Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is on Management Accounting. QUESTION I Collin Manufacturing Bhd manufactures QX12 in its Bot Cans Division as raw material in Can's product. Bottle

This question is on Management Accounting.

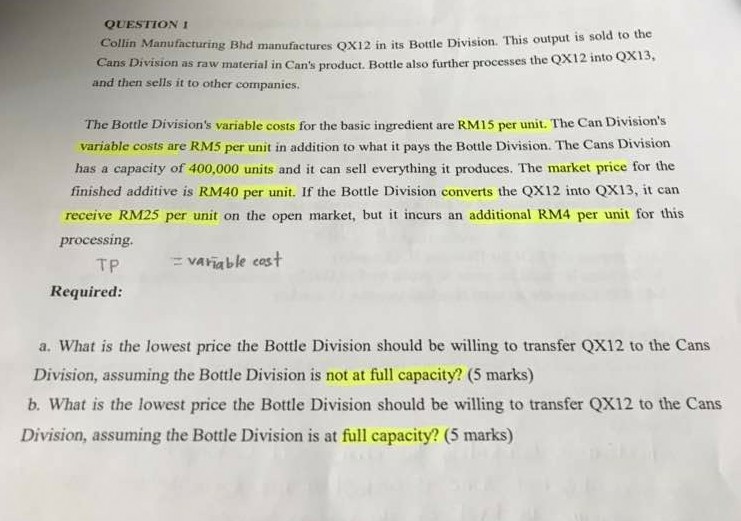

QUESTION I Collin Manufacturing Bhd manufactures QX12 in its Bot Cans Division as raw material in Can's product. Bottle also further processes tle Division. This output is sold to the and then sells it to other companics. The Bottle Division's variable costs for the basic ingredient are RM15 per unit. The Can Division's variable costs are RM5 per unit in addition to what it pays the Bottle Division. The Cans Division has a capacity of 400,000 units and it can sell everything it produces. The market price for the finished additive is RM40 per unit. If the Bottle Division converts the QX12 into QX13, it can receive RM25 per unit on the open market, but it incurs an additional RM4 per unit for this processing. TP Variable cest Required: a. What is the lowest price the Bottle Division should be willing to transfer QX12 to the Cans Division, assuming the Bottle Division is not at full capacity? (5 marks) b. What is the lowest price the Bottle Division should be willing to transfer QX12 to the Cans Division, assuming the Bottle Division is at full capacityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started