Question

This question provides a chance to understand the response of the economy to an government policy under IS-LM framework. Assume (1 + 1 ) 1

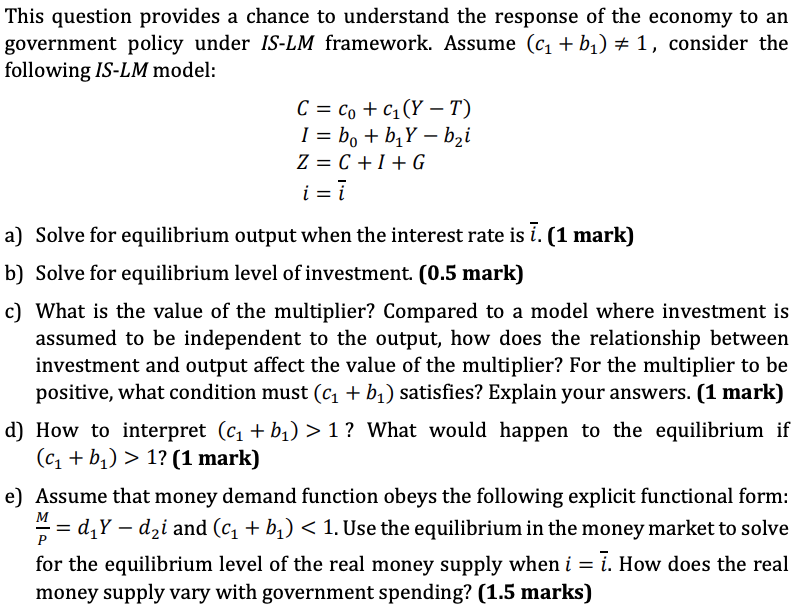

This question provides a chance to understand the response of the economy to an government policy under IS-LM framework. Assume (1 + 1 ) 1 , consider the following IS-LM model: = 0 + 1 ( ) = 0 + 1 2 = + + = a) Solve for equilibrium output when the interest rate is . (1 mark) b) Solve for equilibrium level of investment. (0.5 mark) c) What is the value of the multiplier? Compared to a model where investment is assumed to be independent to the output, how does the relationship between investment and output affect the value of the multiplier? For the multiplier to be positive, what condition must (1 + 1) satisfies? Explain your answers. (1 mark) d) How to interpret (1 + 1 ) > 1 ? What would happen to the equilibrium if (1 + 1 ) > 1? (1 mark) e) Assume that money demand function obeys the following explicit functional form: = 1 2 and (1 + 1 ) This question provides a chance to understand the response of the economy to an government policy under IS-LM framework. Assume (c1 + b ) #1, consider the following IS-LM model: C = Co + ci(Y T) I = bo + b2Y bzi Z=+I+G i= a) Solve for equilibrium output when the interest rate is i. (1 mark) b) Solve for equilibrium level of investment. (0.5 mark) c) What is the value of the multiplier? Compared to a model where investment is assumed to be independent to the output, how does the relationship between investment and output affect the value of the multiplier? For the multiplier to be positive, what condition must (c1 + b) satisfies? Explain your answers. (1 mark) d) How to interpret (C1 + b1) >1? What would happen to the equilibrium if (C1 + b ) > 1? (1 mark) e) Assume that money demand function obeys the following explicit functional form: -= d.Y dzi and (C1 + b) 1? What would happen to the equilibrium if (C1 + b ) > 1? (1 mark) e) Assume that money demand function obeys the following explicit functional form: -= d.Y dzi and (C1 + b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started