this question is partially finished. need help finishing it!! thank you to whoever can do it!!

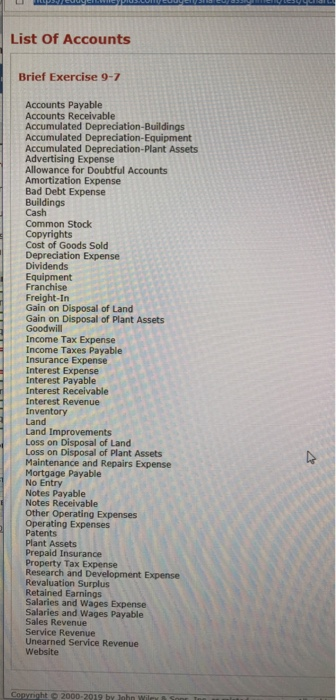

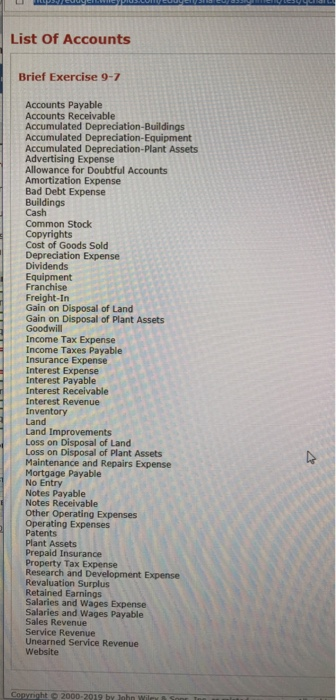

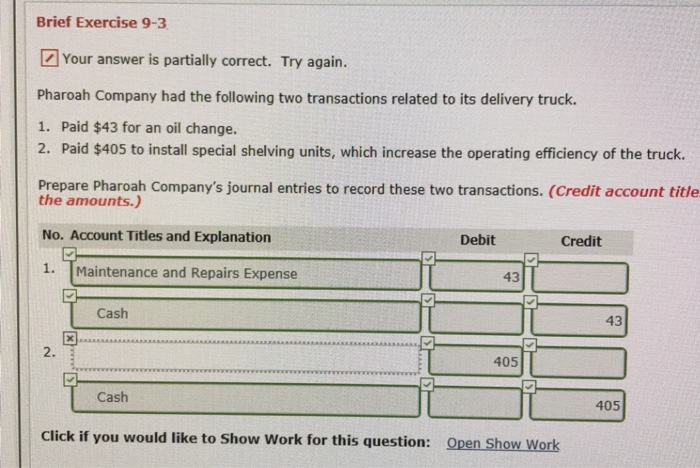

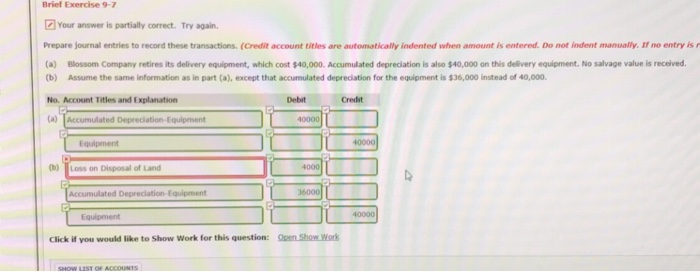

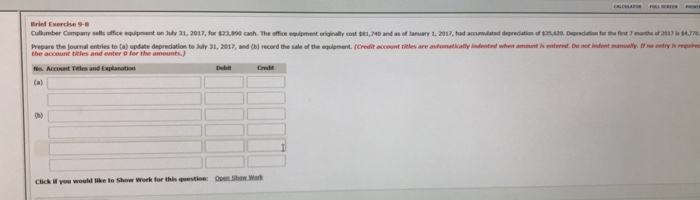

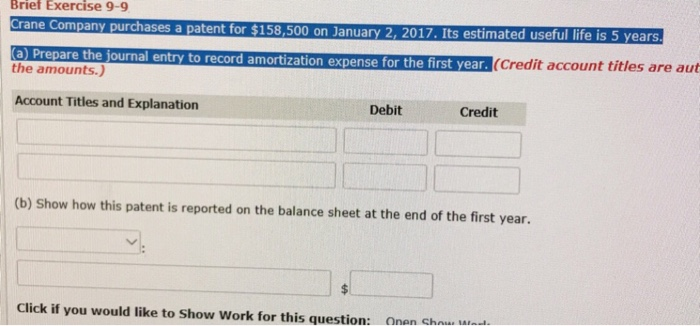

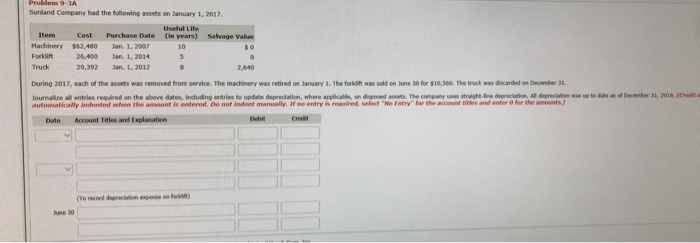

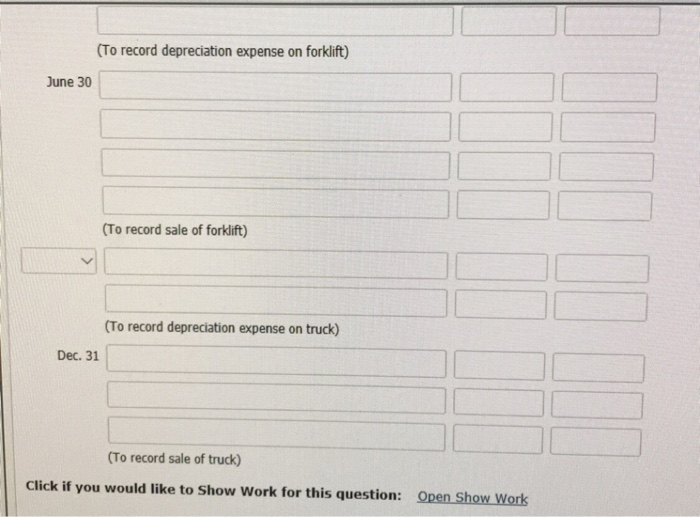

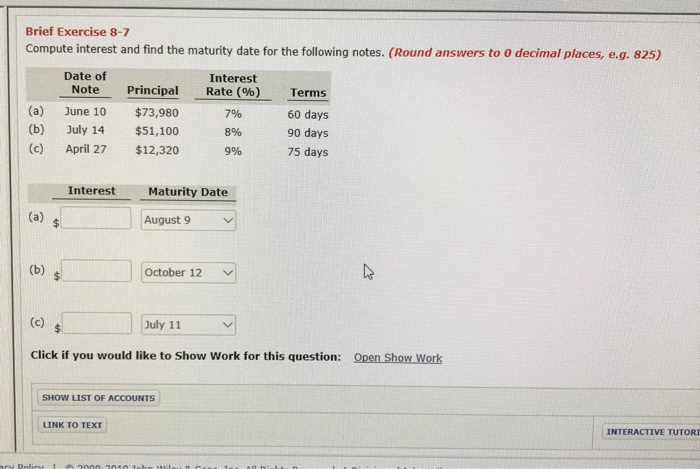

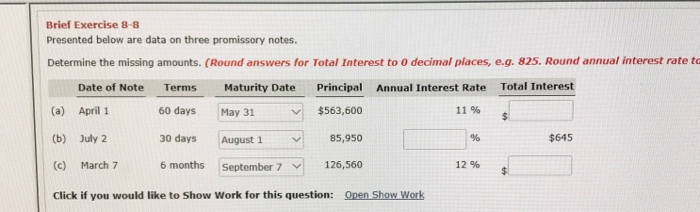

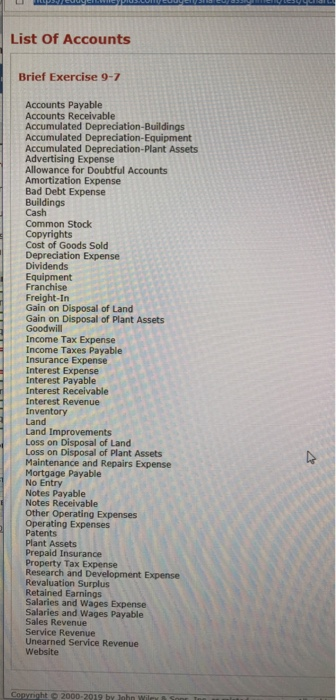

Brief Exercise 9-3 Your answer is partially correct. Try again. Pharoah Company had the following two transactions related to its delivery truck. 1. Paid $43 for an oil change. 2. Paid $405 to install special shelving units, which increase the operating efficiency of the truck. Prepare Pharoah Company's journal entries to record these two transactions. (Credit account title the amounts.) No. Account Titles and Explanation Debit Credit Maintenance and Repairs Expense 1. 43 Cash 43 2. 405 Cash 405 Click if you would lil to Show Work for this question: Open Show Work Brief Exercise 9-7 Your answer is partially correct. Try again. Prepare journal entries to record these transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is r Blossom Company retires its delivery equipment, which cost $40,000. Accumulated depreciation is also $40,000 on this delivery equipment. No salvage value is received. (a) (b) Assume the same information as in part (a), except that accumulated depreciation for the equipment is $36,000 instead of 40,000. No. Account Titles and Explanation Debit Credit (a) Accumulated Depreciation-Equipment 40000 40000 Equipment 4000 (b) Loss on Disposal of Land 36000 Accumulated Depreciation-Equipment 40000 Equipment Open Show Work Click if you would like to Show Work for this question: SHOW LIST OF ACCOUNTS CRLOABD rL SCREES Bried Exercise 9-8 Culumber Company sells office equipment on July 31, 2017, for $23,890 cash. The office equipment originally cost $81,40 and as of January 1, 2017, had accumulated depredation of $35,620. Depreciation for the first 7 months of 2017 s $4.770. Prepare the journal entries to (a) update depreciation to July 31, 2017, and (b) record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. Do net indent manually. If no entry is required the account tRles and enter o for the amounts.) Debit Credt No. Account Ttles and Explanation (a) Qpen Show Wark Click if you would like to Show Work for this question: Brief Exercise 9-9 Crane Company purchases a patent for $158,500 on January 2, 2017. Its estimated useful life is 5 years Prepare the journal entry to record amortization expense for the first year. (Credit account titles are aut the amounts.) Account Titles and Explanation Debit Credit (b) Show how this patent is reported on the balance sheet at the end of the first year. Click if you would like to Show Work for this question: Onen Shou W . Problem 9F3A Sunland Company had the following assets on January 1, 2017. Useful Life Item Cost Purchase Date (in years) Salvage Value Machinery s62.480 Jan. 1, 20071 10 Forklift 5 26,400 Jan. 1, 2014 Truck 29,392 Jan. 1, 2012 2,640 During 2017, each of the assets was removed from service. The machinery was retired on January 1. The forkdift was sold on June 30 for $10,560. The truck was discarded on December 31. Journalize all entries required on the above dates, induding entries to update depreciation, where applicable, on disposed assets. The company uses straight-ne depreciation. All depreciation was up to date as of December 31, 2016. (Credt a automatically indented when the amount is entered. Do not indent manually, If no entry is required, selet "No Entry" for the account titles and enter 0 for the amounts) Debit Credit Account Ttles and Explanation Date (Te record depreciaion expanse on fay June 30 (To record depreciation expense on forklift) June 30 (To record sale of forklift) (To record depreciation expense on truck) Dec. 31 (To record sale of truck) Click if you would like to Show Work for this question: Open Show Work Brief Exercise 8-7 Compute interest and find the maturity date for the following notes. (Round answers to 0 decimal places, e.g. 825) Date of Note Interest Principal Rate (%) Terms (a) June 10 $73,980 7% 60 days (b) July 14 $51,100 90 days 8% (c) April 27 $12,320 75 days 9% Interest Maturity Date (a) August 9 (b) October 12 $ (c) July 11 $ Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT INTERACTIVE TUTORE any Polier 100o 301O 1-k- s81 n c.- Brief Exercise 8-8 Presented below are data on three promissory notes. Determine the missing amounts. (Round answers for Total Interest to 0 decimal places, e.g. 825. Round annual interest rate to Maturity Date Principal Annual Int erest Rate Total Interest Date of Note Terms (a) April 1 60 days $563,600 11 % May 31 $ (b) July 2 30 days 85,950 % $645 August 1 (c) March 7 6 months 126,560 12 % September 7 $ Open Show Work Click if you would like to Show Work for this