Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this question pls Question 2 May Ltd acquired 100 per cent of the shares of June Ltd for $50 000. At that date the equity

this question pls

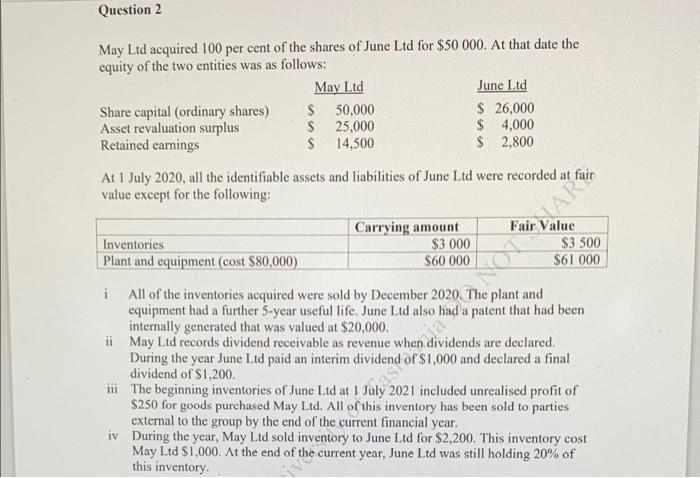

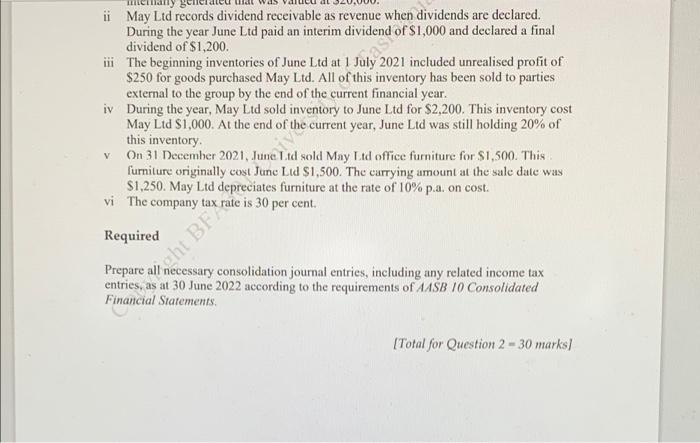

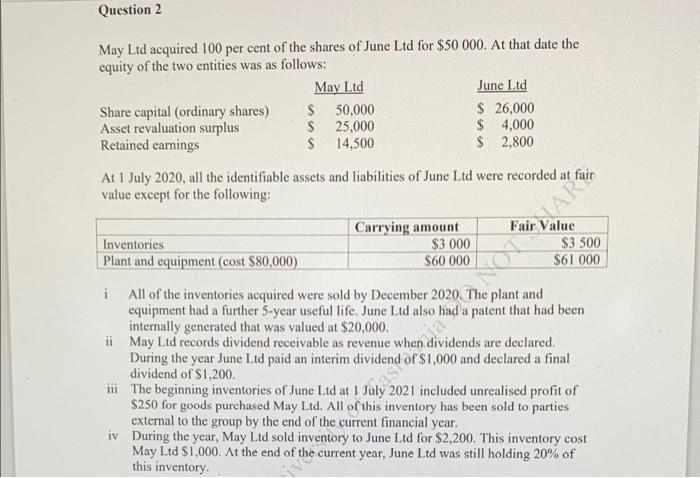

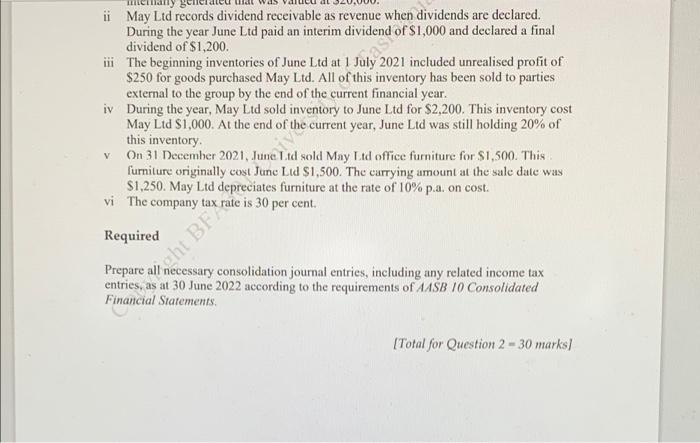

Question 2 May Ltd acquired 100 per cent of the shares of June Ltd for $50 000. At that date the equity of the two entities was as follows: May Ltd June Ltd Share capital (ordinary shares) $ 50,000 $ 26,000 Asset revaluation surplus $ 25,000 $ 4,000 Retained earnings $ 14,500 $ 2,800 At 1 July 2020, all the identifiable assets and liabilities of June Ltd were recorded at value except for the following: Carrying amount Inventories $3 000 $3 500 Plant and equipment (cost $80,000) $60 000 $61 000 i All of the inventories acquired were sold by December 2020. The plant and equipment had a further 5-year useful life. June Ltd also da patent that had been internally generated that was valued at $20,000. ii May Ltd records dividend receivable as revenue when dividends are declared. During the year June Lid paid an interim dividend of $1.000 and declared a final dividend of $1,200. 2021 included unrealised profit of $250 for goods purchased May Ltd. All of this inventory has been sold to parties external to the group by the end of the current financial year. iv During the year, May sold inventory to June Ltd for $2,200. This inventory cost May Ltd $1,000. At the end of the current year, June Ltd was still holding 20% of this inventory in emories or bune Lied at i vly 202 as ii May Ltd records dividend receivable as revenue when dividends are declared. During the year June Ltd paid an interim dividend of $1,000 and declared a final dividend of $1,200. i The beginning inventories of June Ltd at 1 July 2021 included unrealised profit of $250 for goods purchased May Ltd. All of this inventory has been sold to parties external to the group by the end of the current financial year. iv During the year, May Ltd sold inventory to June Ltd for $2,200. This inventory cost May Ltd $1,000. At the end of the current year, June Ltd was still holding 20% of this inventory v On 31 December 2021, June Ltd sold May Ltd office furniture for $1,500. This furniture originally cost Juno Lid $1,500. The currying amount at the sale date was $1,250. May Ltd depreciates furniture at the rate of 10% pa, on cost. vi The company tax Required Eht B18 30 per cent. Prepare all necessary consolidation journal entries, including any related income tax entries, as at 30 June 2022 according to the requirements of AASB 10 Consolidated Financial Statements [Total for Question 2 - 30 marks/ Question 2 May Ltd acquired 100 per cent of the shares of June Ltd for $50 000. At that date the equity of the two entities was as follows: May Ltd June Ltd Share capital (ordinary shares) $ 50,000 $ 26,000 Asset revaluation surplus $ 25,000 $ 4,000 Retained earnings $ 14,500 $ 2,800 At 1 July 2020, all the identifiable assets and liabilities of June Ltd were recorded at value except for the following: Carrying amount Inventories $3 000 $3 500 Plant and equipment (cost $80,000) $60 000 $61 000 i All of the inventories acquired were sold by December 2020. The plant and equipment had a further 5-year useful life. June Ltd also da patent that had been internally generated that was valued at $20,000. ii May Ltd records dividend receivable as revenue when dividends are declared. During the year June Lid paid an interim dividend of $1.000 and declared a final dividend of $1,200. 2021 included unrealised profit of $250 for goods purchased May Ltd. All of this inventory has been sold to parties external to the group by the end of the current financial year. iv During the year, May sold inventory to June Ltd for $2,200. This inventory cost May Ltd $1,000. At the end of the current year, June Ltd was still holding 20% of this inventory in emories or bune Lied at i vly 202 as ii May Ltd records dividend receivable as revenue when dividends are declared. During the year June Ltd paid an interim dividend of $1,000 and declared a final dividend of $1,200. i The beginning inventories of June Ltd at 1 July 2021 included unrealised profit of $250 for goods purchased May Ltd. All of this inventory has been sold to parties external to the group by the end of the current financial year. iv During the year, May Ltd sold inventory to June Ltd for $2,200. This inventory cost May Ltd $1,000. At the end of the current year, June Ltd was still holding 20% of this inventory v On 31 December 2021, June Ltd sold May Ltd office furniture for $1,500. This furniture originally cost Juno Lid $1,500. The currying amount at the sale date was $1,250. May Ltd depreciates furniture at the rate of 10% pa, on cost. vi The company tax Required Eht B18 30 per cent. Prepare all necessary consolidation journal entries, including any related income tax entries, as at 30 June 2022 according to the requirements of AASB 10 Consolidated Financial Statements [Total for Question 2 - 30 marks/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started