Answered step by step

Verified Expert Solution

Question

1 Approved Answer

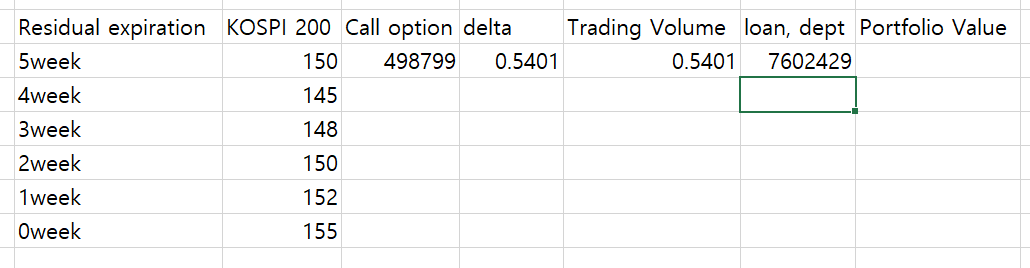

This question is related to Black-Scholes Model. Calculate to Excel. Fill in the following blanks in the KOSPI 200 index fund example for dynamic hedging

This question is related to Black-Scholes Model.

Calculate to Excel.

Fill in the following blanks in the KOSPI 200 index fund example for dynamic hedging and calculate the portfolio value of the delta hedge maturity.

Here, suppose that volatility is 30% and risk-free interest rate is 6%, and the event index is 150, and that the first unit of the fund is traded at KOSPI200*100,000\ (\ is a monetary unit in South Korea). Write a detailed description of each calculation and the calculation process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started