Answered step by step

Verified Expert Solution

Question

1 Approved Answer

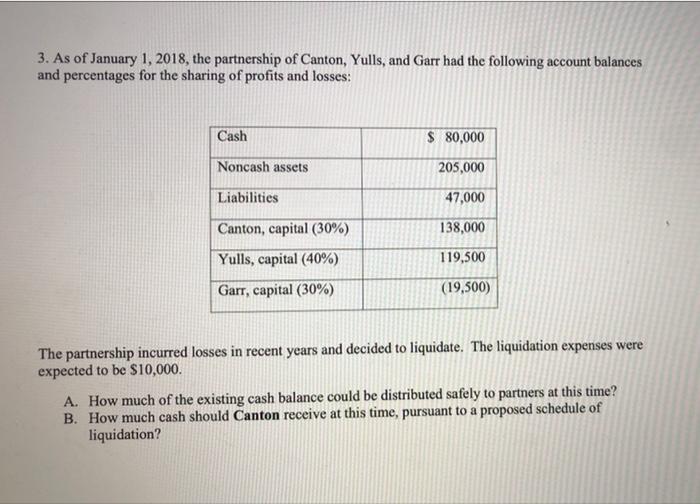

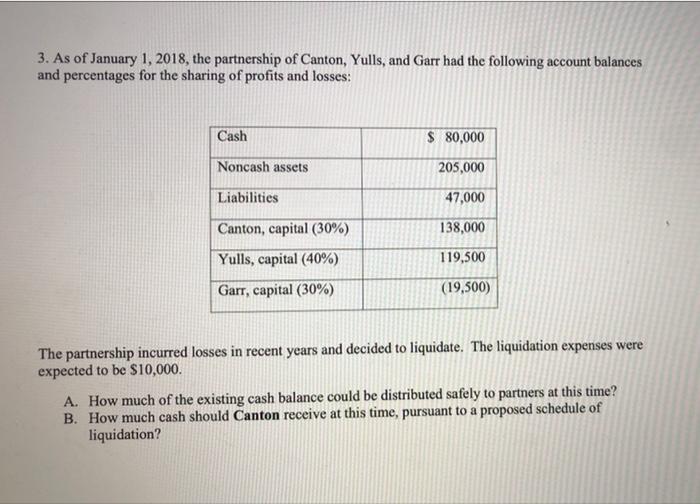

this question is from Advanced Accounting class, thanks for answering both questions 3. As of January 1, 2018, the partnership of Canton, Yulls, and Garr

this question is from Advanced Accounting class, thanks for answering both questions

3. As of January 1, 2018, the partnership of Canton, Yulls, and Garr had the following account balances and percentages for the sharing of profits and losses: Cash $ 80,000 Noncash assets 205,000 Liabilities 47,000 138,000 Canton, capital (30%) Yulls, capital (40%) 119,500 Garr, capital (30%) (19,500) The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $10,000. A. How much of the existing cash balance could be distributed safely to partners at this time? B. How much cash should Canton receive at this time, pursuant to a proposed schedule of liquidation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started