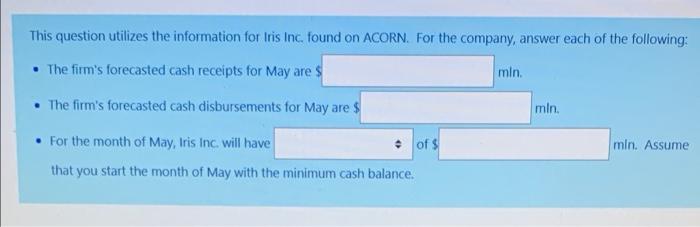

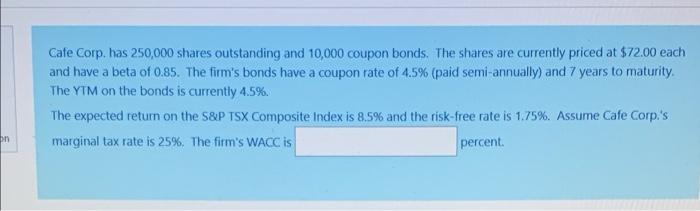

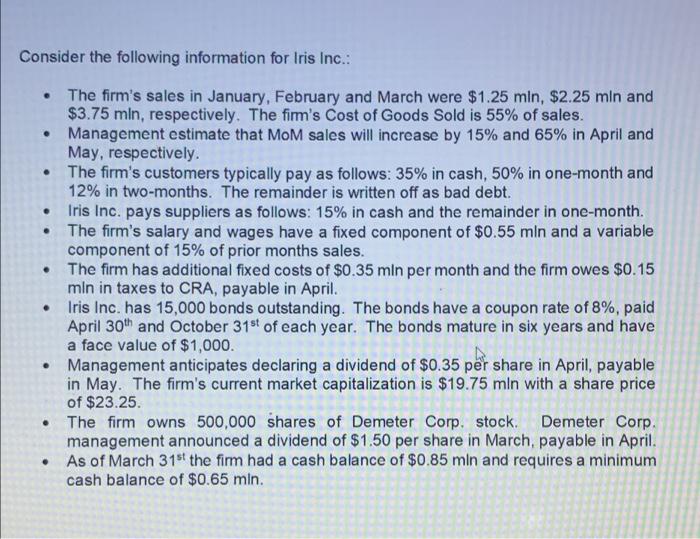

This question utilizes the information for Iris Inc. found on ACORN. For the company, answer each of the following: . The firm's forecasted cash receipts for May are $ min The firm's forecasted cash disbursements for May are $ min. min. Assume . For the month of May, Iris Inc will have of $ that you start the month of May with the minimum cash balance. Cafe Corp. has 250,000 shares outstanding and 10,000 coupon bonds. The shares are currently priced at $72.00 each and have a beta of 0.85. The firm's bonds have a coupon rate of 4.5% (paid semi-annually) and 7 years to maturity. The YTM on the bonds is currently 4.5%. The expected return on the S&P TSX Composite Index is 8.5% and the risk-free rate is 1.75%. Assume Cafe Corp.'s marginal tax rate is 25%. The firm's WACC is percent on Consider the following information for Iris Inc.: . . The firm's sales in January, February and March were $1.25 min, $2.25 min and $3.75 mln, respectively. The firm's Cost of Goods Sold is 55% of sales. Management estimate that Mom sales will increase by 15% and 65% in April and May, respectively. The firm's customers typically pay as follows: 35% in cash, 50% in one-month and 12% in two-months. The remainder is written off as bad debt. Iris Inc. pays suppliers as follows: 15% in cash and the remainder in one-month. The firm's salary and wages have a fixed component of $0.55 min and a variable component of 15% of prior months sales. The firm has additional fixed costs of $0.35 mln per month and the firm owes $0.15 min in taxes to CRA, payable in April. Iris Inc. has 15,000 bonds outstanding. The bonds have a coupon rate of 8%, paid April 30th and October 31st of each year. The bonds mature in six years and have a face value of $1,000. Management anticipates declaring a dividend of $0.35 per share in April, payable in May. The firm's current market capitalization is $19.75 mln with a share price of $23.25. The firm owns 500,000 shares of Demeter Corp. stock. Demeter Corp. management announced a dividend of $1.50 per share in March, payable in April. As of March 31st the firm had a cash balance of $0.85 mln and requires a minimum cash balance of $0.65 mln