This question is not "incomplete"; it is a direct screenshot, so if you say that it is incomplete I will give you a thumbs down 100%.

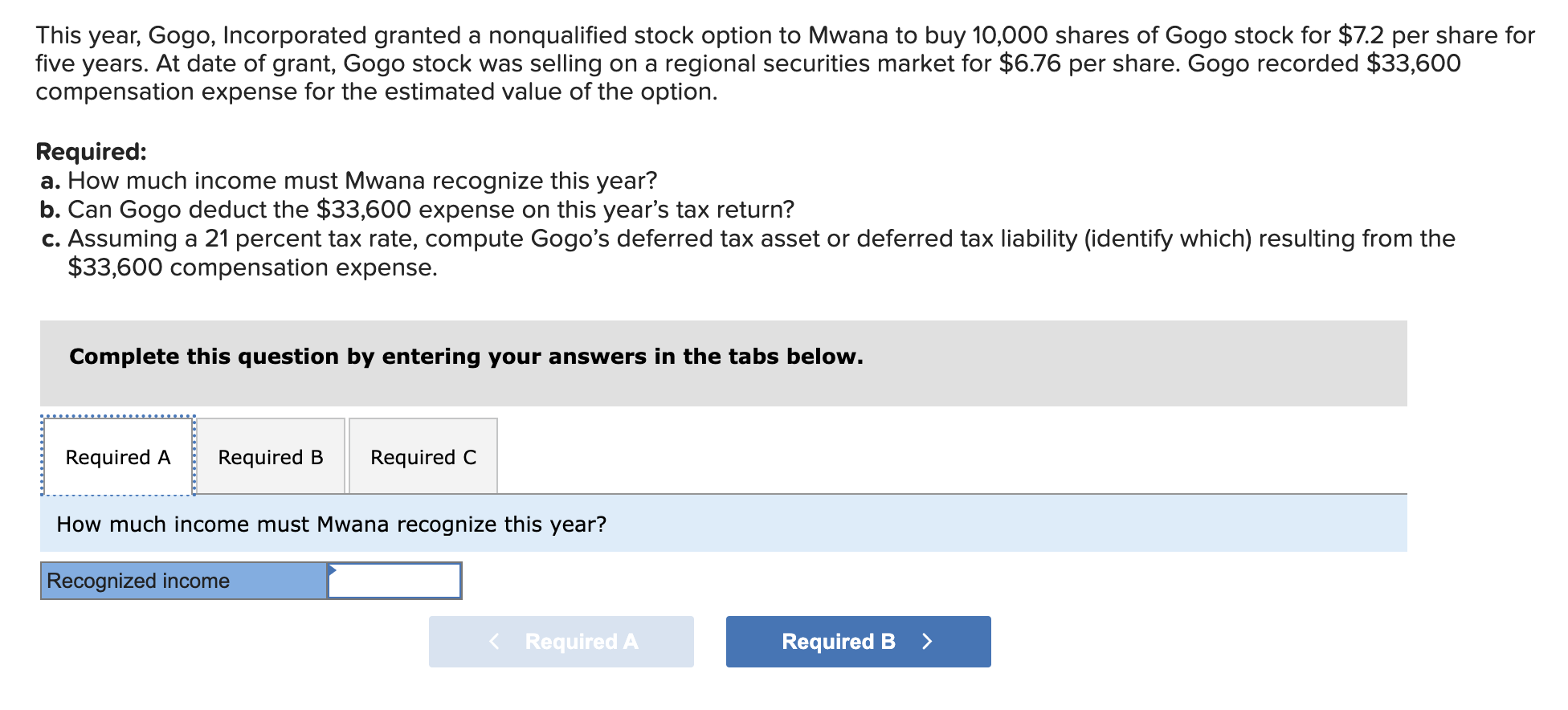

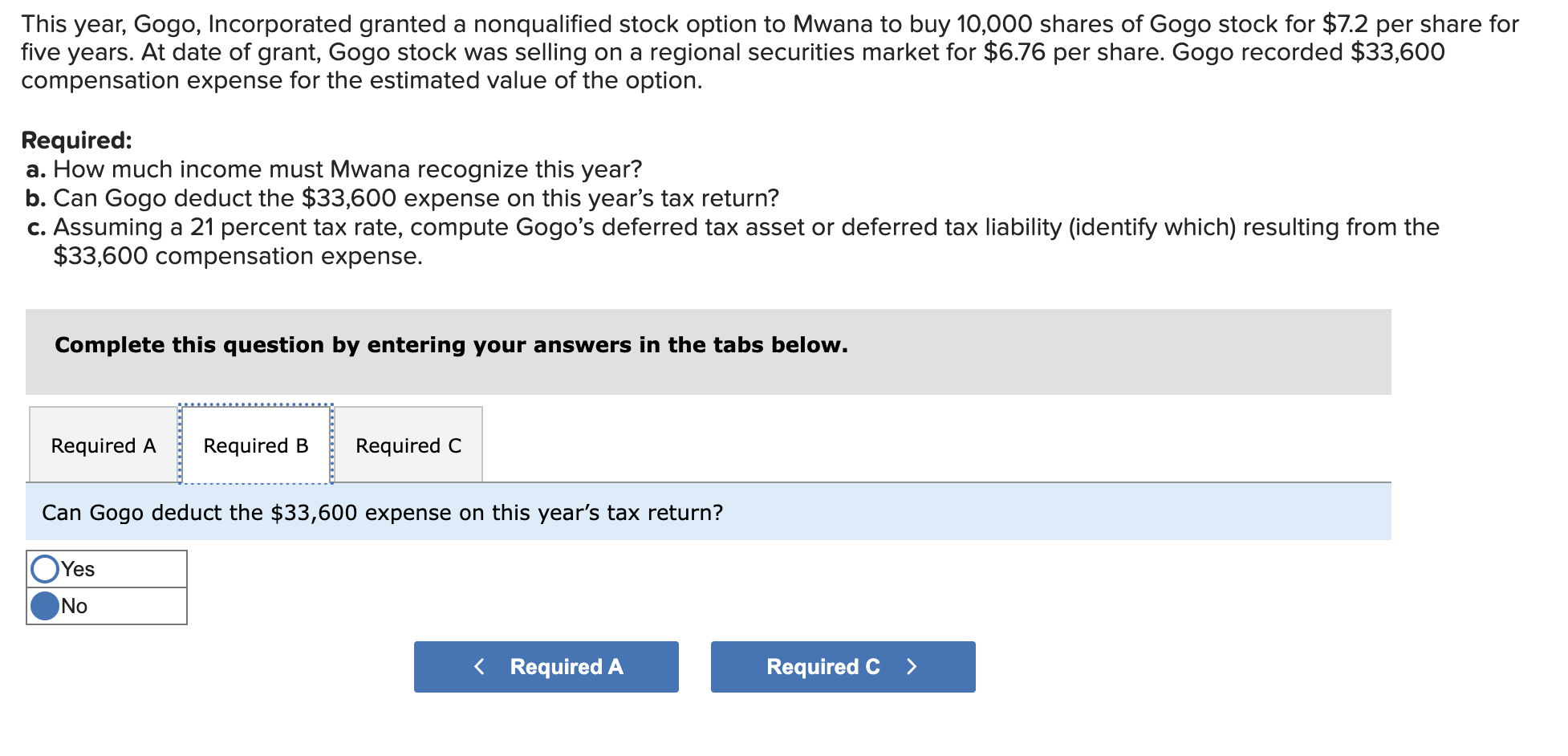

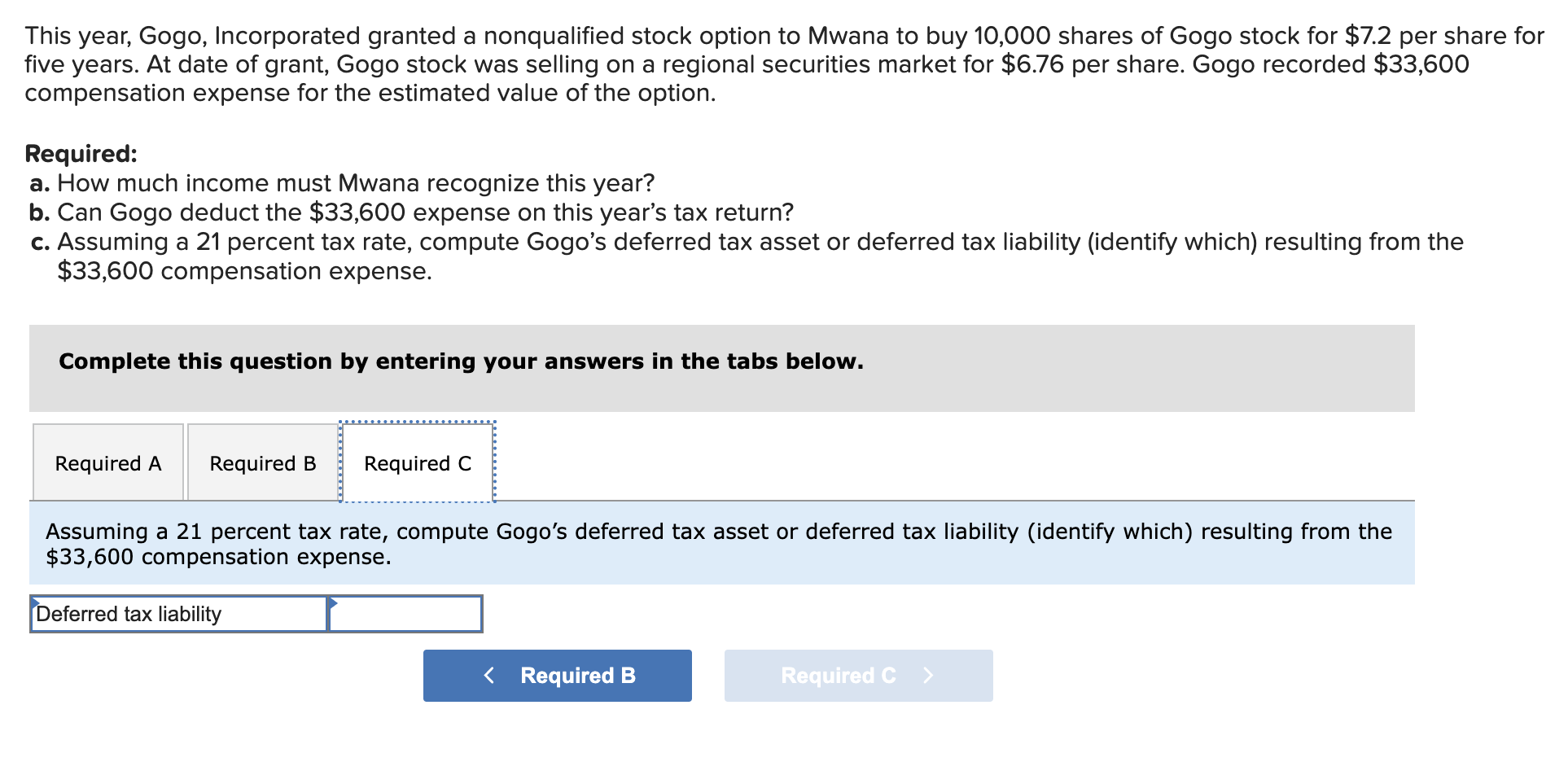

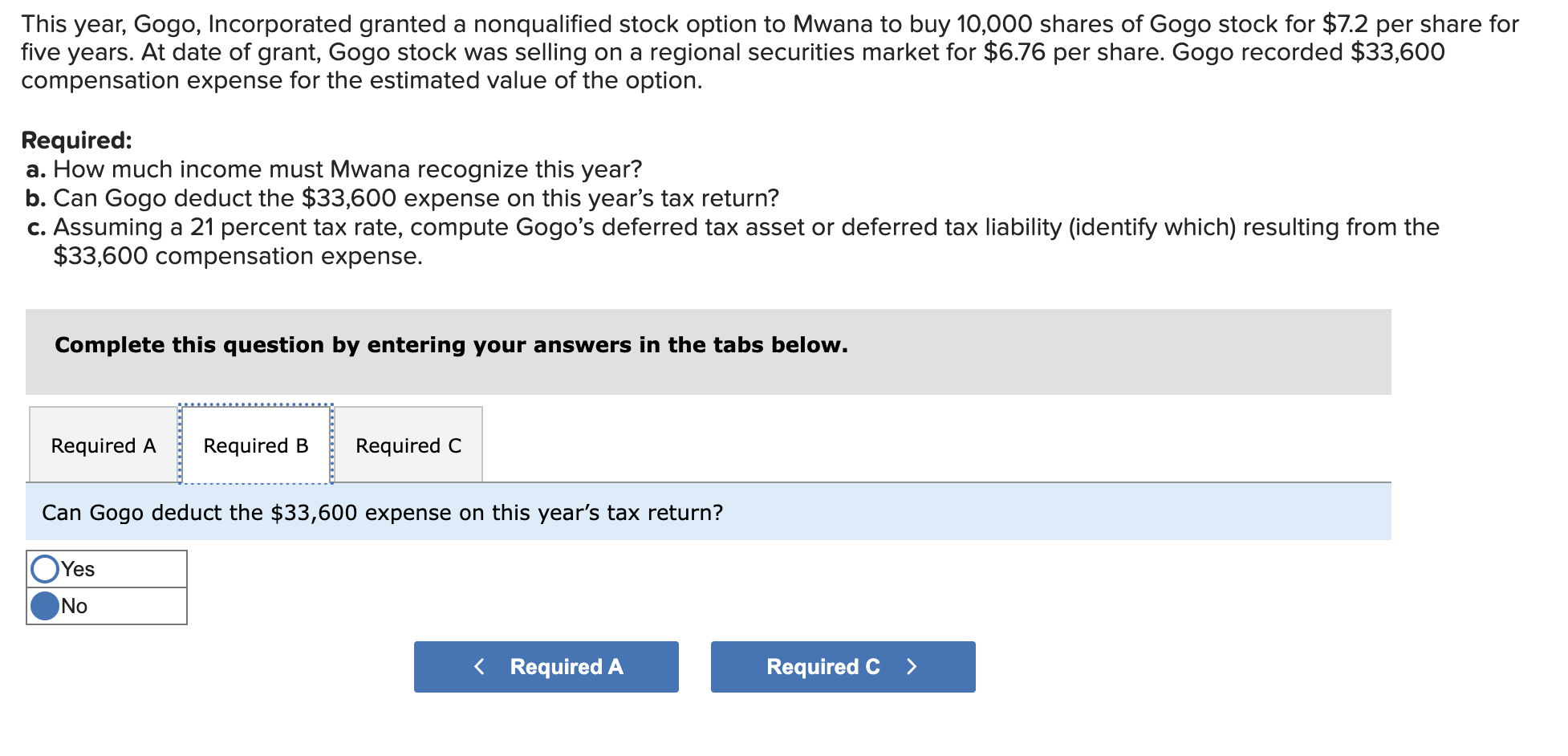

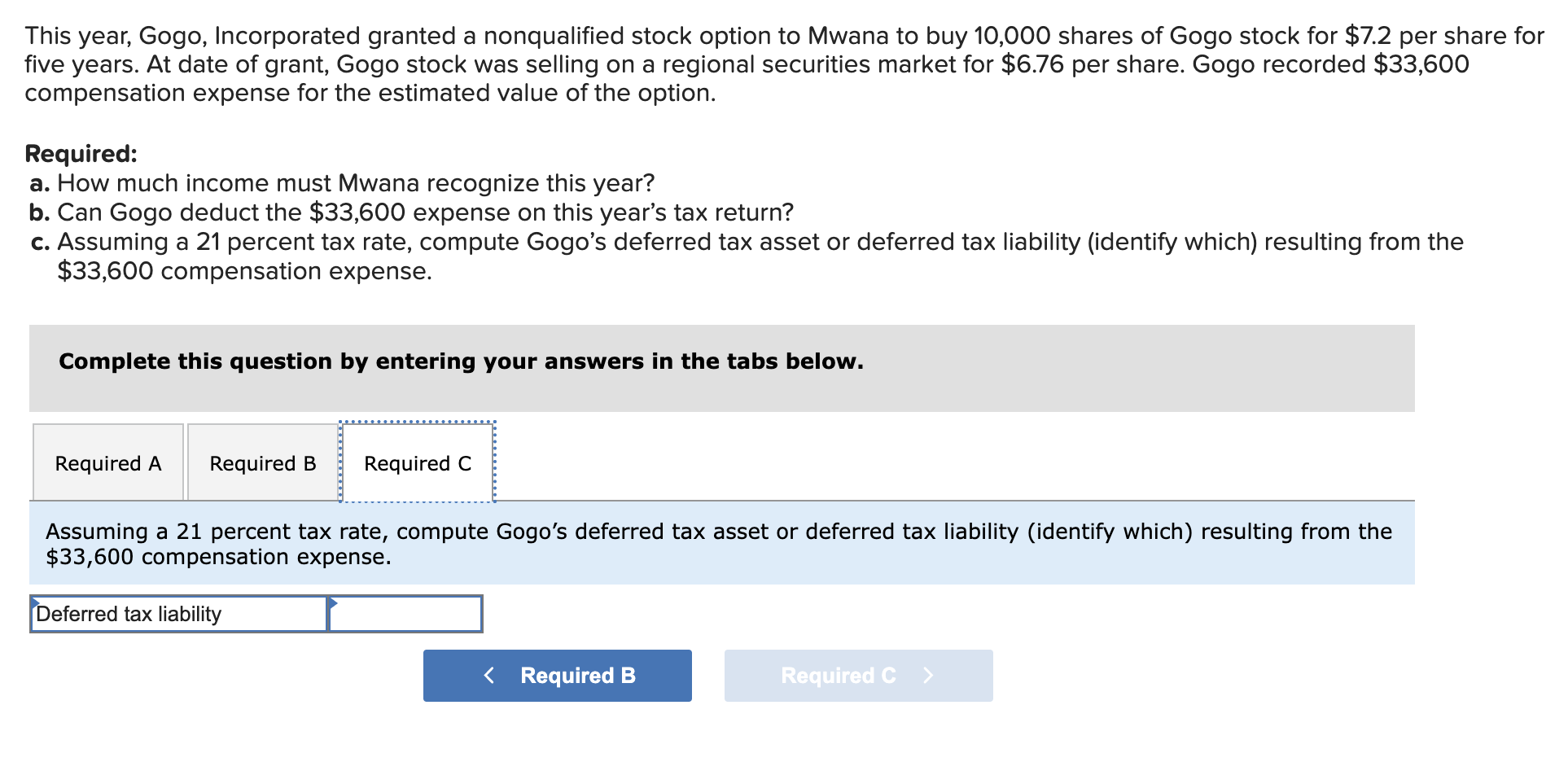

This year, Gogo, Incorporated granted a nonqualified stock option to Mwana to buy 10,000 shares of Gogo stock for $7.2 per share for five years. At date of grant, Gogo stock was selling on a regional securities market for $6.76 per share. Gogo recorded $33,600 compensation expense for the estimated value of the option. Required: a. How much income must Mwana recognize this year? b. Can Gogo deduct the $33,600 expense on this year's tax return? c. Assuming a 21 percent tax rate, compute Gogo's deferred tax asset or deferred tax liability (identify which) resulting from the $33,600 compensation expense. Complete this question by entering your answers in the tabs below. How much income must Mwana recognize this year? This year, Gogo, Incorporated granted a nonqualified stock option to Mwana to buy 10,000 shares of Gogo stock for $7.2 per share fo five years. At date of grant, Gogo stock was selling on a regional securities market for $6.76 per share. Gogo recorded $33,600 compensation expense for the estimated value of the option. Required: a. How much income must Mwana recognize this year? b. Can Gogo deduct the $33,600 expense on this year's tax return? c. Assuming a 21 percent tax rate, compute Gogo's deferred tax asset or deferred tax liability (identify which) resulting from the $33,600 compensation expense. Complete this question by entering your answers in the tabs below. Can Gogo deduct the $33,600 expense on this year's tax return? This year, Gogo, Incorporated granted a nonqualified stock option to Mwana to buy 10,000 shares of Gogo stock for $7.2 per share fo five years. At date of grant, Gogo stock was selling on a regional securities market for $6.76 per share. Gogo recorded $33,600 compensation expense for the estimated value of the option. Required: a. How much income must Mwana recognize this year? b. Can Gogo deduct the $33,600 expense on this year's tax return? c. Assuming a 21 percent tax rate, compute Gogo's deferred tax asset or deferred tax liability (identify which) resulting from the $33,600 compensation expense. Complete this question by entering your answers in the tabs below. Assuming a 21 percent tax rate, compute Gogo's deferred tax asset or deferred tax liability (identify which) resulting from the $33,600 compensation expense