Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is related to Foreign exchange and international finance. Thanks, and definite thumbs up for answers! 2 pt Question 26 Questions 23-36 are based

This question is related to Foreign exchange and international finance. Thanks, and definite thumbs up for answers!

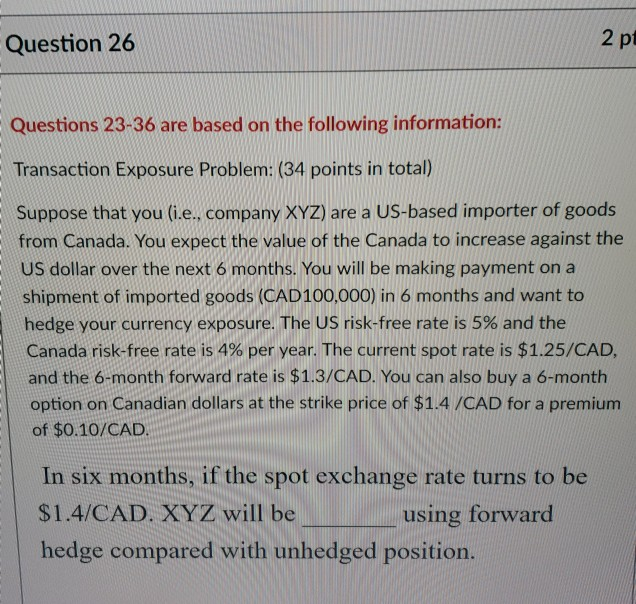

2 pt Question 26 Questions 23-36 are based on the following information: Transaction Exposure Problem: (34 points in total) Suppose that you (i.e. company XYZ) are a US-based importer of goods from Canada. You expect the value of the Canada to increase against the US dollar over the next 6 months. You will be making payment on a shipment of imported goods (CAD100,000) in 6 months and want to hedge your currency exposure. The US risk-free rate is 5% and the Canada risk-free rate is 4% per year. The current spot rate is $1.25/CAD, and the 6-month forward rate is $1.3/CAD. You can also buy a 6-month option on Canadian dollars at the strike price of $1.4 /CAD for a premium of $0.10/CAD. In six months, if the spot exchange rate turns to be $1.4/CAD. XYZ will be hedge compared with unhedged position. using forward of $0.10/CAD In six months, if the spot exchange rate turns to be $1.4/CAD. XYZ will be hedge compared with unhedged position. using forward O better-off O worse-off O indifferent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started