Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This scenario relates to two requirements. You should assume that today's date is 25 March 2022. Bertie is the managing director of, and 100% shareholder

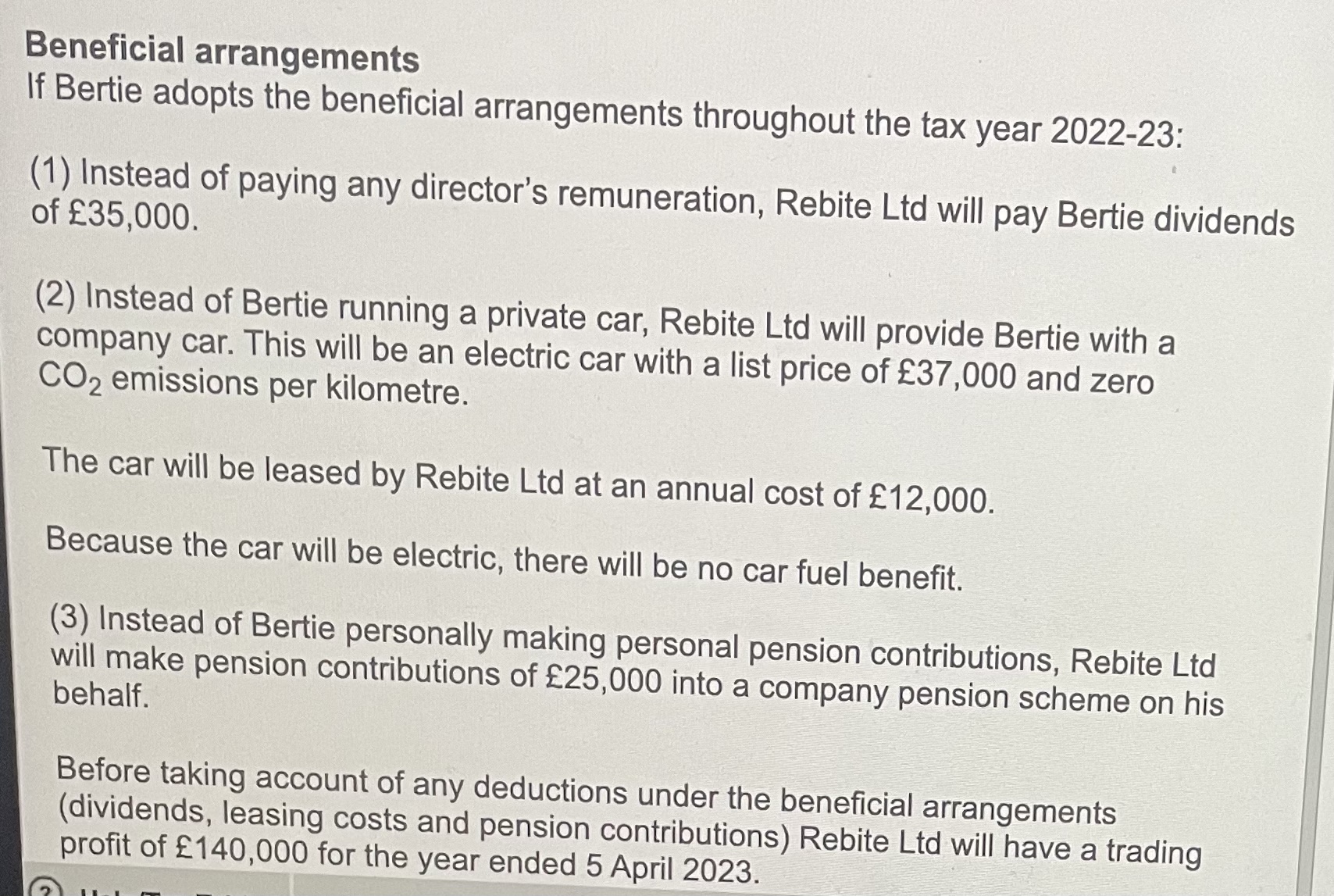

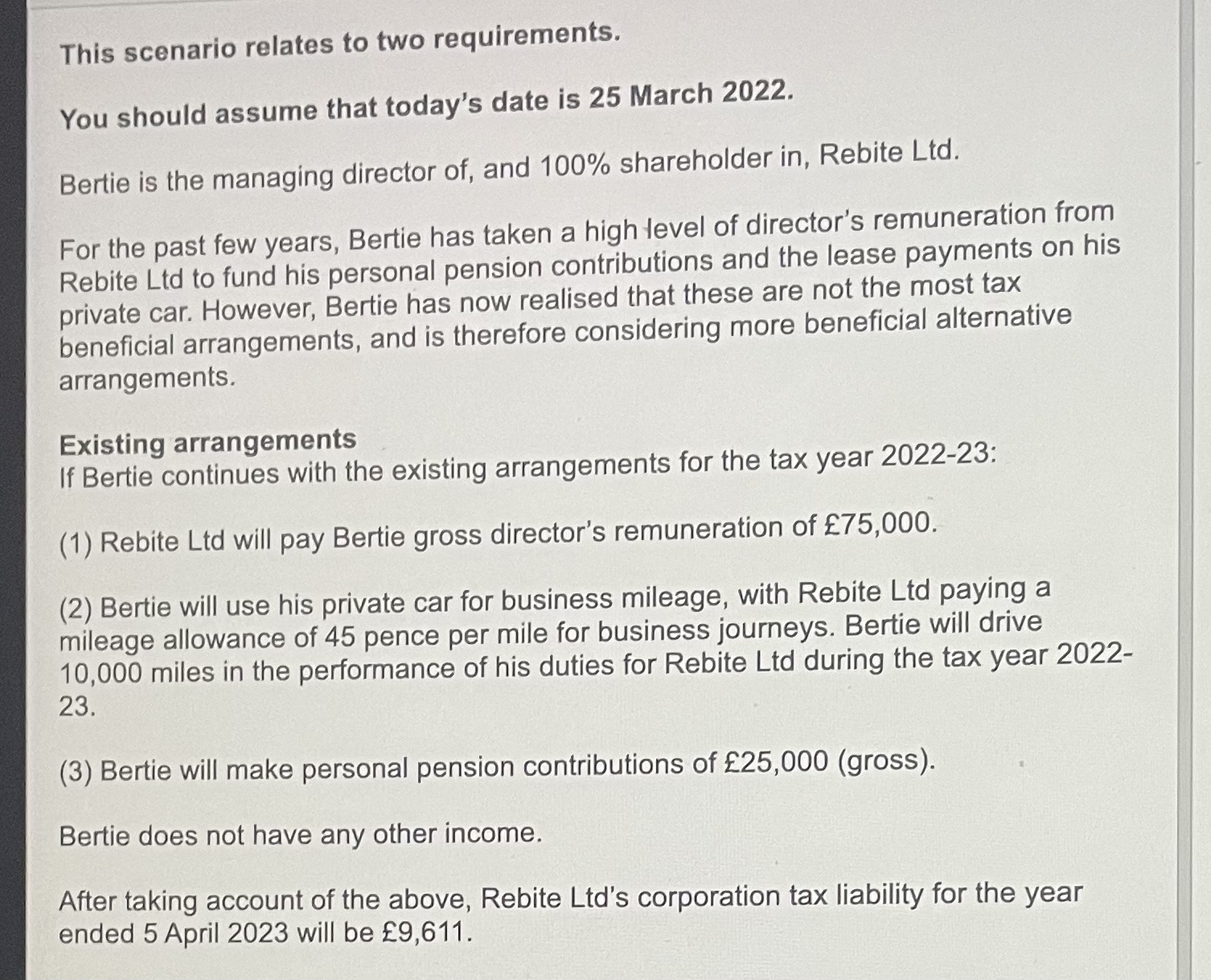

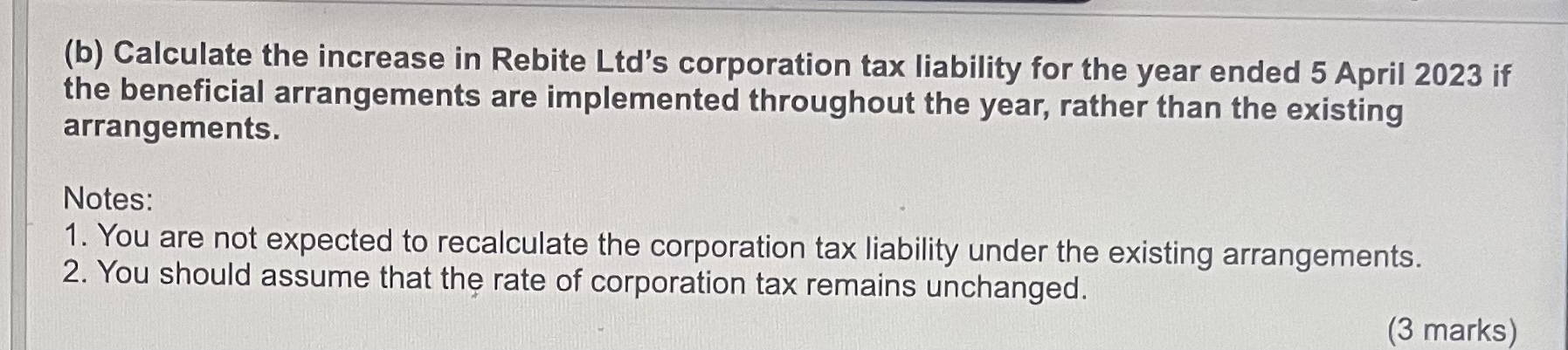

This scenario relates to two requirements. You should assume that today's date is 25 March 2022. Bertie is the managing director of, and 100% shareholder in, Rebite Ltd. For the past few years, Bertie has taken a high level of director's remuneration from Rebite Ltd to fund his personal pension contributions and the lease payments on his private car. However, Bertie has now realised that these are not the most tax beneficial arrangements, and is therefore considering more beneficial alternative arrangements. Existing arrangements If Bertie continues with the existing arrangements for the tax year 2022-23: (1) Rebite Ltd will pay Bertie gross director's remuneration of 75,000. (2) Bertie will use his private car for business mileage, with Rebite Ltd paying a mileage allowance of 45 pence per mile for business journeys. Bertie will drive 10,000 miles in the performance of his duties for Rebite Ltd during the tax year 202223. (3) Bertie will make personal pension contributions of 25,000 (gross). Bertie does not have any other income. After taking account of the above, Rebite Ltd's corporation tax liability for the year ended 5 April 2023 will be 9,611. (b) Calculate the increase in Rebite Ltd's corporation tax liability for the year ended 5 April 2023 if the beneficial arrangements are implemented throughout the year, rather than the existing arrangements. Notes: 1. You are not expected to recalculate the corporation tax liability under the existing arrangements. 2. You should assume that the rate of corporation tax remains unchanged. If Bertie adopts the beneficial arrangements throughout the tax year 2022-23: (1) Instead of paying any director's remuneration, Rebite Ltd will pay Bertie dividen of 35,000. (2) Instead of Bertie running a private car, Rebite Ltd will provide Bertie with a company car. This will be an electric car with a list price of 37,000 and zero CO2 emissions per kilometre. The car will be leased by Rebite Ltd at an annual cost of 12,000. Because the car will be electric, there will be no car fuel benefit. (3) Instead of Bertie personally making personal pension contributions, Rebite Ltd will make pension contributions of 25,000 into a company pension scheme on his behalf. Before taking account of any deductions under the beneficial arrangements (dividends, leasing costs and pension contributions) Rebite Ltd will have a trading profit of 140,000 for the year ended 5 April 2023

This scenario relates to two requirements. You should assume that today's date is 25 March 2022. Bertie is the managing director of, and 100% shareholder in, Rebite Ltd. For the past few years, Bertie has taken a high level of director's remuneration from Rebite Ltd to fund his personal pension contributions and the lease payments on his private car. However, Bertie has now realised that these are not the most tax beneficial arrangements, and is therefore considering more beneficial alternative arrangements. Existing arrangements If Bertie continues with the existing arrangements for the tax year 2022-23: (1) Rebite Ltd will pay Bertie gross director's remuneration of 75,000. (2) Bertie will use his private car for business mileage, with Rebite Ltd paying a mileage allowance of 45 pence per mile for business journeys. Bertie will drive 10,000 miles in the performance of his duties for Rebite Ltd during the tax year 202223. (3) Bertie will make personal pension contributions of 25,000 (gross). Bertie does not have any other income. After taking account of the above, Rebite Ltd's corporation tax liability for the year ended 5 April 2023 will be 9,611. (b) Calculate the increase in Rebite Ltd's corporation tax liability for the year ended 5 April 2023 if the beneficial arrangements are implemented throughout the year, rather than the existing arrangements. Notes: 1. You are not expected to recalculate the corporation tax liability under the existing arrangements. 2. You should assume that the rate of corporation tax remains unchanged. If Bertie adopts the beneficial arrangements throughout the tax year 2022-23: (1) Instead of paying any director's remuneration, Rebite Ltd will pay Bertie dividen of 35,000. (2) Instead of Bertie running a private car, Rebite Ltd will provide Bertie with a company car. This will be an electric car with a list price of 37,000 and zero CO2 emissions per kilometre. The car will be leased by Rebite Ltd at an annual cost of 12,000. Because the car will be electric, there will be no car fuel benefit. (3) Instead of Bertie personally making personal pension contributions, Rebite Ltd will make pension contributions of 25,000 into a company pension scheme on his behalf. Before taking account of any deductions under the beneficial arrangements (dividends, leasing costs and pension contributions) Rebite Ltd will have a trading profit of 140,000 for the year ended 5 April 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started