Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This scenario relates to four requirements. You are a trainee Chartered Certified Accountant assisting your manager with the tax affairs of three unrelated limited companies,

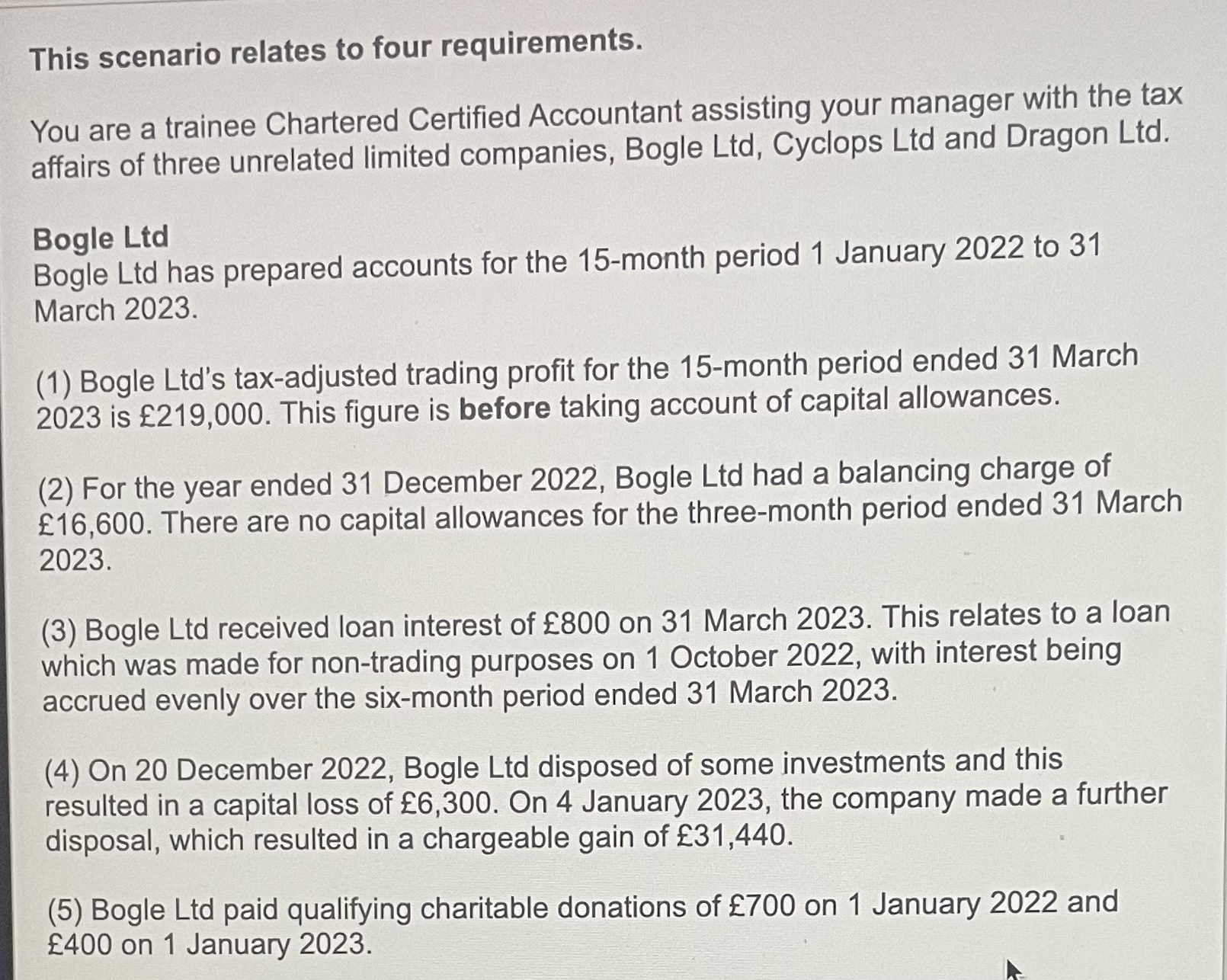

This scenario relates to four requirements. You are a trainee Chartered Certified Accountant assisting your manager with the tax affairs of three unrelated limited companies, Bogle Ltd, Cyclops Ltd and Dragon Ltd. Bogle Ltd Bogle Ltd has prepared accounts for the 15-month period 1 January 2022 to 31 March 2023. (1) Bogle Ltd's tax-adjusted trading profit for the 15-month period ended 31 March 2023 is 219,000. This figure is before taking account of capital allowances. (2) For the year ended 31 December 2022, Bogle Ltd had a balancing charge of 16,600. There are no capital allowances for the three-month period ended 31 March 2023. (3) Bogle Ltd received loan interest of 800 on 31 March 2023. This relates to a loan which was made for non-trading purposes on 1 October 2022, with interest being accrued evenly over the six-month period ended 31 March 2023. (4) On 20 December 2022, Bogle Ltd disposed of some investments and this resulted in a capital loss of 6,300. On 4 January 2023 , the company made a further disposal, which resulted in a chargeable gain of 31,440. (5) Bogle Ltd paid qualifying charitable donations of 700 on 1 January 2022 and 400 on 1 January 2023. (a) Calculate Bogle Ltd's taxable total profits for the year ended 31 December 2022 and for the three-month period ended 31 March 2023

This scenario relates to four requirements. You are a trainee Chartered Certified Accountant assisting your manager with the tax affairs of three unrelated limited companies, Bogle Ltd, Cyclops Ltd and Dragon Ltd. Bogle Ltd Bogle Ltd has prepared accounts for the 15-month period 1 January 2022 to 31 March 2023. (1) Bogle Ltd's tax-adjusted trading profit for the 15-month period ended 31 March 2023 is 219,000. This figure is before taking account of capital allowances. (2) For the year ended 31 December 2022, Bogle Ltd had a balancing charge of 16,600. There are no capital allowances for the three-month period ended 31 March 2023. (3) Bogle Ltd received loan interest of 800 on 31 March 2023. This relates to a loan which was made for non-trading purposes on 1 October 2022, with interest being accrued evenly over the six-month period ended 31 March 2023. (4) On 20 December 2022, Bogle Ltd disposed of some investments and this resulted in a capital loss of 6,300. On 4 January 2023 , the company made a further disposal, which resulted in a chargeable gain of 31,440. (5) Bogle Ltd paid qualifying charitable donations of 700 on 1 January 2022 and 400 on 1 January 2023. (a) Calculate Bogle Ltd's taxable total profits for the year ended 31 December 2022 and for the three-month period ended 31 March 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started