Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is related to Foreign exchange and international finance. it will be best to use excel functions to get answer. Thanks, and definite thumbs

This question is related to Foreign exchange and international finance. it will be best to use excel functions to get answer. Thanks, and definite thumbs up for answers

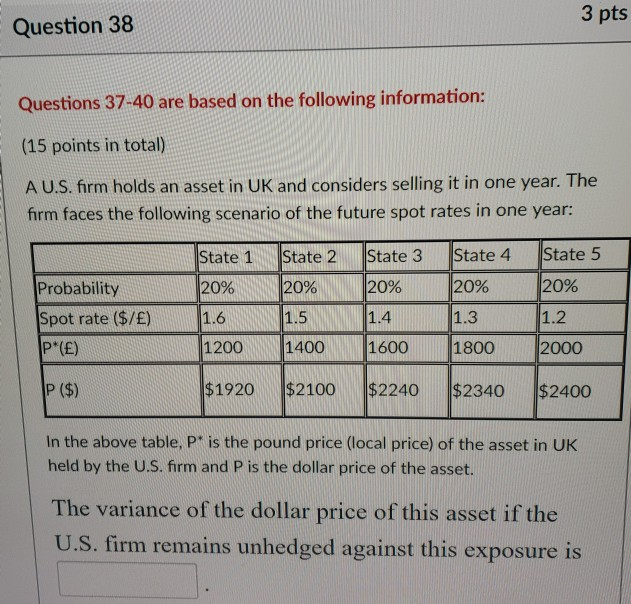

3 pts Question 38 Questions 37-40 are based on the following information: (15 points in total) A U.S. frm holds an asset in UK and considers selling it in one year. The firm faces the following scenario of the future spot rates in one year: State 1 State 2 State 3 State 4 State 5 20% .6 1200 20% 1.2 2000 Probability Spot rate (S/E) P*(E) 2090 1.3 1800 20% 1.5 1400 20% 1.4 1600 $1920 $2100 $2240$2340 $2400 In the above table, Pt is the pound price (local price) of the asset in UK held by the U.S. firm and P is the dollar price of the asset. The variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started