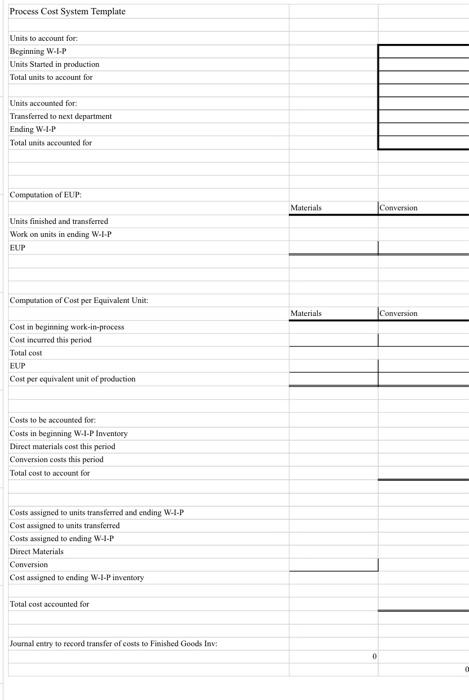

This requires you to prepare a cost of production report. There is a template below that you can use in completing these problems.

The GreenEarth Aluminum Company uses a process cost accounting system to record the costs of manufacturing rolled aluminum. The manufacturing process consists of three processes. The beginning balance of the goods-in-process inventory of one of the processes (the rolling department) on September 1, 2021 and debits to the account for September are summarized below: Beginning balance-5,100 units, 1/3 completed for conversion: Direct materials (5,100 x 38.70) s 197,370 Conversion costs (5,100 x 1/3 x 11.72) 19.924 Total beginning balance 217,294 Additional debits during the month: Costs from Smelting Department (162,000 units) 6,240,000 Direct Labor 765,800 Factory Overhead 1,144,000 During the month of September, the 5,100 units in process at the beginning of the month were completed, and of the 162,000 units entering the department from Smelting, all were completed except 5,400 units that were 4/5 completed for conversion (hint -remember the materials are the items transferred from the Smelting Department). REQUIRED: Using Excel, prepare a Cost of Production Report, and answer the following: 1. Determine the number of units transferred to the next department during September. 2. Compute the EUP for materials and for conversion costs for September 3. Calculate the unit costs for materials and conversion for September 4. Determine the amount of costs to be assigned to the units transferred to the next department from the rolling department 5. Determine the dollar amount of ending W-I-P inventory as of the end of September. Process Cost System Template Units to account for Beginning W-I-P Units Started in production Total units to account for Units accounted for Transferred to next department Ending WIP Total units accounted for Computation of EUP Materials Conversion Units finished and transferred Work on units in ending W-I-P EUP Computation of Cost per Equivalent Unit: Materials Conversion Costin beginning work-in-process Cost incurred this period Total cost EUP Cost per equivalent unit of production Costs to be accounted for Costs in beginning W.I-P Inventory Direct materials cost this period Conversion costs this period Total cost to account for Costs assigned to units transferred and ending WHI-P Cost assigned to units transferred Costs assigned to ending W-I-P Direct Materials Conversion Cost assigned to ending W-IP inventory Total cost accounted for entry to ord transfer of costs to Finished Goods Inv 0