This question is derived from this book information Technology Project Management by Kathy Schwalne. in Chapter 3-4

This question is derived from this book information Technology Project Management by Kathy Schwalne. in Chapter 3-4

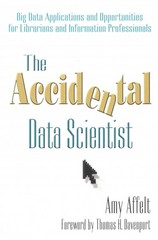

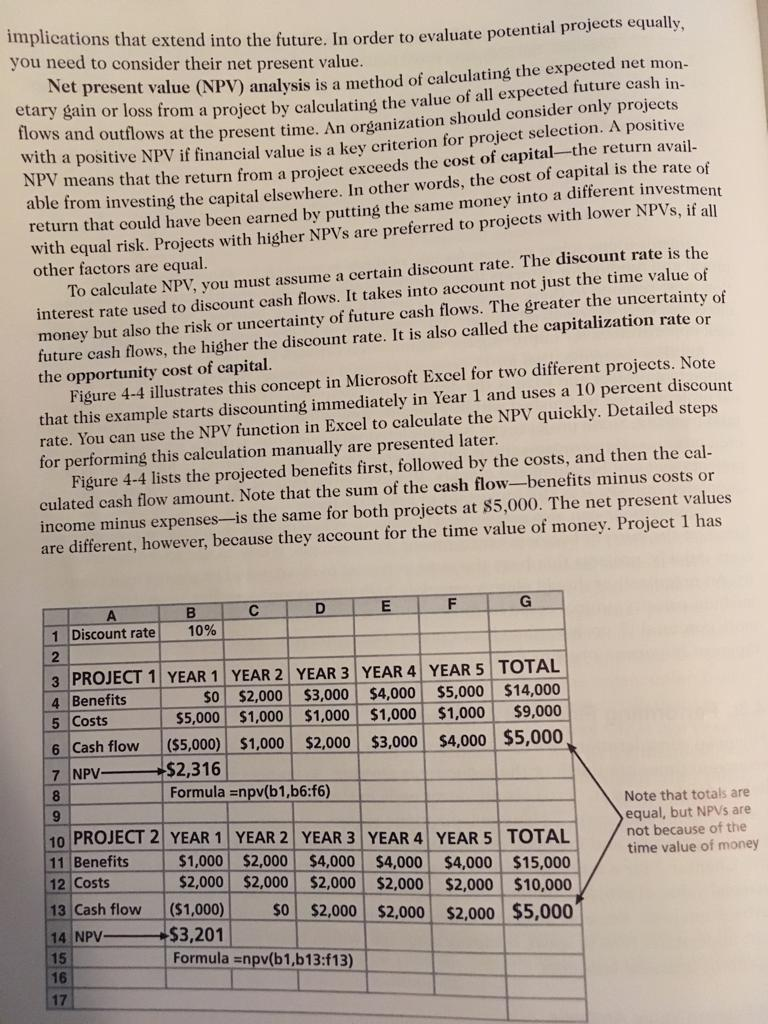

ons that extend into the future. In order to evaluate potential projects equally ou need to consider their net present value Net present value (NPV) analysis is a method of calculating the expected net mon ry gain or loss from a project by calculating the value of all expected future cash in- ows and outflows at the present time. An organization should consider only projects With a positive NPV if financial value is a key criterion for project selection. A positive NPV means that the return from a project exceeds the cost of capital-the return avail ng the capital elsewhere. In other words, the cost of capital is the rate of different investment return that could have been earned by putting the same money into a with equal risk. Projects with hig other factors are equal her NPV s are preferred to projects with lower NPVs, if all o calculate NPV, you must assume a certain discount rate. The discount rate is the the time value of interest rate used to discount cash flows. It takes into account not just money but also the risk or uncertainty of future cash flows. The greater the uncertainty of future cash flows, the higher the discount rate. It is also called the capitalization rate or the opportunity cost of capital Figure 4-4 illustrates this concept in Microsoft Excel for two different projects. Note that this example starts discounting immediately in Year 1 and uses a 10 percent discount rate. You can use the NPV function in Excel to calculate the NPV quickly. Detailed steps for performing this calculation manually are presented later. Figure 4-4 lists the projected benefits first, followed by the costs, and then the cal culated cash flow amount. Note that the sum of the cash flow-benefits minus costs or income minus expenses-is the same for both projects at $5,000. The net present values are different, however, because they account for the time value of money. Project 1 has 1 Discount rate 10% PROJECT 1 | YEAR 1 | YEAR 2 | YEAR31 YEAR 41 YEAR 51 TOTAL S0 $2,000 $3,000 $4,000 $5,000 $14,000 Costs $5,000 $1,000 $1,000 1,000 1,000 9,000 6 Cash flow (55,000) $1,000 $2,000 3,000 $4,000 $5,000 4 Benefits $2,316 Formula Enpv(b1,b6:f6) 7 NPV 10 PROJECT 2 YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 TOTAL 11 Benefits 12 Costs Note that totals ane equal, but NPVs are not because of the time value of money $1,000 $2,000 $4,000 $4,000 $4,000 $15,000 $2,000 $2,000 $2,000 $2,000 $2,000 $10,000 Cash flow ($1,000)0 $2,000 $2,000 $2,000 $5,000 14 NPV 15 16 $3,201 Formula Enpv(b1,b13:f13) ons that extend into the future. In order to evaluate potential projects equally ou need to consider their net present value Net present value (NPV) analysis is a method of calculating the expected net mon ry gain or loss from a project by calculating the value of all expected future cash in- ows and outflows at the present time. An organization should consider only projects With a positive NPV if financial value is a key criterion for project selection. A positive NPV means that the return from a project exceeds the cost of capital-the return avail ng the capital elsewhere. In other words, the cost of capital is the rate of different investment return that could have been earned by putting the same money into a with equal risk. Projects with hig other factors are equal her NPV s are preferred to projects with lower NPVs, if all o calculate NPV, you must assume a certain discount rate. The discount rate is the the time value of interest rate used to discount cash flows. It takes into account not just money but also the risk or uncertainty of future cash flows. The greater the uncertainty of future cash flows, the higher the discount rate. It is also called the capitalization rate or the opportunity cost of capital Figure 4-4 illustrates this concept in Microsoft Excel for two different projects. Note that this example starts discounting immediately in Year 1 and uses a 10 percent discount rate. You can use the NPV function in Excel to calculate the NPV quickly. Detailed steps for performing this calculation manually are presented later. Figure 4-4 lists the projected benefits first, followed by the costs, and then the cal culated cash flow amount. Note that the sum of the cash flow-benefits minus costs or income minus expenses-is the same for both projects at $5,000. The net present values are different, however, because they account for the time value of money. Project 1 has 1 Discount rate 10% PROJECT 1 | YEAR 1 | YEAR 2 | YEAR31 YEAR 41 YEAR 51 TOTAL S0 $2,000 $3,000 $4,000 $5,000 $14,000 Costs $5,000 $1,000 $1,000 1,000 1,000 9,000 6 Cash flow (55,000) $1,000 $2,000 3,000 $4,000 $5,000 4 Benefits $2,316 Formula Enpv(b1,b6:f6) 7 NPV 10 PROJECT 2 YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 TOTAL 11 Benefits 12 Costs Note that totals ane equal, but NPVs are not because of the time value of money $1,000 $2,000 $4,000 $4,000 $4,000 $15,000 $2,000 $2,000 $2,000 $2,000 $2,000 $10,000 Cash flow ($1,000)0 $2,000 $2,000 $2,000 $5,000 14 NPV 15 16 $3,201 Formula Enpv(b1,b13:f13)

This question is derived from this book information Technology Project Management by Kathy Schwalne. in Chapter 3-4

This question is derived from this book information Technology Project Management by Kathy Schwalne. in Chapter 3-4