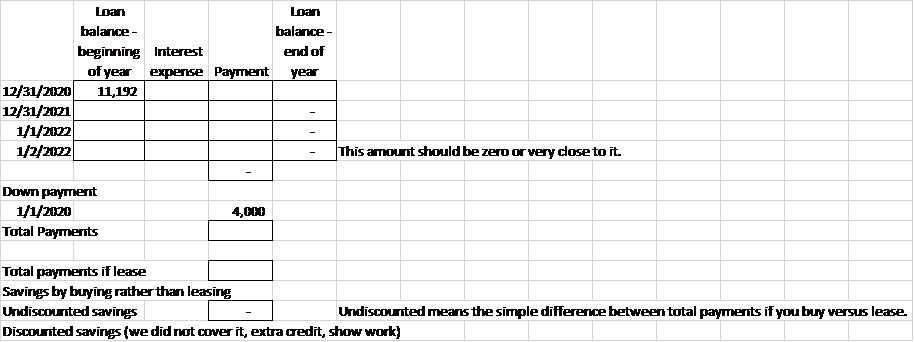

Suppose we decide the buy (not lease) the equipment which sells for $15,192, not including interest of 12 percent. The down payment is $4,000. The remaining balance of $11,192 is paid off through a mortgage of four payments at the end of each of the next four years (ordinary annuity).

1. on the date of purchase 1/1/2020, record the journal entry to purchase the equipment.

2. What are the annual end-of-year payments? (hint: $11,192 divided by a factor from the multiple-choice table below).

3. On 12/31/2020, record the journal entry to record the payment and interest expense for year 1.

4. What other journal entry needs to be recorded on 12/31/2020?

5. Complete and attach the attached template showing loan payoff and balances. (1 point)

6. Does it make more sense to lease (based on 5 payments of $4,000) or to buy at $15,192 and 12 percent interest? Justify your answer with the total lease payments versus the total principal and interest payments, and the difference between the two (see spreadsheet template).

Use the multiple-choice question to answer questions 1-6. Thank you.

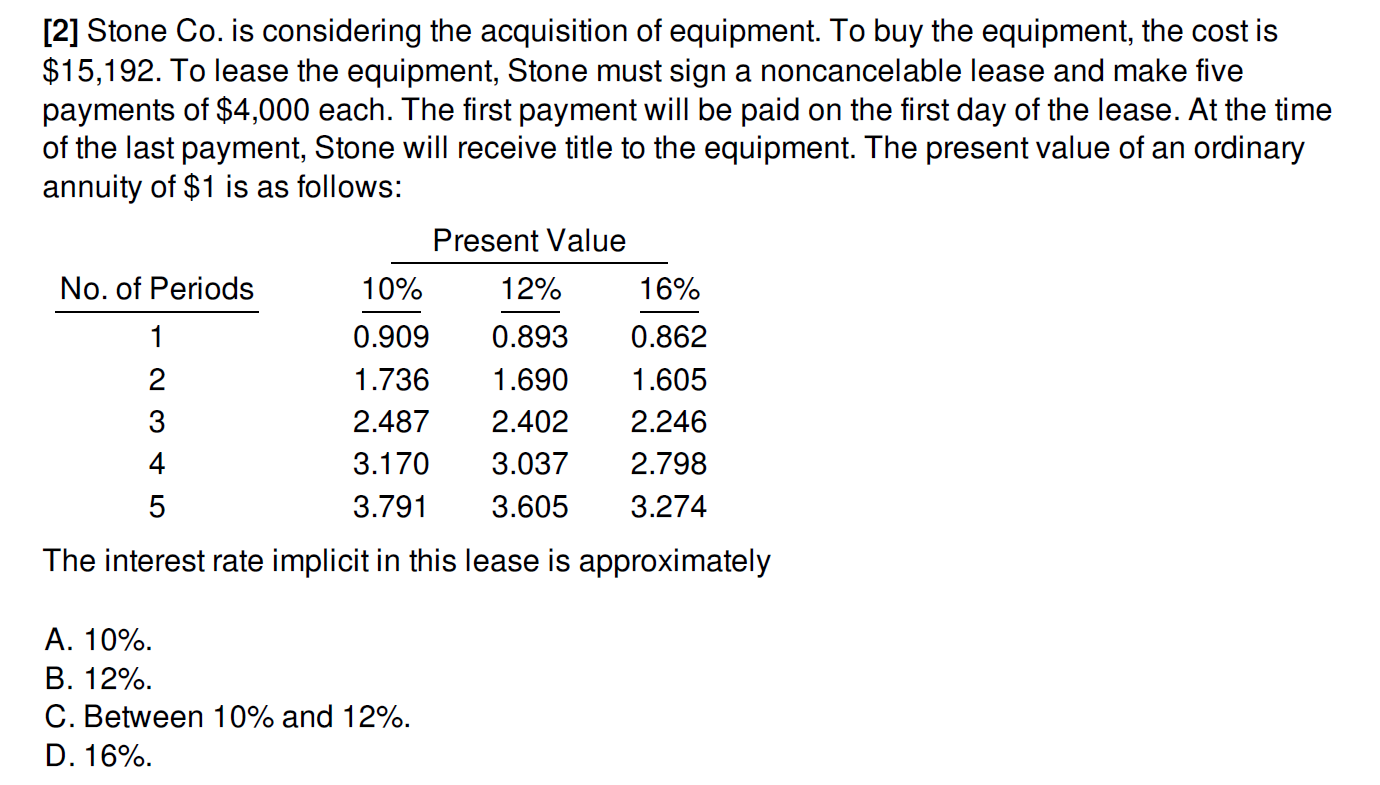

| [2] Stone Co. is considering the acquisition of equipment. To buy the equipment, the cost is $15,192. To lease the equipment, Stone must sign a noncancelable lease and make five payments of $4,000 each. The first payment will be paid on the first day of the lease. At the time of the last payment, Stone will receive title to the equipment. The present value of an ordinary annuity of $1 is as follows: Present Value No. of Periods 10% 12% 16% 0.909 0.893 0.862 1.736 1.690 1.605 2.487 2.402 2.246 3.170 3.037 2.798 3.791 3.605 3.274 The interest rate implicit in this lease is approximately A. 10%. B. 12%. C. Between 10% and 12%. D. 16%. Loan Loan balance - Interest end of expense Payment year balance - beginning of year 12/31/2020 11,192 12/31/2071 1/1/2022 1/2/2022 This amount should be zero or very dose to it. Down payment 1/1/2020 Total Payments 4,00 Total payments if lease Savings by buying rather than leasing Undiscounted savings Undiscounted means the simple difference between total payments if you buy versus lease. Discounted savings (we did not cover it, extra credit, show work)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started