Answered step by step

Verified Expert Solution

Question

1 Approved Answer

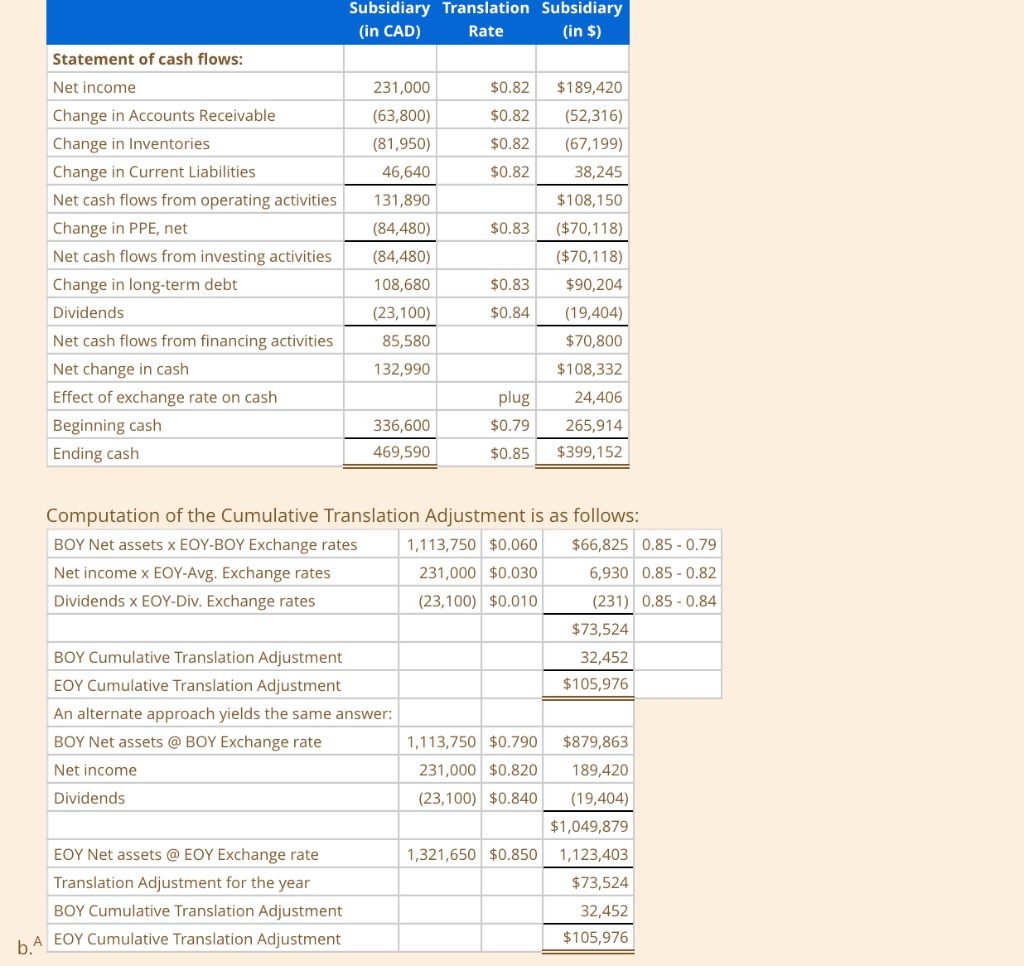

This question is fully answered, but I want to know how to calculate the BOY net assets in part B, which is $1113750. What is

This question is fully answered, but I want to know how to calculate the BOY net assets in part B, which is $1113750.

What is the formula of the BOY net assets? I do not want the formula like (1321650 + 23100 - 231000). Could you tell me really specifically? Thank you.

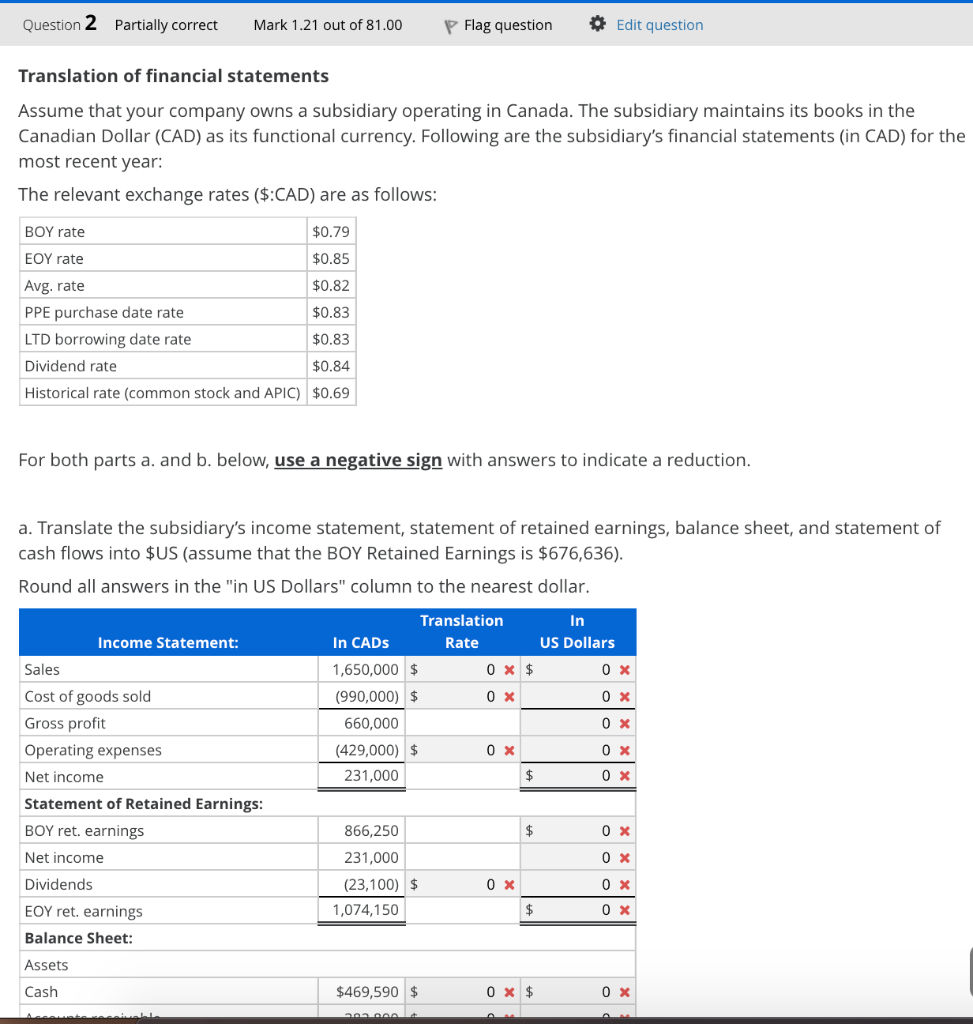

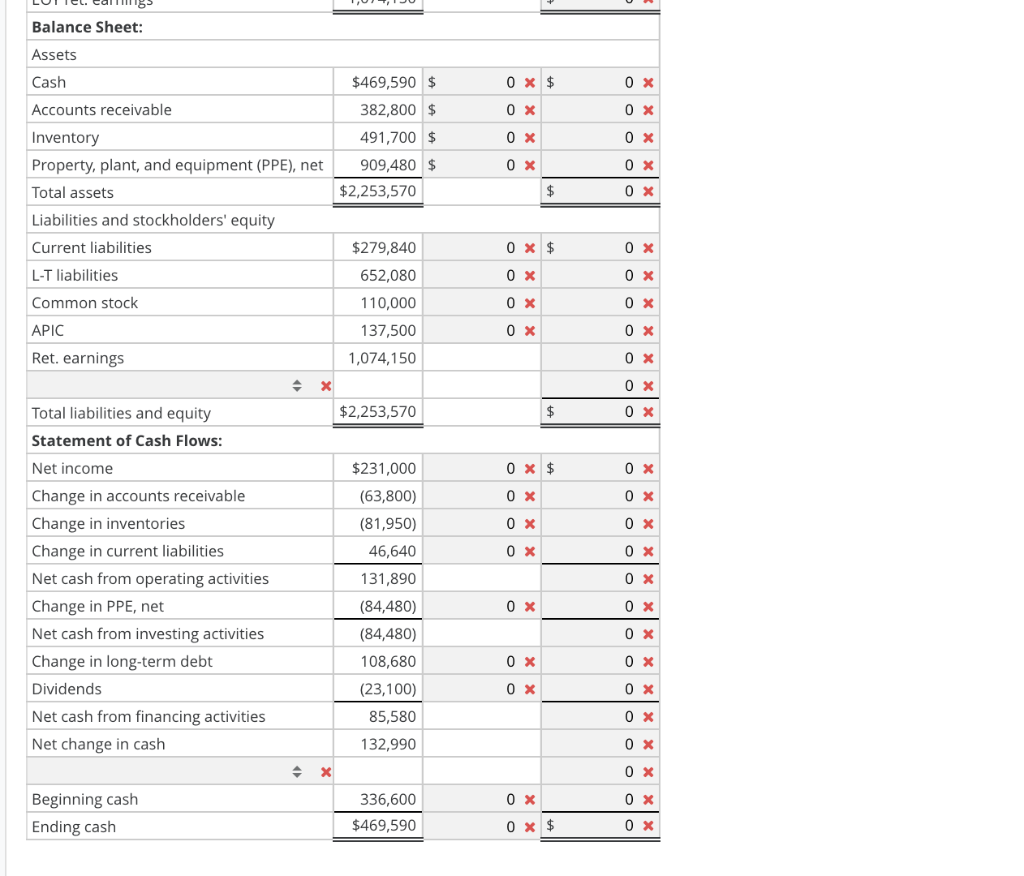

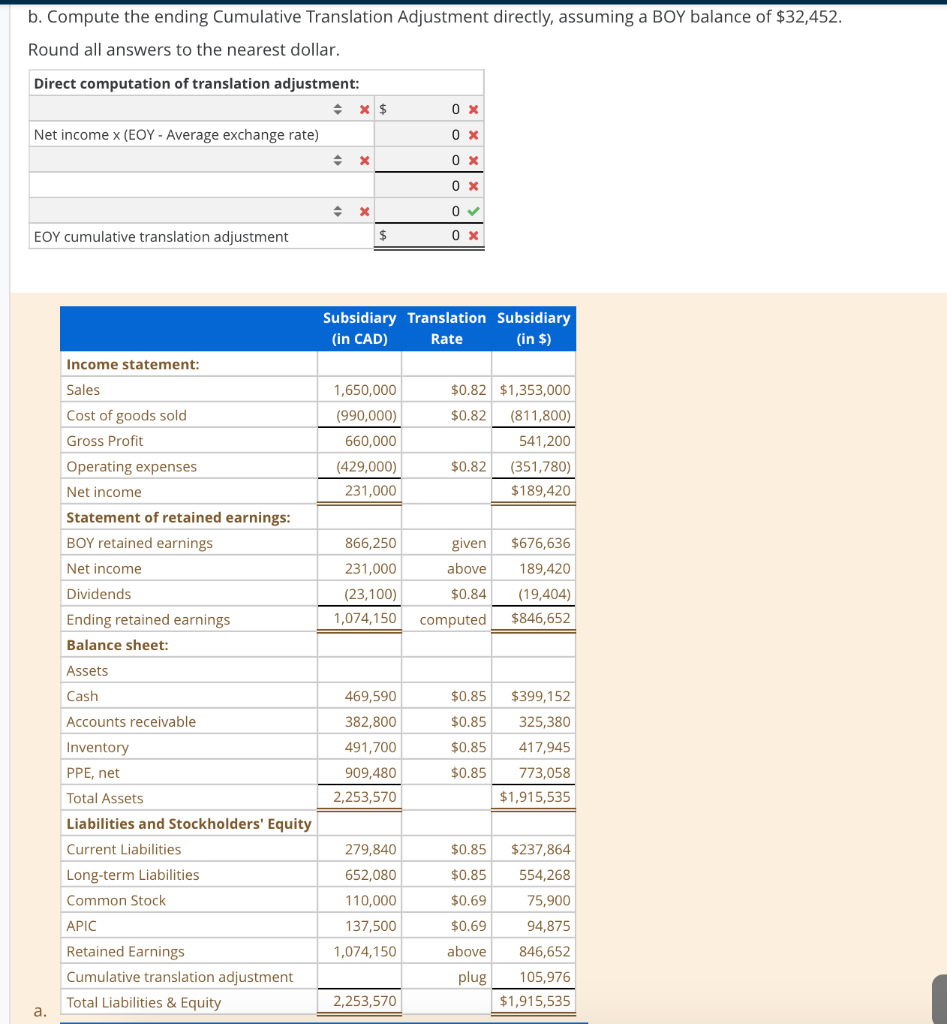

Question 2 Partially correct Mark 1.21 out of 81.00 P Flag question Edit question Translation of financial statements Assume that your company owns a subsidiary operating in Canada. The subsidiary maintains its books in the Canadian Dollar (CAD) as its functional currency. Following are the subsidiary's financial statements (in CAD) for the most recent year: The relevant exchange rates ($:CAD) are as follows: BOY rate $0.79 EOY rate $0.85 Avg. rate $0.82 PPE purchase date rate $0.83 LTD borrowing date rate $0.83 Dividend rate $0.84 Historical rate (common stock and APIC) $0.69 For both parts a. and b. below, use a negative sign with answers to indicate a reduction. a. Translate the subsidiary's income statement, statement of retained earnings, balance sheet, and statement of cash flows into $US (assume that the BOY Retained Earnings is $676,636). Round all answers in the "in US Dollars" column to the nearest dollar. Translation In In CADs Rate US Dollars 1,650,000 $ 0 x $ 0 x (990,000) $ 0 X 0 x 0 x 660,000 (429,000) $ 231,000 OX 0 x $ 0 X Income Statement: Sales Cost of goods sold Gross profit Operating expenses Net income Statement of Retained Earnings: BOY ret. earnings Net income Dividends EOY ret. earnings Balance Sheet: $ 0 x 866,250 231,000 Ox 0 X 0 x (23,100) $ 1,074,150 $ Ox Assets Cash $469,590 $ 0 x $ OX Balance Sheet: Assets Cash 0 x $ 0 x $469,590 $ 382,800 $ Accounts receivable 0 x 0 x OX OX 491,700 $ 909,480 $ $2,253,570 0 x Inventory Property, plant, and equipment (PPE), net Total assets Liabilities and stockholders' equity Current liabilities OX $ OX $279,840 0 x $ OX L-T liabilities 652,080 0 X 0 x Common stock 0 x OX 110,000 137,500 1,074,150 0 x OX APIC Ret. earnings OX X 0 x $2,253,570 $ OX Total liabilities and equity Statement of Cash Flows: 0 x $ OX 0 x OX 0 x 0 x 0 x 0 x O X Net income Change in accounts receivable Change in inventories Change in current liabilities Net cash from operating activities Change in PPE, net Net cash from investing activities Change in long-term debt Dividends Net cash from financing activities Net change in cash $231,000 (63,800) (81,950) 46,640 131,890 (84,480) (84,480) 108,680 (23,100) 85,580 0 x 0 x 0 x 0 X OX 0 x OX OX 132,990 0X 0 x 0 x 0 x Beginning cash Ending cash 336,600 $469,590 0 x $ OX b. Compute the ending Cumulative Translation Adjustment directly, assuming a BOY balance of $32,452. Round all answers to the nearest dollar. OX Direct computation of translation adjustment: x $ Net income x (EOY - Average exchange rate) X 0 x 0x OX X 0 EOY cumulative translation adjustment $ OX Subsidiary Translation Subsidiary (in CAD) Rate (in $) Income statement: Sales 1,650,000 (990,000) 660,000 (429,000) 231,000 $0.82 $1,353,000 $0.82 (811,800) 541,200 $0.82 (351,780) $189,420 Cost of goods sold Gross Profit Operating expenses Net income Statement of retained earnings: BOY retained earnings Net income Dividends Ending retained earnings Balance sheet: 866,250 231,000 (23,100) 1,074,150 $676,636 189,420 given above $0.84 (19,404) $846,652 computed Assets Cash $0.85 Accounts receivable $0.85 469,590 382,800 491,700 909,480 2,253,570 $0.85 $399,152 325,380 417,945 773,058 $1,915,535 $0.85 Inventory PPE, net Total Assets Liabilities and Stockholders' Equity Current Liabilities Long-term Liabilities Common Stock $0.85 $0.85 279,840 652,080 110,000 137,500 1,074,150 $237,864 554,268 75,900 $0.69 APIC $0.69 94,875 Retained Earnings Cumulative translation adjustment Total Liabilities & Equity above plug 846,652 105,976 $1,915,535 2,253,570 a. Subsidiary Translation Subsidiary (in CAD) Rate (in $) Statement of cash flows: $0.82 $0.82 $0.82 $0.82 Net income Change in Accounts Receivable Change in Inventories Change in Current Liabilities Net cash flows from operating activities Change in PPE, net Net cash flows from investing activities Change in long-term debt Dividends Net cash flows from financing activities Net change in cash Effect of exchange rate on cash Beginning cash Ending cash 231,000 (63,800) (81,950) 46,640 131,890 (84,480) (84,480) 108,680 (23,100) 85,580 132,990 $189,420 (52,316) (67,199) 38,245 $108,150 ($ 70,118) ($70,118) $90,204 $0.83 $0.83 $0.84 (19,404) $70,800 $108,332 24,406 265,914 $399,152 plug $0.79 336,600 469,590 $0.85 Computation of the Cumulative Translation Adjustment is as follows: BOY Net assets x EOY-BOY Exchange rates 1,113,750 $0.060 $66,825 0.85 -0.79 Net income x EOY-Avg. Exchange rates 231,000 $0.030 6,930 0.85 -0.82 Dividends x EOY-Div. Exchange rates (23,100) $0.010 (231) 0.85 -0.84 $73,524 BOY Cumulative Translation Adjustment 32,452 EOY Cumulative Translation Adjustment $105,976 An alternate approach yields the same answer: BOY Net assets @ BOY Exchange rate 1,113,750 $0.790 $879,863 Net income 231,000 $0.820 189,420 Dividends (23,100) $0.840 (19,404) $1,049,879 EOY Net assets @ EOY Exchange rate 1,321,650 $0.850 1,123,403 Translation Adjustment for the year $73,524 BOY Cumulative Translation Adjustment 32,452 b. EOY Cumulative Translation Adjustment $105,976 Question 2 Partially correct Mark 1.21 out of 81.00 P Flag question Edit question Translation of financial statements Assume that your company owns a subsidiary operating in Canada. The subsidiary maintains its books in the Canadian Dollar (CAD) as its functional currency. Following are the subsidiary's financial statements (in CAD) for the most recent year: The relevant exchange rates ($:CAD) are as follows: BOY rate $0.79 EOY rate $0.85 Avg. rate $0.82 PPE purchase date rate $0.83 LTD borrowing date rate $0.83 Dividend rate $0.84 Historical rate (common stock and APIC) $0.69 For both parts a. and b. below, use a negative sign with answers to indicate a reduction. a. Translate the subsidiary's income statement, statement of retained earnings, balance sheet, and statement of cash flows into $US (assume that the BOY Retained Earnings is $676,636). Round all answers in the "in US Dollars" column to the nearest dollar. Translation In In CADs Rate US Dollars 1,650,000 $ 0 x $ 0 x (990,000) $ 0 X 0 x 0 x 660,000 (429,000) $ 231,000 OX 0 x $ 0 X Income Statement: Sales Cost of goods sold Gross profit Operating expenses Net income Statement of Retained Earnings: BOY ret. earnings Net income Dividends EOY ret. earnings Balance Sheet: $ 0 x 866,250 231,000 Ox 0 X 0 x (23,100) $ 1,074,150 $ Ox Assets Cash $469,590 $ 0 x $ OX Balance Sheet: Assets Cash 0 x $ 0 x $469,590 $ 382,800 $ Accounts receivable 0 x 0 x OX OX 491,700 $ 909,480 $ $2,253,570 0 x Inventory Property, plant, and equipment (PPE), net Total assets Liabilities and stockholders' equity Current liabilities OX $ OX $279,840 0 x $ OX L-T liabilities 652,080 0 X 0 x Common stock 0 x OX 110,000 137,500 1,074,150 0 x OX APIC Ret. earnings OX X 0 x $2,253,570 $ OX Total liabilities and equity Statement of Cash Flows: 0 x $ OX 0 x OX 0 x 0 x 0 x 0 x O X Net income Change in accounts receivable Change in inventories Change in current liabilities Net cash from operating activities Change in PPE, net Net cash from investing activities Change in long-term debt Dividends Net cash from financing activities Net change in cash $231,000 (63,800) (81,950) 46,640 131,890 (84,480) (84,480) 108,680 (23,100) 85,580 0 x 0 x 0 x 0 X OX 0 x OX OX 132,990 0X 0 x 0 x 0 x Beginning cash Ending cash 336,600 $469,590 0 x $ OX b. Compute the ending Cumulative Translation Adjustment directly, assuming a BOY balance of $32,452. Round all answers to the nearest dollar. OX Direct computation of translation adjustment: x $ Net income x (EOY - Average exchange rate) X 0 x 0x OX X 0 EOY cumulative translation adjustment $ OX Subsidiary Translation Subsidiary (in CAD) Rate (in $) Income statement: Sales 1,650,000 (990,000) 660,000 (429,000) 231,000 $0.82 $1,353,000 $0.82 (811,800) 541,200 $0.82 (351,780) $189,420 Cost of goods sold Gross Profit Operating expenses Net income Statement of retained earnings: BOY retained earnings Net income Dividends Ending retained earnings Balance sheet: 866,250 231,000 (23,100) 1,074,150 $676,636 189,420 given above $0.84 (19,404) $846,652 computed Assets Cash $0.85 Accounts receivable $0.85 469,590 382,800 491,700 909,480 2,253,570 $0.85 $399,152 325,380 417,945 773,058 $1,915,535 $0.85 Inventory PPE, net Total Assets Liabilities and Stockholders' Equity Current Liabilities Long-term Liabilities Common Stock $0.85 $0.85 279,840 652,080 110,000 137,500 1,074,150 $237,864 554,268 75,900 $0.69 APIC $0.69 94,875 Retained Earnings Cumulative translation adjustment Total Liabilities & Equity above plug 846,652 105,976 $1,915,535 2,253,570 a. Subsidiary Translation Subsidiary (in CAD) Rate (in $) Statement of cash flows: $0.82 $0.82 $0.82 $0.82 Net income Change in Accounts Receivable Change in Inventories Change in Current Liabilities Net cash flows from operating activities Change in PPE, net Net cash flows from investing activities Change in long-term debt Dividends Net cash flows from financing activities Net change in cash Effect of exchange rate on cash Beginning cash Ending cash 231,000 (63,800) (81,950) 46,640 131,890 (84,480) (84,480) 108,680 (23,100) 85,580 132,990 $189,420 (52,316) (67,199) 38,245 $108,150 ($ 70,118) ($70,118) $90,204 $0.83 $0.83 $0.84 (19,404) $70,800 $108,332 24,406 265,914 $399,152 plug $0.79 336,600 469,590 $0.85 Computation of the Cumulative Translation Adjustment is as follows: BOY Net assets x EOY-BOY Exchange rates 1,113,750 $0.060 $66,825 0.85 -0.79 Net income x EOY-Avg. Exchange rates 231,000 $0.030 6,930 0.85 -0.82 Dividends x EOY-Div. Exchange rates (23,100) $0.010 (231) 0.85 -0.84 $73,524 BOY Cumulative Translation Adjustment 32,452 EOY Cumulative Translation Adjustment $105,976 An alternate approach yields the same answer: BOY Net assets @ BOY Exchange rate 1,113,750 $0.790 $879,863 Net income 231,000 $0.820 189,420 Dividends (23,100) $0.840 (19,404) $1,049,879 EOY Net assets @ EOY Exchange rate 1,321,650 $0.850 1,123,403 Translation Adjustment for the year $73,524 BOY Cumulative Translation Adjustment 32,452 b. EOY Cumulative Translation Adjustment $105,976Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started