Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is tricky. Please help me re-work through question 1 a-d using a 5-year CD. If all is correct I will make sure to

This question is tricky. Please help me re-work through question 1 a-d using a 5-year CD. If all is correct I will make sure to thumbs up. Thank you!

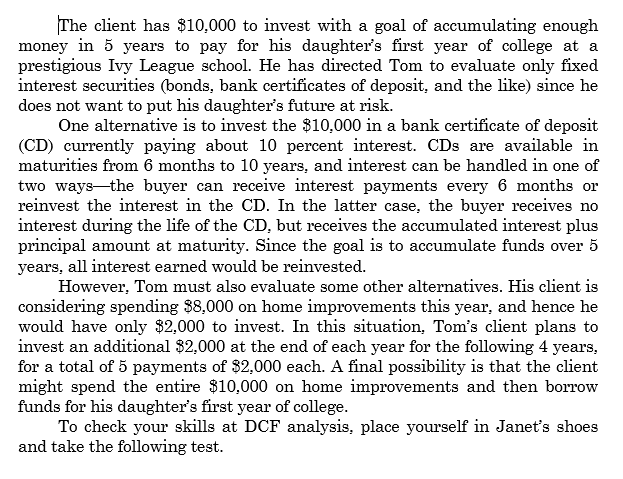

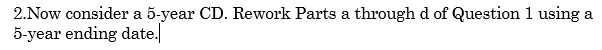

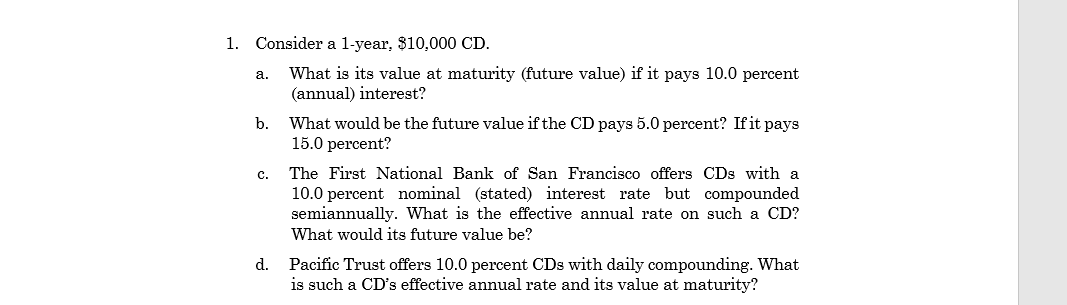

The client has $10,000 to invest with a goal of accumulating enough money in 5 years to pay for his daughter's first year of college at a prestigious Ivy League school. He has directed Tom to evaluate only fixed interest securities (bonds, bank certificates of deposit, and the like) since he does not want to put his daughter's future at risk. One alternative is to invest the $10,000 in a bank certificate of deposit (CD) currently paying about 10 percent interest. CDs are available in maturities from 6 months to 10 years, and interest can be handled in one of two waysthe buyer can receive interest payments every 6 months or reinvest the interest in the CD. In the latter case, the buyer receives no interest during the life of the CD, but receives the accumulated interest plus principal amount at maturity. Since the goal is to accumulate funds over 5 years, all interest earned would be reinvested. However, Tom must also evaluate some other alternatives. His client is considering spending $8,000 on home improvements this year, and hence he would have only $2,000 to invest. In this situation, Tom's client plans to invest an additional $2.000 at the end of each year for the following 4 years, for a total of 5 payments of $2,000 each. A final possibility is that the client might spend the entire $10,000 on home improvements and then borrow funds for his daughter's first year of college. To check your skills at DCF analysis, place yourself in Janet's shoes and take the following test. 2.Now consider a 5-year CD. Rework Parts a through d of Question 1 using a 5-year ending date. 1. Consider a 1-year, $10,000 CD. a. What is its value at maturity (future value) if it pays 10.0 percent (annual) interest? b. What would be the future value if the CD pays 5.0 percent? If it pays 15.0 percent? The First National Bank of San Francisco offers CDs with a 10.0 percent nominal (stated) interest rate but compounded semiannually. What is the effective annual rate on such a CD? What would its future value be? d. Pacific Trust offers 10.0 percent CDs with daily compounding. What is such a CD's effective annual rate and its value at maturityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started